Tangerine USD Account Overview

No monthly fee and USD savings. Here’s everything you need to know about the Tangerine USD account.

Tangerine USD Account

The Tangerine USD account is aimed at people who need a place to save their USD – or deposit money that they are paid in USD. You won't have to convert your money to Canadian dollars if you use this account, which could be a significant benefit if the exchange rates aren't favourable.

With Tangerine, you can put your USD in a savings account with no monthly fee and earn interest. Here's everything you need to know about how the Tangerine USD account works.

How to Create USD Account With Tangerine

Tangerine allows users to sign up on both the app and the website. You’ll need to have your Social Insurance Number before you begin, as well as your work info.

Sign up with the app

The app makes it easier to sign up. You can scan your identification document right in the app, and take a selfie using your phone for verification.

Sign up with the website

Using the website signup form, you'll have to manually enter some information, and you might have to go through a few additional procedures to verify your identity.

You'll see a confirmation screen, where either Tangerine has confirmed your identity online, or there is a prompt to confirm identity in person.

You’ll get your client number right away, which is all you need to bank online and by phone. Use your banking PIN that you chose in the first step to log in.

Key features

The Tangerine US dollar savings account allows you to save your US funds at a good interest rate with no hidden fees or service charges. Some of the key features include:

Monthly Fees & Interest Rate & Minimum Balance

Monthly fees:

Tangerine charges ZERO monthly fees and unlimited transactions are allowed.

Interest rate:

Account holders benefit from a rate of 0.1%.

Minimum Balance:

There is no minimum balance for the Tangerine US dollar account, so $0.

Offers

If you open a savings and chequing account with the promo code EARNMORE you could get a 2.10 percent Savings rate and $200. Tangerine sometimes offers interest rates like these that are better for the first few months you hold the account. The current promotion works like this.

