WorldRemit Money Transfer Review

Exchange rates, Payment methods, How to, Transfer fees and much more

One of the problems with traditional money transfer services is the limited options for the money pickup. For people in remote areas or who don’t have a strong banking relationship, it can be difficult or expensive to get their money.

The online money transfer industry has allowed people to get better access to the funds sent to them. In this way their funds are more accessible and the cost of such a transfer is very low.

One of the leaders in the online money transfer industry is WorldRemit. This company allows people in 50 countries to transfer money to friends and family in more than 150 countries. WorldRemit serves more than 4 million customers, and authorizes nearly 90 percent of its transfers in minutes.

If you want to send money quickly and easily using your computer or smartphone and allow your recipient access to their money in a variety of ways, WorldRemit may be a great option to try.

How WorldRemit Money Transfers Work

Open a free account. Register your account with WorldRemit using either their website or by downloading the mobile app.

Add information about your recipient.

Enter how much money you want to send and how you want to pay for your transfer.

Fund your transfer by paying with your bank account, credit card, debit card, or another method.

WorldRemit will convert your money into the recipient’s currency and send it to them in their preferred method.

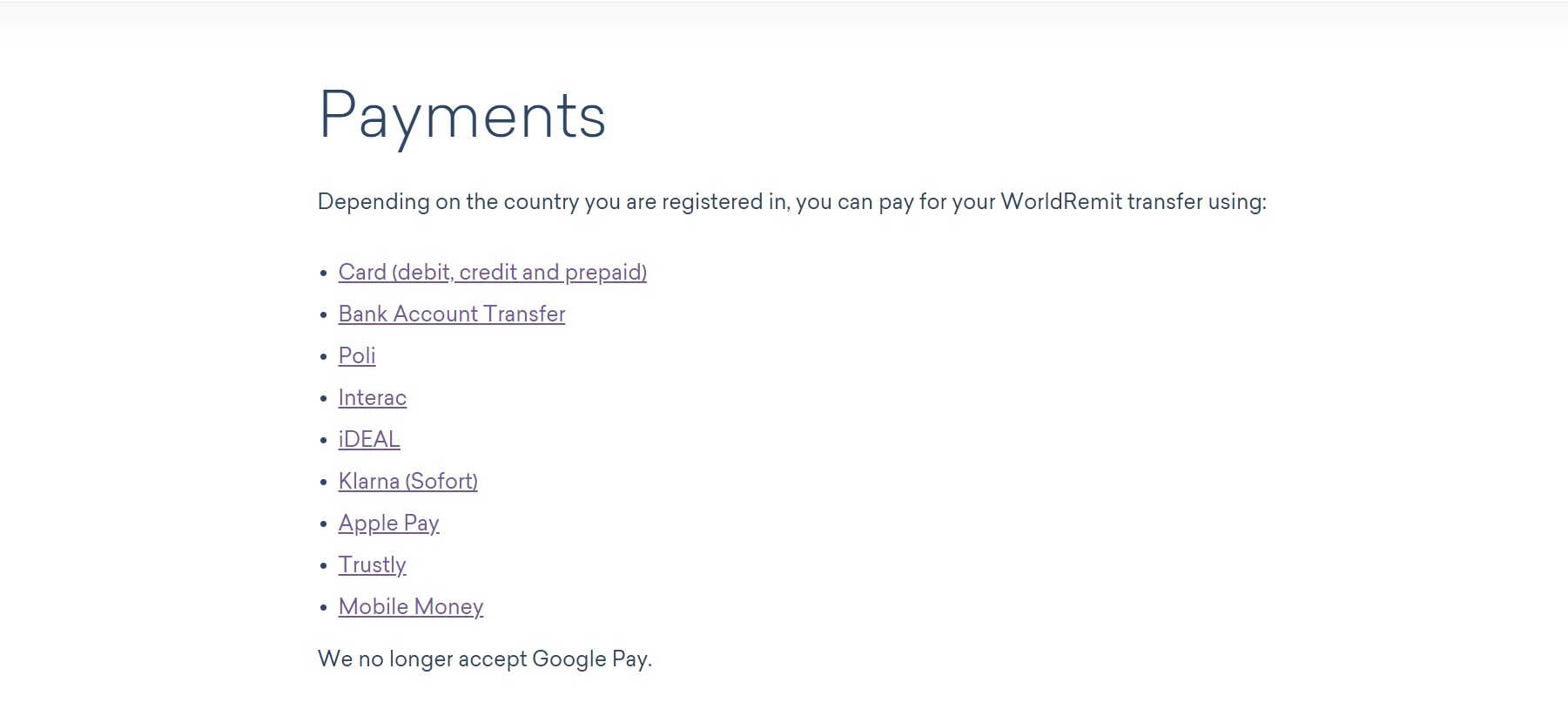

The payment methods available to you through WorldRemit vary depending on the country you’re sending money to. Some payment options include:

- Debit card

- Credit card

- Prepaid card

- Bank transfer

- Poli

- Interac

- iDEAL

- Klarna

- Apple Pay

- Trustly

WorldRemit doesn’t list specific daily limits on their website. The amount of money you can send to someone depends on the country where you’re sending money. Some countries have higher daily limits on money transfers, impacting the amount you’re able to send.

The recipient can receive their funds in a variety of ways, including:

