Xoom Money Transfer Review

Exchange rates, Payment methods, How to, Transfer fees and much more

Finding a company that sends money to a wide variety of countries globally can be difficult. Many services that offer global coverage don’t give your recipient too many choices on how to receive their money.

As one of the leading money transfer services, Xoom provides a large network of money delivery options to more than 130 countries internationally. Recipients have multiple options for getting their funds, and Xoom can even be used to pay utility bills in 10 countries.

However, Xoom isn’t always transparent about their markup on exchange rates. Their fees can make them more expensive than many other online money transfer companies.

How Xoom Money Transfers Work

Visit www.xoom.com and sign up for your free account.

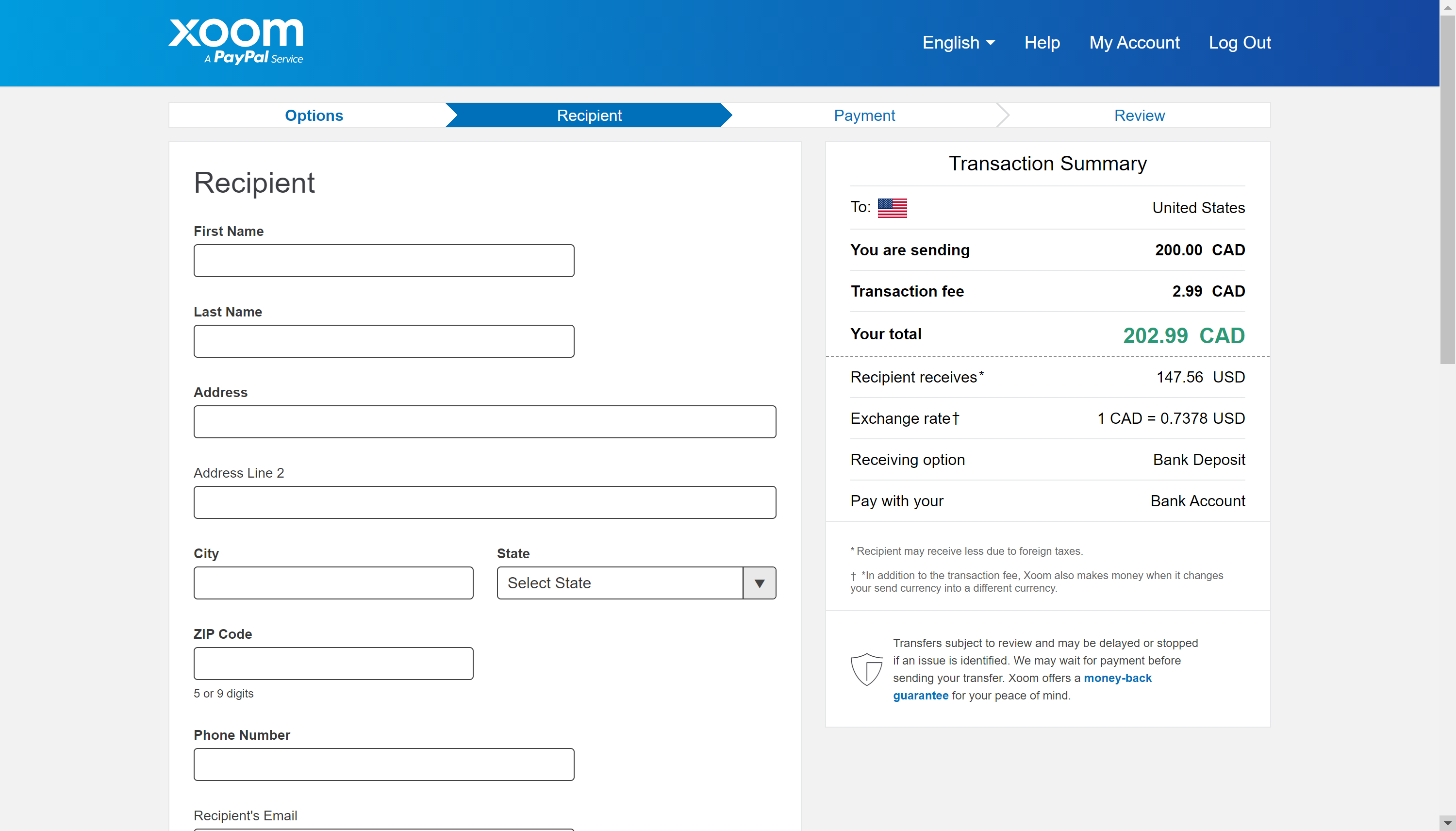

Enter details about your recipient, including what country you’re sending to and the person’s contact information.

