Scotiabank USD Account Overview

With this account, you can benefit from an interest rate that gets higher the more your balance increases.

Scotiabank USD Account

One of the most popular USD accounts for Canadians is the Scotiabank US Dollar Daily Interest account. It's an excellent option for saving US cash or depositing money received in US dollars. You won't have to switch your money into Canadian dollars if you open a Scotiabank USD account, which is a major plus if the exchange rates aren't in your favor.

With this Scotiabank account, you can benefit from an interest rate that gets higher the more your balance increases. Read on to learn everything there is to know about the Scotiabank USD account and how it can benefit you.

How to Create a USD Account With Scotiabank

A Scotiabank US Dollar Daily Interest account must be signed up for by going into a branch or contacting the bank by phone. Here’s how to do so.

Sign up by phone

Call Scotiabank on either 1-800-747-3208 or 1-800-747-3208.

Sign up in a branch

You can book an appointment to open an account using the Scotiabank website to see the nearest branch to you. Use the map link to find your branch.

You can also chat with a live agent online to book an appointment with an advisor.

Key features

Scotiabank offers a smarter way to save your US dollars in an account you can manage easily from your phone or via their online banking and app.

Here are the account’s key features.

Monthly Fees & Interest Rate & Minimum Balance

Monthly fees:

Scotiabank charges no monthly fees as long as you maintain a 200 USD balance daily. Otherwise, it is only 1 USD per month.

Interest rate:

Account holders benefit from a tiered interest rate that can be as high as 0.05% depending on your account balance.

Minimum Balance:

There is no minimum balance for the BMO US dollar account, so $0.

Offers

If you open a new bank account you could benefit from Scotiabank’s Ultimate Package. Here’s how to earn a 300 CAD bonus.