- Bank transfer

- Cash pickup

- Mobile money, such as MTN Mobile Money, Airtel, and Tigo

- Airtime top-up

- Home delivery

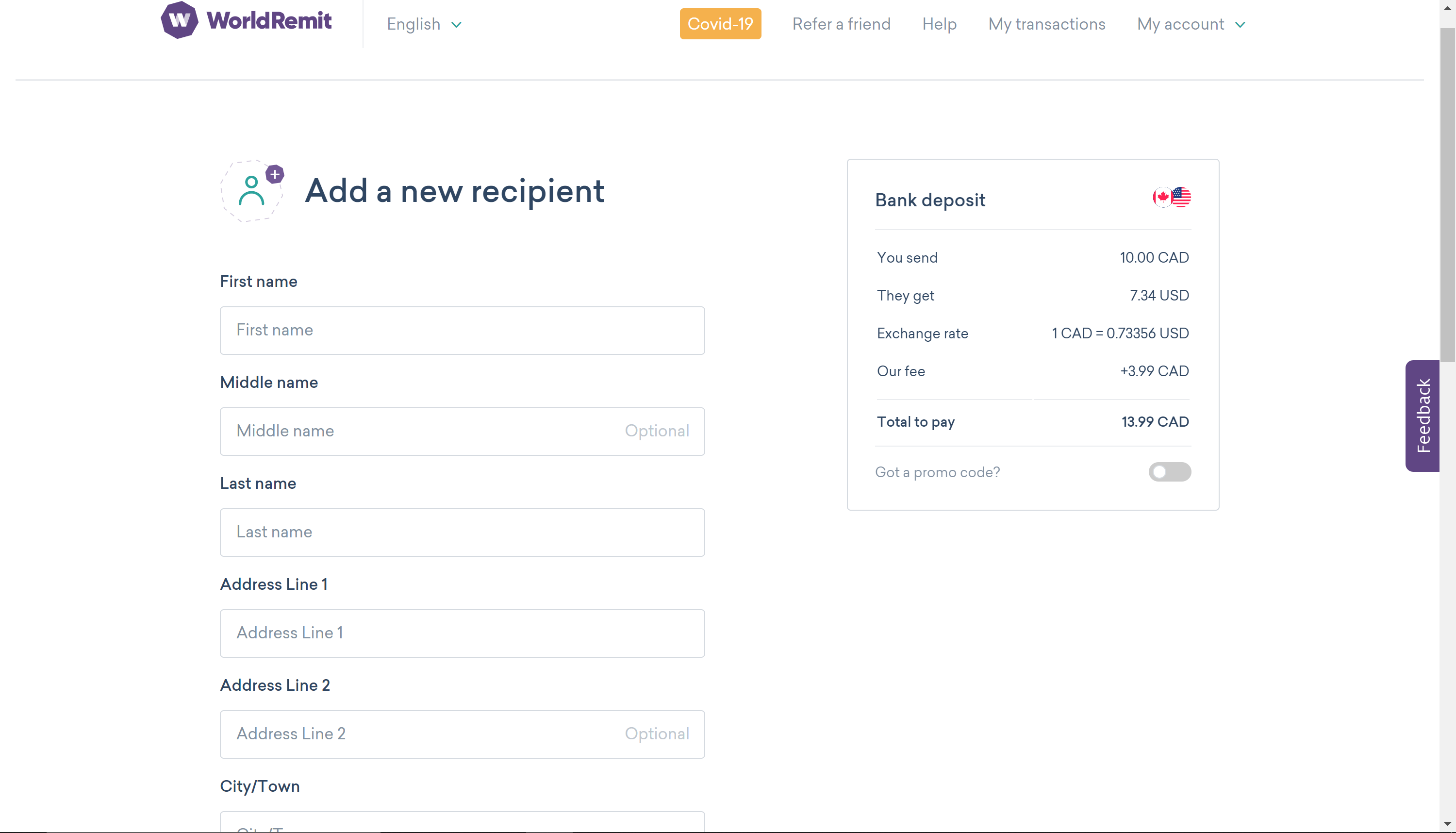