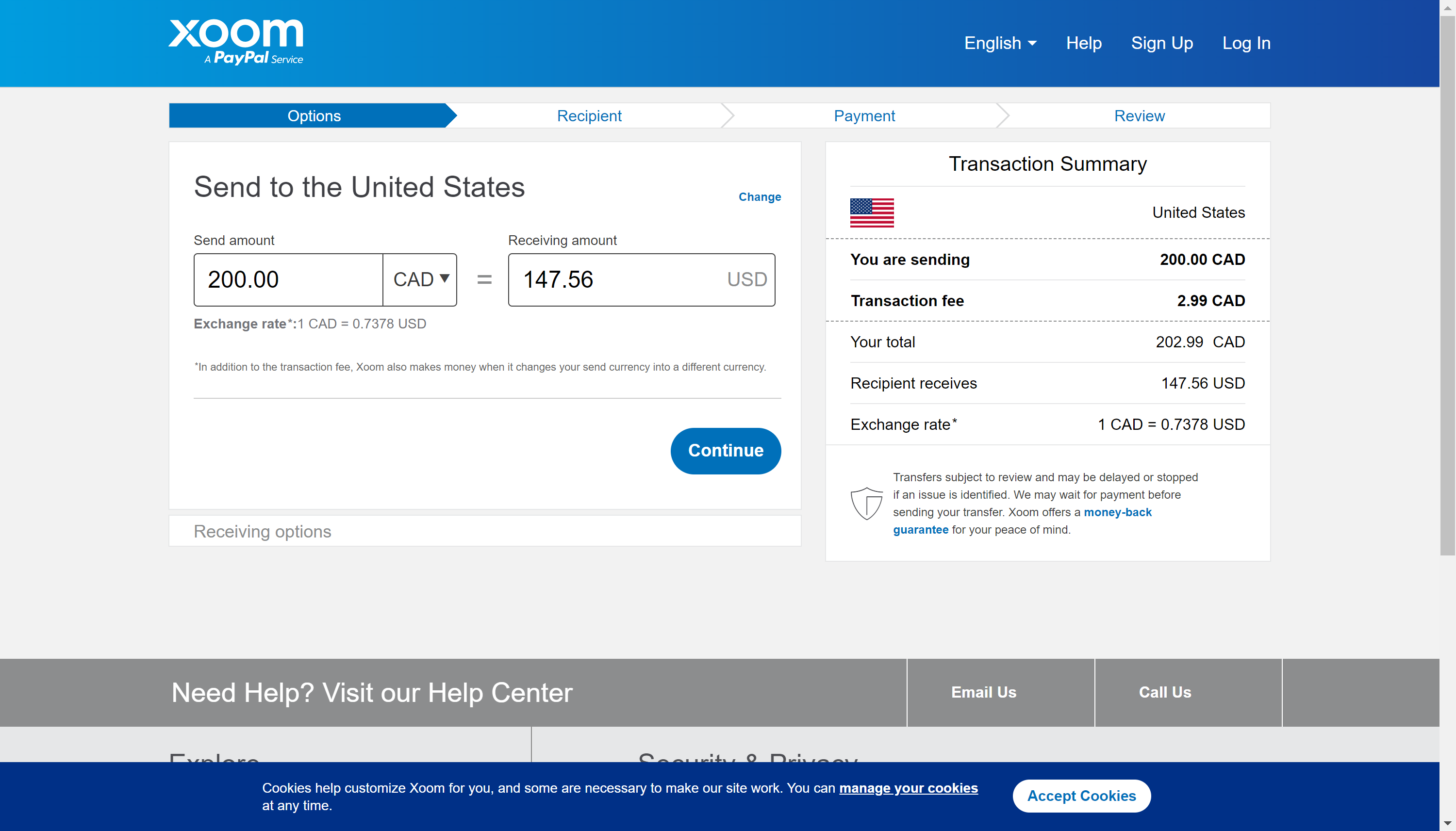

Tell Xoom how much money you want to send.