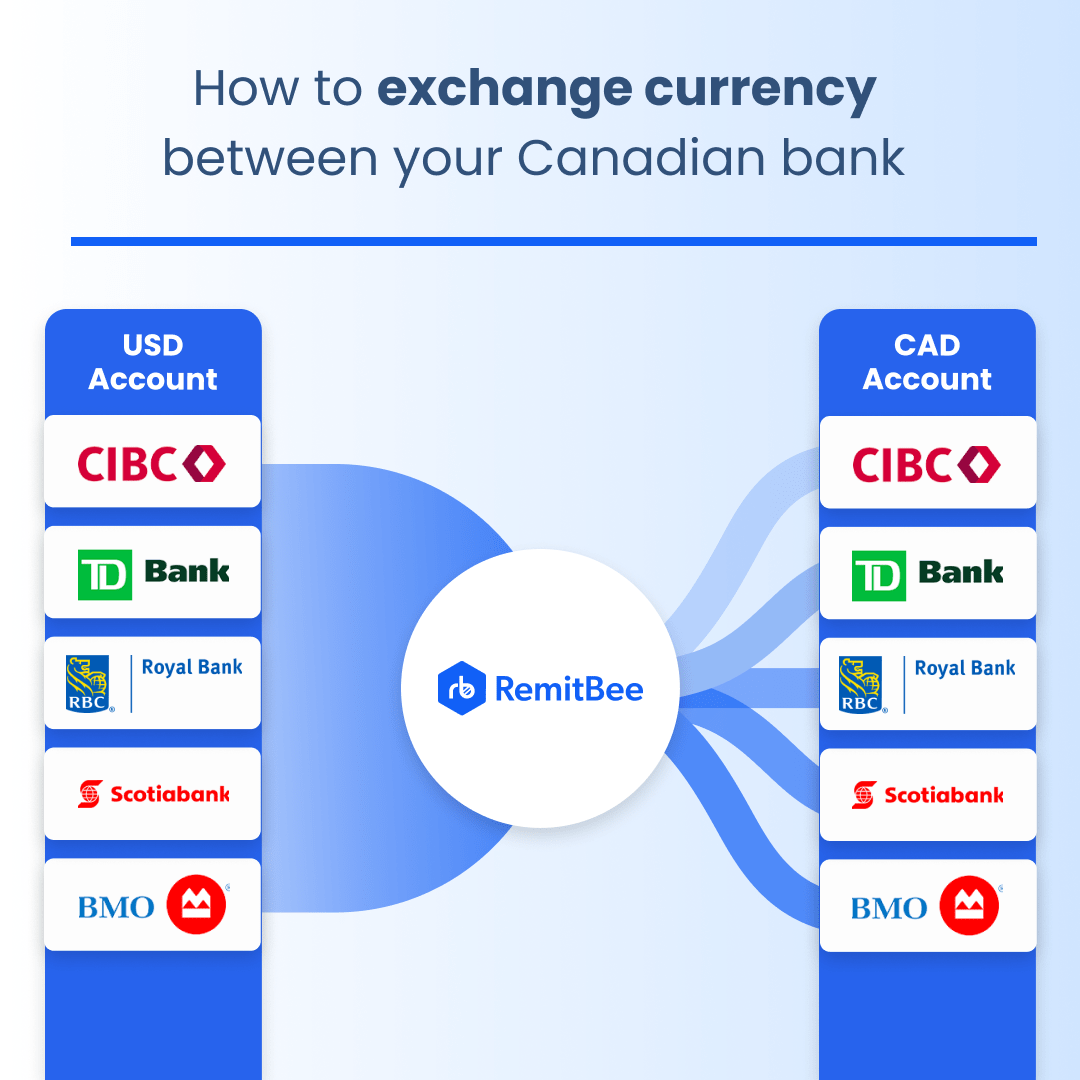

Currency Exchange Using USD Account

Sign up for an account at https://www.remitbee.com/signup by entering your email address and choosing a password. Your Canadian phone number will be required to be verified. Fill in your personal information, such as your name and address.

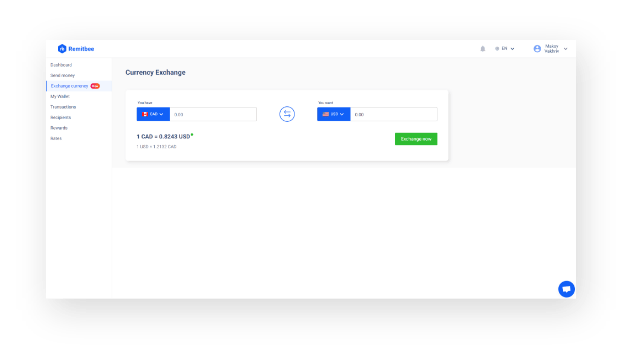

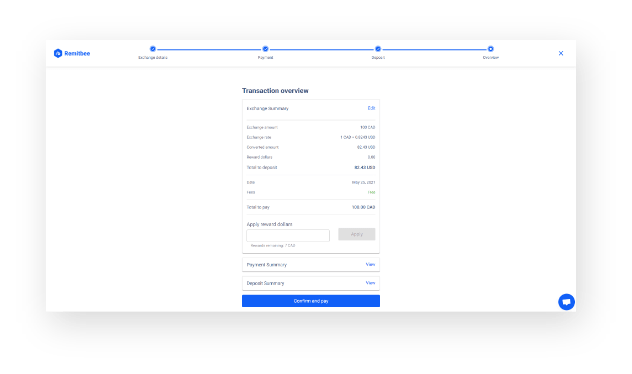

From the menu, select Exchange Currency. Now enter the details of your currency exchange, depending on your exchange amount further verification may be required.

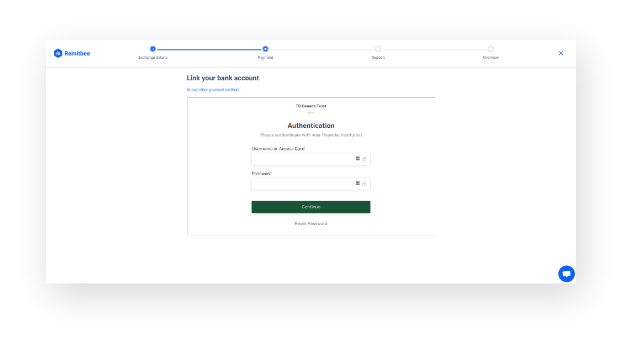

Connect your CAD and USD bank accounts

Choose the amount and confirm your exchange rate. The entire transaction takes place between your own two currency accounts via EFT

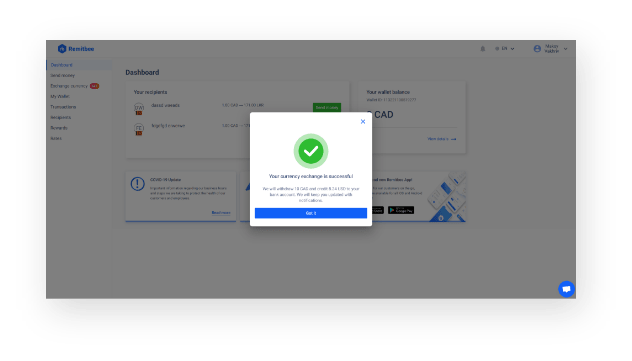

Convert your money! You can see all of your transactions in future by going to the Dashboard and clicking on the Transactions tab.

Other USD Accounts