Asenso Remit Money Transfer Review

Exchange rates, Payment methods, How to, Transfer fees and much more

Asenso Remit Money Transfer Review

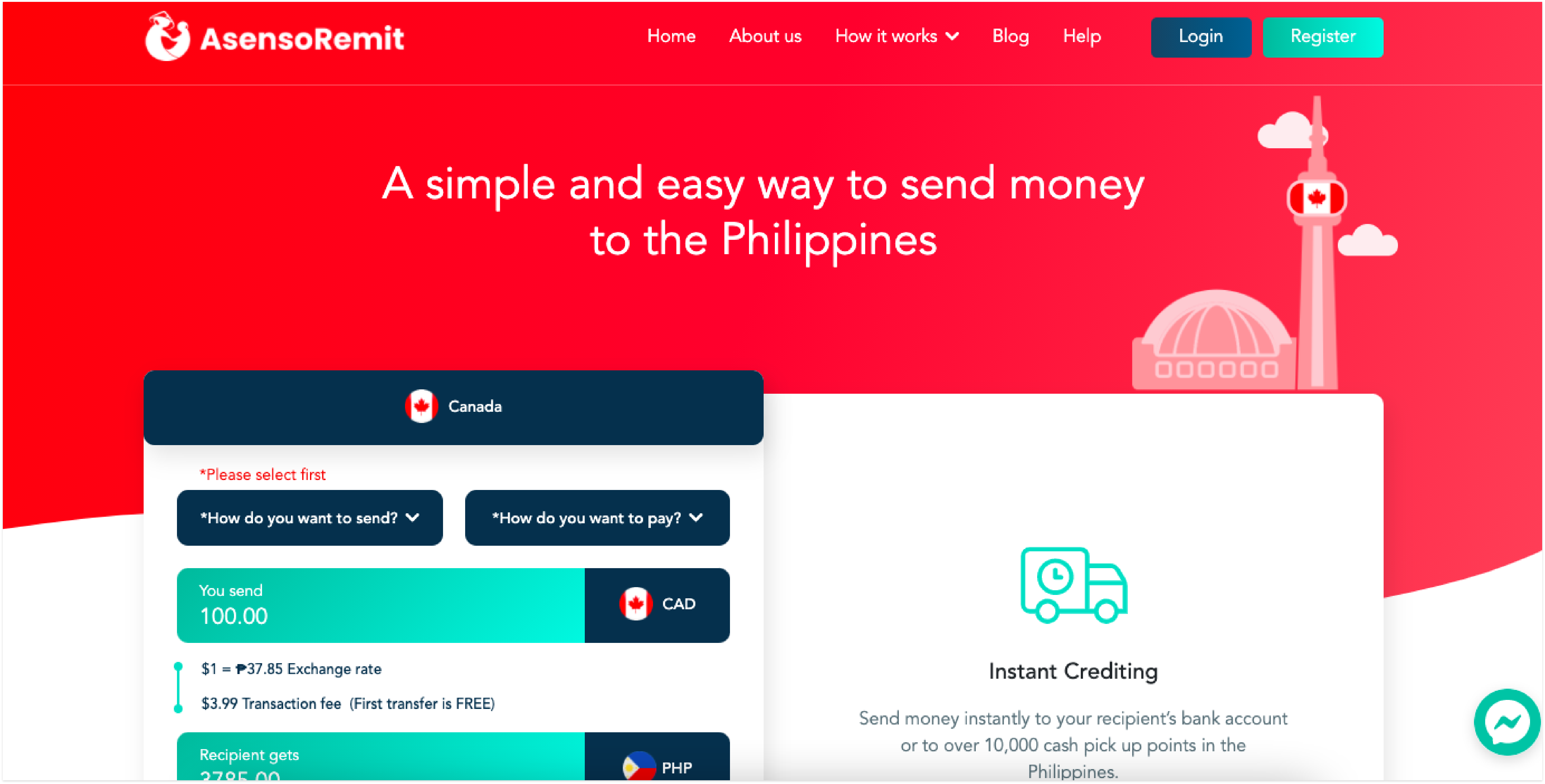

When sending money from Canada to the Philippines, senders have many choices. Asenso Remit international money transfer is a website and app offering services to send money to Philippine recipients.

But how does Asenso Remit work? How much can you send and how can you pay for a transfer? You may also be concerned to know if this money transfer service is legitimate and safe to use. Operating in Canada since 2017, it is a fairly new company. That means it can be hard to find information about the service.If you want a review of Asenso Remit, keep reading. This article will tell you everything you need to know about Asenso Remit and its money transfer service in Canada.