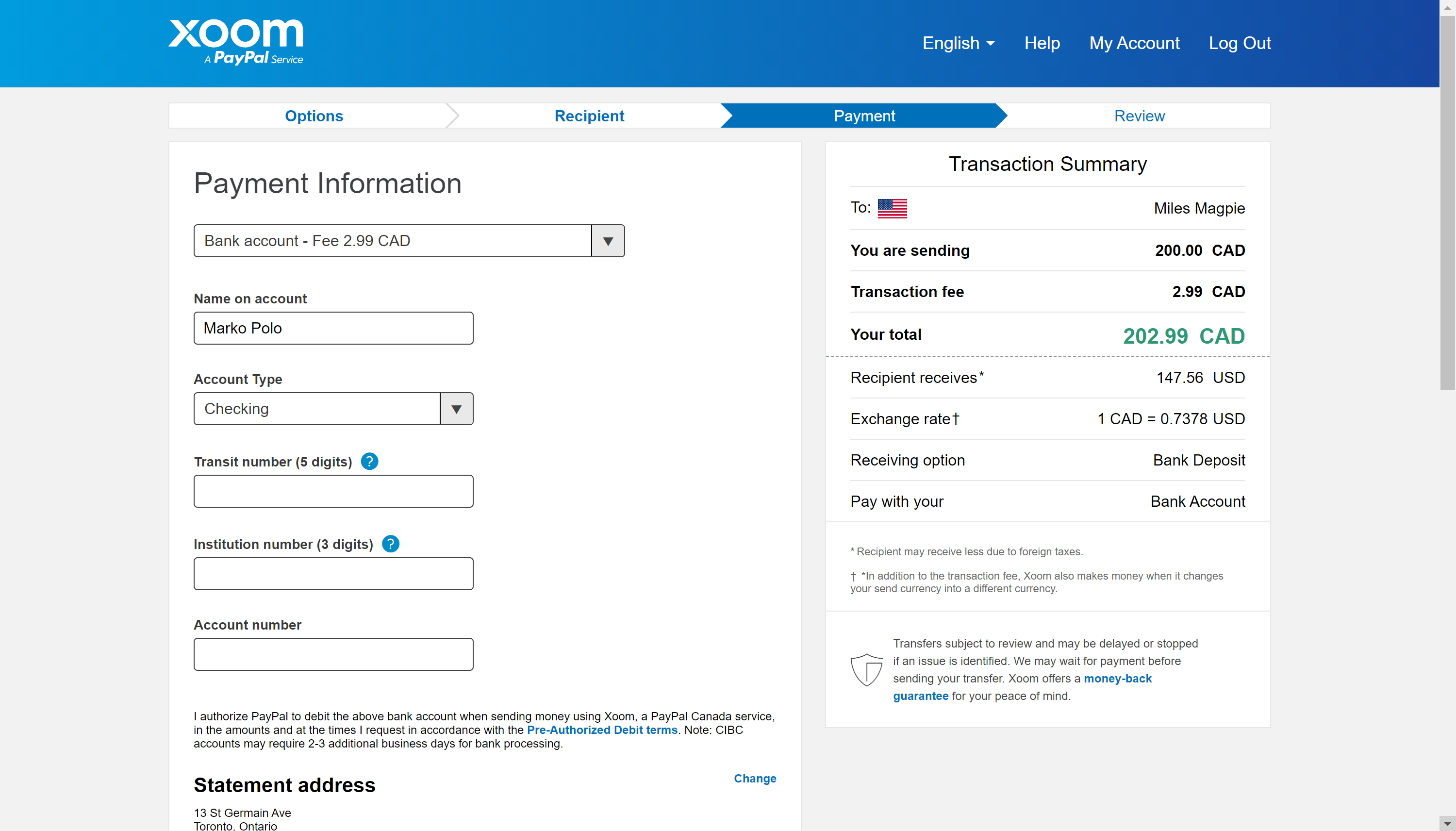

Select how you want to pay for the transfer. You can pay with a bank account, debit card, or credit card.

Xoom converts your money into the recipient’s currency, allowing them to receive the money in the form they choose.

When sending money online with Xoom, you can pay for the transfer using a bank account, credit card, or debit card.

Because Xoom is owned by PayPal, users also can pay for their transfers using bank accounts, credit cards, and debit cards linked to their PayPal accounts. However, you can’t fund a Xoom transfer using your actual PayPal account balance.