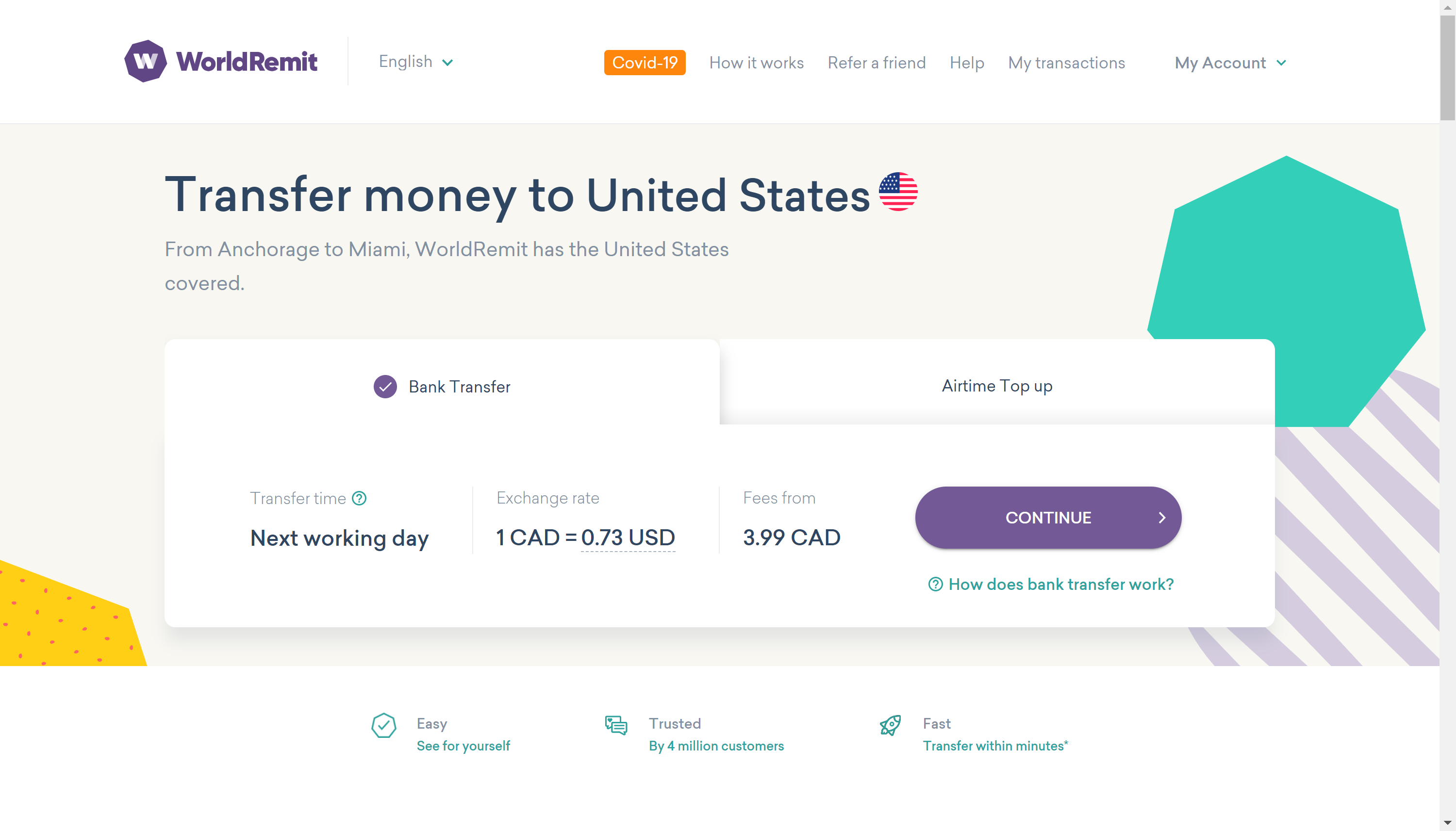

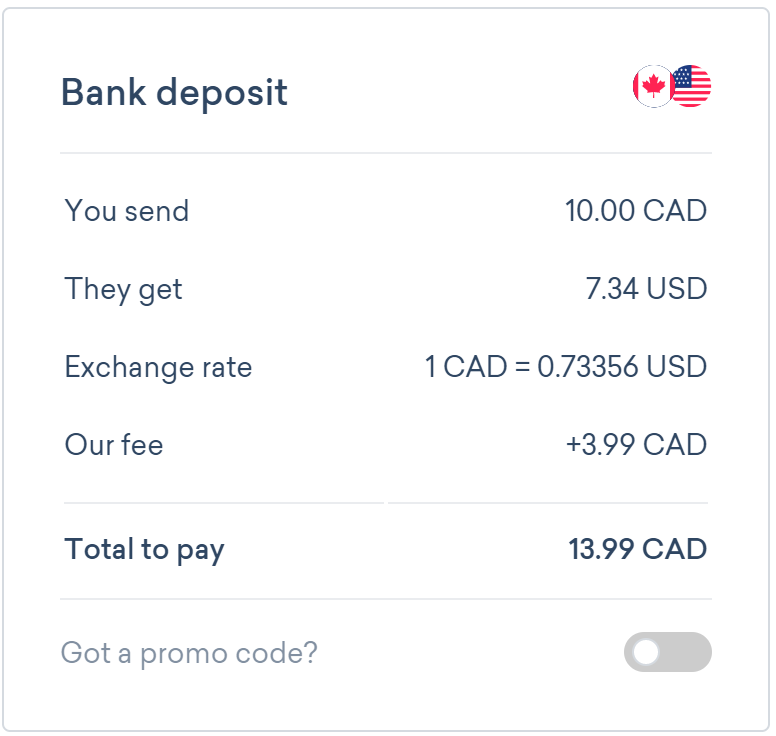

As with many money transfer services, the exact amount you will pay in transfer fees for using WorldRemit depends on a few factors. These include how much money you’re sending, where you’re sending money to, and how the recipient will receive the money.