Payment Methods Available With Asenso Remit

Asenso Remit has two major ways to pay for a transfer. The first is using a debit card in your own name. You cannot send with a credit card, however. The second is by Interac e-transfer, the Canadian interbank transfer system. To use this you must log into your bank’s online banking system.

How Much I Can Transfer With Asenso Remit?

The maximum you can send in a single transaction with Asenso Remit is different according to the method you use to fund the transfer.

While Asenso Remit says it doesn’t impose maximum limits on all transfers, there is an additional thing to keep in mind. To send larger amounts with Asenso Remit, it is necessary to contact their customer service department. To do a single transfer over $1,000, or if you send $5,000 or more in a 31-day period, you will have to provide the company with documents so they can perform additional verification.

How To Sign Up For An Account With Asenso Remit

In order to register with Asenso Remit, you will need a few things.

After you have provided this information, you will be required to verify your identity and address, as detailed above. Asenso Remit also uses a form of verifying called “selfie verification” which means you can verify by uploading a photo of yourself.

Asenso Remit Transfer Fees

Note that Asenso Remit's transfer fees will change according to a couple of things. There’s the pickup option you choose, then the method you use to pay for the transfer. The highest fees occur when you choose a debit card to fund the transfer, and the receiver collects the money in cash.

These fees can be quite high. For example, if you send 300 CAD using Asenso Remit and pay for the transfer with your debit card, you will pay $10.99 in fees.

Sending to a Filipino bank account, and using Interac to fund the transfer, attracts the lowest fees. To make this easier to understand, here are the starting fees for various methods. Note that these are minimum fees and the fee for your transfer may be higher.

To encourage sign ups, Asenso Remit allows you to send the first transfer for no fee.

Pros And Cons Of Using Asenso Remit

Pros

Competitive fees for some services

Bilingual customer support

Recipient can get money in as little as 1 hour

Small referral bonus if you recommend Asenso to a friend

Cons

Cannot use credit card to fund transfers, only debit card

Fee structure is confusing and can be expensive

Can only send a small amount in each transfer if using a debit card

Only offers money transfers and bill payments, no other services

How Does Asenso Remit Money Transfer Work?

You can send money using the Asenso Remit app, website, or by calling the company.

There are three options for a recipient to get money.

Verification is another step in Asenso Remit’s process that you should keep in mind. To verify your identity they require one of each from the following list:

Identification

Address

Other Money Transfer Providers

Asenso Remit Exchange Rates

According to Asenso Remit, its exchange rates change twice per day. The current rate can be found on the website. For example, if you send CAD 1000 the recipient will get 37,900.00 pesos. This breaks down to an exchange rate of 1.00 CAD = PHP 37.90. This is a worse rate than the daily mid-market exchange rate, which is 1.00 CAD = PHP 37.91. If the real mid-market rate was used, the receiver would have gotten more money, i.e. 37,910.63 pesos. Rate checked 2:30 p.m. 6 January 2021

How Does Asenso Remit Make Money?

Asenso Remit makes money both on their fees and on the exchange rate margin.

Platforms Where Asenso Remit Is Available

Asenso Remit has a full service website and its mobile apps are highly rated. Both the iPhone and Android versions have 4.6 out of 5 stars as a rating on the App Store and Google Play.

Is Asenso Remit Secure?

Asenso Remit is registered in Canada with the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC). This body is responsible for regulating and authorising all money transfer services in the country. It has procedures in place to avoid money laundering and enhanced KYC (Know Your Client) rules for verifying senders. Asenso Remit says that it securely stores customer details in its system. It also claims that its technology for transactions is the same encryption and security level as banks.

What Countries Does Asenso Remit Allow You To Send Money To?

Asenso Remit only sends money to the Philippines.

How To Contact Asenso Remit

Email Support - [email protected]

Telephone: Ontario 1-437-886-2999, Alberta 1-587-287-2580, Quebec 1-514-545-2701, Manitoba 1-204-202-9343, British Columbia 1-778-775-9987

Contact form Asenseo Remit Customer Support

Banks

Online banks

Traditional Money Transfer Providers

Online Money transfer companies

History Of Asenso Remit

Asenso is a Canadian subsidiary of another money remittance company, Kabayan Capital. It has been trading since 2017 across Canada, including Quebec. Kabayan Capital operates in the UK and Europe, offering money transfer services to the Philippines from there as well.

Other Services Asenso Remit Offers

Asenso Remit also offers bill payment for your Philippine bills. There is a fee, just as there is for money transfers.

So What Is Asenso Remit In A Nutshell?

Asenso Remit provides a fairly competitive service for sending to the Philippines from Canada. However, it does have its negatives, such as a complicated fee structure and the possibility to only send small amounts at a time. In order to find the best international money transfer service for you, it’s good to shop around. Read more reviews of money transfer companies on the Remitbee blog.