With a basic Xoom profile, you are limited to transferring $2,999 per day. However, if you verified your account and provided extra identifying information to Xoom, your daily transfer limit will increase. With full verification you can send up to $50,000 from the United States. Some of the verifying information Xoom requests includes your Social Security number, driver’s license, and proof of address.

Xoom allows your recipient to select how they want to get their money. These methods include deposit into a bank account, cash pickup at a variety of partner banks and locations, and delivery of cash to their door.

Additionally, Xoom allows you to send money to reload someone’s prepaid cell phone and to transfer money to another country to pay bills.

Xoom allows users to send money to more than 130 countries around the world. Xoom also is available to send for bill pay in more than 70 countries, giving users the ability to pay utility bills and other obligations overseas.

Some of the countries where you can send money with Xoom include:

- Austria

- Colombia

- Egypt

- Bolivia

- Ireland

- India

- Mexico

- Latvia

- Nicaragua

- Peru

- Thailand

- Philippines

- Singapore

- United Kingdom

- Vietnam

- Saudi Arabia

- Malaysia

- Pakistan

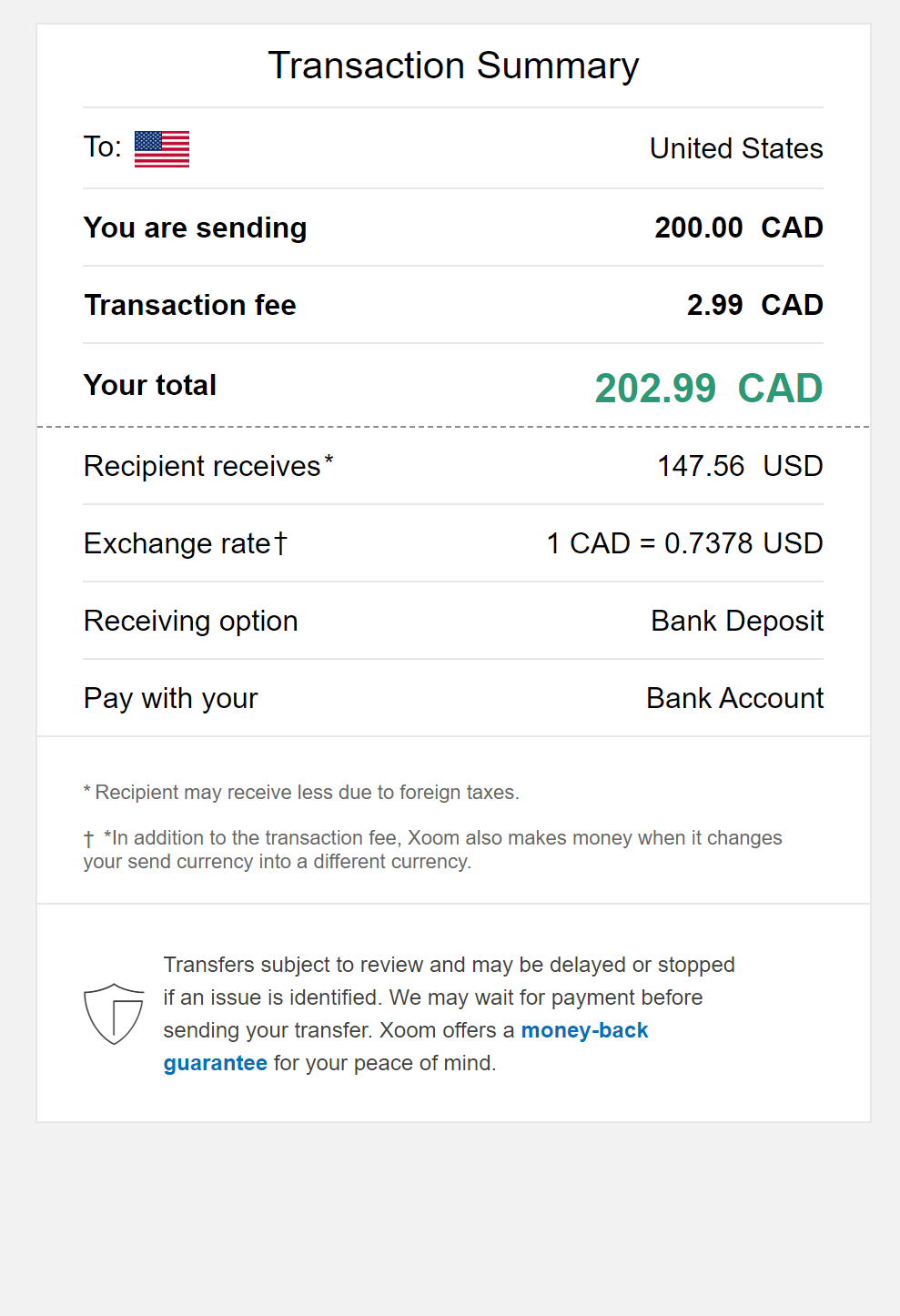

How much you’ll pay to send money with Xoom depends on a few factors. These factors include:

- Where you’re sending money to.

- How you’re paying for the transfer.

- The method your recipient has chosen to get their money.

Sending money using a bank account is the most affordable way to transfer money with Xoom, with fees starting at $4.99. However, Xoom is not the least expensive option in the industry.

Pros and Cons of Xoom

Pros

Same-day delivery is available to many countries, getting money to your recipient faster.

Send money to more than 130 countries internationally.

A large network of cash pickup options, giving recipients greater access to their funds.

Reliable customer service.

Owned by PayPal, giving them the reputation and trust backing of the more well-known company.

Easy-to-use website and mobile app.

Cons

Larger exchange rate markup than many companies, between 1 and 3 percent versus an average of 1 percent from other companies.

Cannot use your PayPal balance to send and receive money.

Daily limits on sending money are lower unless you go through the extra steps of getting your account verified.

Banks

However, banks operate physical branches and have to employ hundreds of people. This large infrastructure makes sending money with a bank more expensive.

Also, being forced to use a physical branch of the bank to send and receive money means much more limited access to money transfers. If you are in a country or area without a branch of your bank, you aren’t able to send money easily.

On the other hand, Xoom is available anywhere you have the internet, allowing you to send and receive money all over the world. You can connect any bank account, credit card, or debit card to Xoom, no matter where you hold that account.