For example, sending money for cash pickup costs more than transferring money from one bank to another. Because cash pickup is a quicker service, you pay more for the extra speed.

Overall, WorldRemit’s fees are low compared to other companies in the industry, and the company is transparent with the fees they charge. When you initiate a transfer, you will see all the transfer fees prior to completing your transaction, so there are no surprises.

You may also be charged fees by your bank, credit union, or credit card company for using WorldRemit to send money. These fees are completely in the control of your financial institution and won’t be shown on WorldRemit’s website.

WorldRemit offers guaranteed exchange rates when you want to send money to another country. Their exchange rates are competitive with the mid-market rate you’ll find at most banks. This means they charge less markup on those rates, overall costing you less.

These rates are locked in when you initiate your transfer, and they are updated daily. This means the amount you are quoted is how much your recipient will receive, even if the transfer takes a few days and rates change.

Pros and Cons of WorldRemit

Pros

Easy-to-use website and mobile apps make sending money easy.

Variety of options when paying for your transfer and for the recipient to get their money.

Some methods, such as airtime top-up, are almost instant.

Lower transfer fees than other similar money transfer companies.

Transparent fees pricing and exchange rate, so you know exactly how much you’ll pay

Send money from 50 countries to more than 150 countries.

For all new customers first 3 transfers are absolutely fee free.

Cons

Fees fluctuate based on how your recipient plans to get their money, which can get expensive.

A limited number of supported overseas banks can make some transfers difficult.

You are limited on how the recipient gets the money depending on the country where you’re sending money to.

You may be limited on how much money you can send depending on where you’re sending money to.

After the first 3 transfers, you need to pay fees for every new transfer. There are no free transfers over 500$ like Remitbee or Remitly have.

Banks

Banks are a trustworthy and very convenient method to transfer money safely. Many consumers view banks’ size and reputation as a sign that their money will be safe in the transfer, getting to the recipient on time.

However, the modern online money transfer industry has brought down those fees, making banks sometimes the more expensive option. Banks can be very selective about who they allow to transfer money. Some banks require you to have an account with them before they will let you send or receive money there. For anyone traveling or who doesn’t have a regular bank account, this can make it difficult to find a bank that allows you to send money.

Online money transfer companies such as WorldRemit, on the other hand, offer lower fees than many banks, and exchange rates that are just as good or better. They also are more convenient, allowing both the sender and recipient to transfer money without ever having to leave home.

Traditional Money Transfer Companies

With agents on nearly every corner, especially in tourist hot spots, traditional money transfer services are convenient. These easily accessible locations make sending or receiving money a lot easier for many people.

But what these money transfer companies offer only convenience. They lack methods for sending and receiving money. Additionally, they can charge high fees for transfers, making transferring money out of reach for some people.

Online money transfer services such as WorldRemit not only offer a greater level of choice for sending and receiving funds, but they charge lower fees.

Other Online Money Transfer Services

Because they do business online, services such as WorldRemit, Transferwise, Remitbee, and Remit2India don’t have the higher overhead of banks and traditional money transfer companies that operate branches. They don’t have to pay for commercial space or lots of employees, allowing them to charge lower fees and offer better exchange rates. These companies also partner with a wide variety of banks and credit unions, giving users greater access to sending and receiving their money.

In comparison to other online money transfer companies, WorldRemit can have lower fees and better exchange rates. They are up front about the fees they charge, allowing users to know right away how much it will cost them to send their funds.

WorldRemit makes its money by charging its users a fee to send money to other countries. These fees vary depending on where you’re sending money to, and how the recipient plans to pickup the money. If, for example, you’re sending money to someone for cash pickup, it will cost you more than simply sending money from one bank account to another.

Additionally, WorldRemit charges a markup on its exchange rates. This markup can vary from transaction to transaction, but averages about 1 percent of the mid-market rate.

The fees charged by WorldRemit are often lower than many of its competitors, but can vary greatly. Check their website for the fees you will be charged, and compare them to other companies to see if you’re getting the best price for your money transfer.