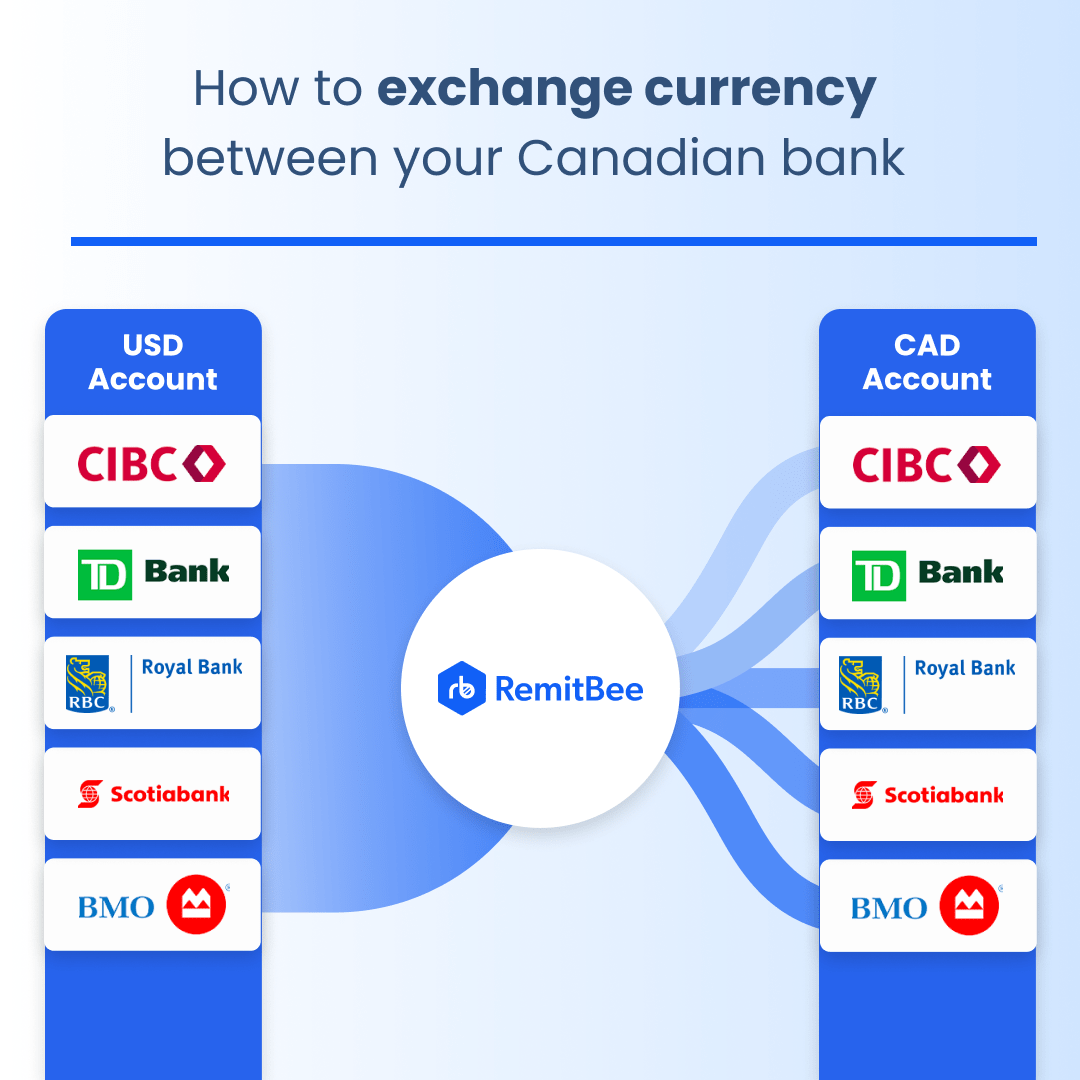

Currency Exchange Using USD Account

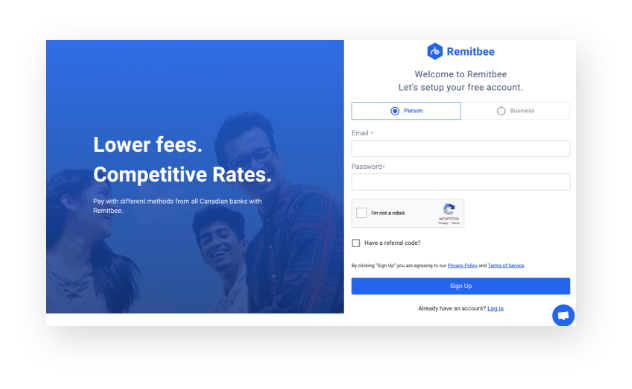

Sign up for an account at https://www.remitbee.com/signup by entering your email address and choosing a password. Your Canadian phone number will be required to be verified. Fill in your personal information, such as your name and address.

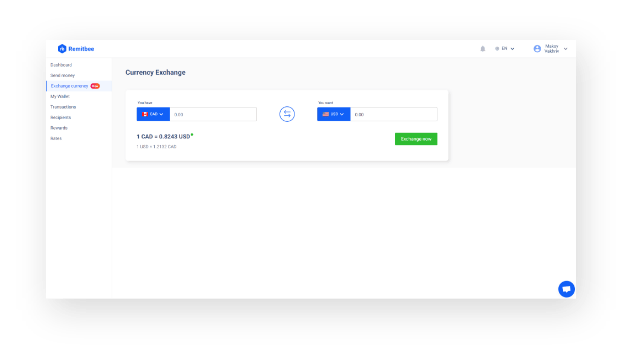

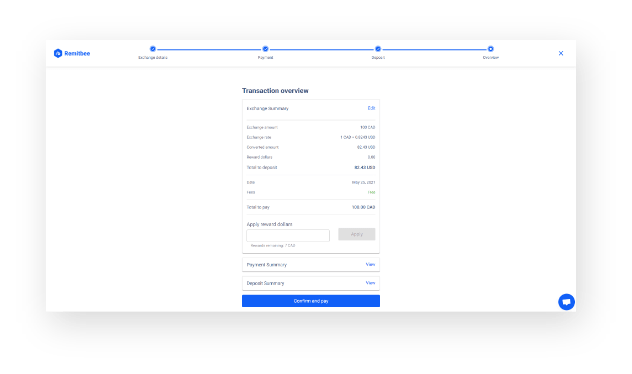

From the menu, select Exchange Currency. Now enter the details of your currency exchange, depending on your exchange amount further verification may be required.

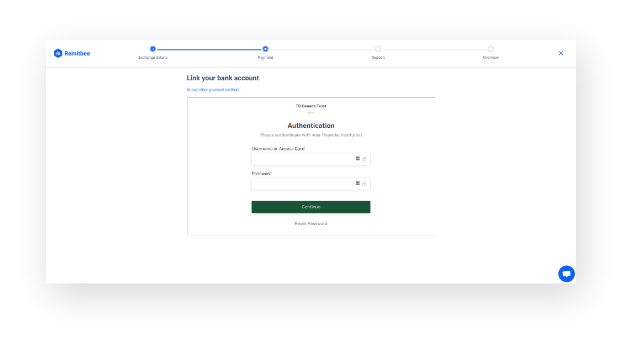

Connect your CAD and USD bank accounts

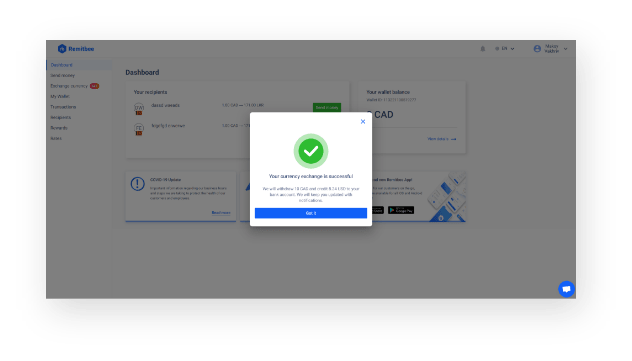

Choose the amount and confirm your exchange rate. The entire transaction takes place between your own two currency accounts via EFT

Convert your money! You can see all of your transactions in future by going to the Dashboard and clicking on the Transactions tab.

Other USD Accounts

Other USD Accounts