Recipients also have broader access to money transfers through Xoom than through traditional banks. They can choose the method most convenient for them to get their funds.

Traditional Money Transfer Companies

However, increased access often means limited options on how to send and receive money. The fees charged by these traditional money transfer companies also can be exorbitant. This makes transfers more expensive for many people.

Comparatively, the fees charged by Xoom and other online money transfer companies are often lower than those charged by traditional money transfer companies. They do not have to operate branches and employ thousands of people worldwide.

Other Online Money Transfer Services

Because these online services, such as Xoom, Transferwise, WorldRemit, and Remitbee, do not operate physical branches, their overhead costs are much lower. They do not have to pay for physical office space, and they don’t have to employ thousands of people. This allows them to maintain much lower operating cost and pass those savings on to the customers.

Online money transfer companies also form relationships with a wide variety of banks, credit unions, and credit card companies. This means that consumers have more choice in how they send and receive money, making money transfers more convenient.

When comparing Xoom directly to its competition in the online space, it does have higher fees than many, and charges a higher markup on its exchange rates. However, compared to other services, Xoom offers more options for funds pickup or cash delivery. This makes it more accessible than some of its competition.

Other Money Transfer Providers

Xoom’s exchange rates are below the mid-market exchange rate. The service marks up its exchange rates between 1 and 3 percent from the mid-market rate.

This markup makes Xoom a more expensive option for transferring money overseas. Many similar online money transfer services charge less than a 1 percent markup.

If you are sending $1,000 using Xoom, for example, Xoom may make between $10 and $30 off your transfer. If you sent the same amount using another money transfer service, they would make less than $10.

Because of this markup, you may pay more to send money with Xoom than you might with another money transfer service.

Xoom makes its money two ways:

- By charging fees for each transfer.

- By charging additional markups on its exchange rates.

In addition to the fees charged on transactions, Xoom also charges a markup on their exchange rates. Their markup is between 1 and 3 percent over the mid-market exchange rate, making them more expensive than many of their competitors who charge closer to 1 percent.

Xoom’s fees and their higher exchange rate markup make them one of the most expensive options for online money transfers, so shop around a bit before choosing your service.