WorldRemit is available to use on your tablet, phone, or computer through its website. It also is available as an app for download on Apple and Android devices.

Their platforms, both web-based and app-based, are highly rated by users.

WorldRemit is considered very secure and reliable in the online money transfer industry.

It is authorized and regulated by the Financial Conduct Authority in the United Kingdom, which imposes strict regulations on companies to protect customers from fraud and to protect individuals’ funds. WorldRemit also is regulated in the United States, Australia, and Canada.

WorldRemit has more than 37,000 individual customer reviews on consumer review website Trustpilot. That makes them among one of the most-reviewed online money transfer companies in the industry.

The majority of WorldRemit reviews are positive, with the company scoring 4.5 out of 5 stars on average.

User Romeo G. found WorldRemit to be a quick and easy way to send money, saying it was more convenient to use than going to his local bank.

Customer Jackson said he was nervous before making his first transfer with WorldRemit, but the company sent him status updates on his transfer. These messages put his mind at ease. After his positive experience, he began recommending the company to his friends and family as a trustworthy way to send money abroad.

However, not all of WorldRemit’s users are happy customers.

User Nancy H. said she tried to send some money to a friend in Nepal, whom she had twice before sent money to with no issues. WorldRemit sent her an email two days later telling her the transaction couldn’t be processed because the recipient’s banking details were incorrect.

All of Nancy’s attempts to contact the company, including by phone and Facebook messenger, were fruitless.

WorldRemit offers an email contact form, a chat support and a customer service phone.

Customer Service Phone(888) 772-7771 (U.S. and Canada)

TransferWise offers both email and online chat support to its members along with a customer service line.

Customer Service Phone:(888) 908-3833

Some countries require money transfer fees to be paid. Because of these requirements, its impossible to completely avoid paying fees with WorldRemit.

However, if you’re willing to change the delivery method to something slower and with lower fees, such as bank-to-bank transfer, you may be able to decrease the amount of money you will pay in fees.

WorldRemit is among the lower-cost ways to send money internationally. How much you will pay for your transfer depends on certain factors, including:

- How much money you’re sending

- Where you’re sending money to

- The method your recipient will use to pick up their money

You can know exactly how much you will pay in fees when you begin a transfer on WorldRemit’s website.

If you want to cancel a transfer with WorldRemit, you must contact the company as soon as possible via phone, email, or chatbot. After a transfer is paid, WorldRemit says there may not be any way they can stop the transfer. However, the sooner you ask for a cancellation, the better your chances you can stop the transfer.

When you do cancel a transaction, you will receive a refund within seven business days using the same method of payment you used to make the transfer.

WorldRemit was founded in 2010 by a Somali immigrant to the United Kingdom - Ismail Ahmed. When he was sending money back to Somalia during the 1990s, he’d often pay high fees in using the traditional money transfer companies.

Later, Ismail Ahmed, WorldRemit’s founder, worked for the United Nations in regulatory compliance. There, he learned the challenges financial institutions faced in meeting anti-money laundering regulations and combating the financing of terrorism.

He founded WorldRemit to improve the way money were transferred between people in different countries, hoping to make it more secure and safer than ever before.

In 2018, WorldRemit processed 1 million transfers per month, and their revenue nearly doubled between 2016 and 2017. WorldRemit is headquartered in London and has more than 700 employees spread across six offices in the United States, Canada, Australia, New Zealand, and Japan.

WorldRemit is one of the leaders in the online money transfer industry, allowing users in 50 countries to send money to over 150 other countries all over the world. Its fees are lower than many of its competitors, making them less expensive. Additionally, users can see exactly how much they expect to pay for their transfer before ever completing payment on WorldRemit’s website.

Recipients have a wide variety of choices in how they want to get their money, making WorldRemit an easy, fast, flexible option for many people.