Xoom is owned by PayPal, one of the biggest and most trusted names in the online money transfer industry. That means Xoom’s website and app are considered very secure and safe for transferring money.

All transactions through Xoom, as well as all customer data, are secure with state-of-the-art encryption and security measures. It also is regulated and monitored by a variety of international financial agencies.

Xoom has processed billions of dollars of customer transfers, and the company has many positive online reviews.

Xoom offers a variety of online money transfer services:

- Transfers between individuals.

- Transfers to top up prepaid cell phones.

- Transfers for paying bills in select countries.

Xoom boasts more than 20,000 reviews on consumer review site Trustpilot, with nearly 90 percent of those reviews rating the company as “excellent.” This is a much higher percentage of great reviews than its owner PayPal has.

Many of Xoom’s reviewers point to the speed of their transfers, as well as how smoothly their transactions processed.

Customer Steve W. was hesitant to trust Xoom at first but was impressed by how quickly the money arrived. He also praised Xoom for providing ample updates on the status of his transfer, allowing him to track its progress.

Client Monika F. had a similar experience transferring money from the United Kingdom to India. She previously had bad experiences with other money transfer services, but with Xoom the money was ready for her friend to access within 2 hours of her initiating the transfer.

Those who report being unhappy with Xoom’s service talk about slower-than-anticipated transfers and transactions that were cancelled without warning.

User Kayleigh R. tried to transfer money from her account in the United Kingdom to another personal account in Australia. As she was in the process of verifying her account, Xoom cancelled her transaction without warning. She also reported that she could not get into contact with anyone at customer support.

Customer Shadae F. had issues with the long transfer time. She said she tried sending money to Jamaica that Xoom said would take three business days to arrive, but it had yet to get to her recipient a full week later.

Xoom offers 24-hour email response times in English and Spanish, using the form located on their website.

Customer Service Phone:(888) 815-1531

Customer Service Hours:24 hours for English, Spanish, and Filipino; 3 a.m.-6 p.m. EST for French

No, you cannot completely avoid paying fees when sending money with Xoom. However, you may be able to decrease the fees you pay.

Some of the ways you can decrease the fees you’ll pay to send money include:

Comparing Xoom’s fees and exchange rates with those you find at other money transfer services.

- Use Xoom’s fee estimation tool to see how much it will cost you to send money using your chosen method. Once you have a quote, you can decide if you can adjust how you’ll send or receive money to decrease the fees.

- Consider working with another online money transfer service if their fees are lower and their exchange rates are better. The more money you save in fees and exchange rate markups, the more money actually gets to the person you’re sending money to.

How much it costs to send money with Xoom depends on a few factors. Some of these factors include:

- Where you’re sending money

- How you’re planning to pay for the transfer (Paying with your bank account is less expensive than a credit or debit card)

- How your recipient wants to get their funds (Depositing it into a bank account is less expensive than cash pickup or delivery)

Use Xoom’s online calculator to see how much it will cost you to send money internationally.

If your transaction has not yet been processed, you can cancel your transaction on Xoom’s website. Visit the Track Transactions page and navigate to “Transaction History.” Find the transaction you wish to cancel and click “Cancel Transaction.”

For transactions that are cancelled within 30 minutes of authorization, you can expect a refund within 3 business days. Transactions that are cancelled more than 30 minutes after authorization may not be eligible for cancellation if the payment has already been processed.

Founded in 2001, Xoom was created with the goal of disrupting the cross-border money transfer industry.

It was founded to go directly up against Western Union, which had recently added an online transfer option to its business. At the time, Western Union’s website was clunky and not user-friendly, and the founders of Xoom wanted to create a better, smoother option.

After several years of missteps and struggles, Xoom transitioned into an online-only money transfer service, poised to make its next big jump.

Xoom’s profits began to boom in the late 2000s, tripling from 2009 to 2012. In 2015, the company was acquired by PayPal. Since then, Xoom has continued to operate as a service separate from PayPal, progressively adding more outbound countries to expand its market.

Xoom may not be the least expensive online money transfer option, but it certainly is among the fastest. Most transfers can be completed within a few hours of authorization. This allows you to get money to friends and family in an emergency instead of them waiting days to receive funds.

Send money through Xoom’s website or mobile app to any of over 130 countries, in a variety of ways. The ease of use, range of sending and receiving options, and it's great customer reviews make Xoom a top choice for many people looking to send money abroad.