Scotiabank Currency Exchange

Scotiabank CAD to USD / USD to CAD Exchange Rate Overview

For institutional, international, private, industrial, and small business customers, Scotiabank is a leading provider of foreign exchange services. The bank publishes its rates online but only for a limited range of transactions.

It states that the rates shown on the website are only for informational purposes. They are also only for non-cash purchases up to $9,999. Scotiabank also displays rates for small business, but they are only valid for purchases up to $999. The bank says rates can only be guaranteed at the time the purchase or sale is conducted. So the rates you see online may not be valid at the time you want to buy currency.

Scotiabank also has an online trading platform. However, it is only for business customers. Called ScotiaFX, it offers live foreign currency exchange quotes, trade execution, and transaction history to commercial and corporate clients.

How does Scotiabank’s currency exchange work?

To exchange currencies with other banks, banks typically use a rate known as the mid-market rate. They do not, however, give this lower cost to their clients. Instead, they benefit from adding a margin to the exchange rate. Additional costs, such as a payment transfer charge or an overseas transaction fee, are also added.

For example, on a particular date the interbank or mid-market rate was 1 USD = 1.2100 CAD. Meanwhile, on the same date, the non-cash rate for Scotiabank’s customers is 1 USD = 1.2476 CAD. (Rate checked on May 19, 2021) This means that a Scotiabank customer who wanted to buy USD was charged more than the rate that they may have found when they entered “current USD exchange rate” into Google..

Here are the nuts and bolts of buying foreign exchange if you bank with Scotiabank.

U.S. Dollar Daily Interest Account

Move between Canadian and US dollar accounts

Scotiabank says in its terms for this account that “The party performing the currency conversion may earn revenue on such currency conversion transaction (a “spread”), in addition to commission or fees related to the Foreign Currency Transactions in your account.

Scotiabank US Dollar VISA Card

Scotiabank branches and ATMs

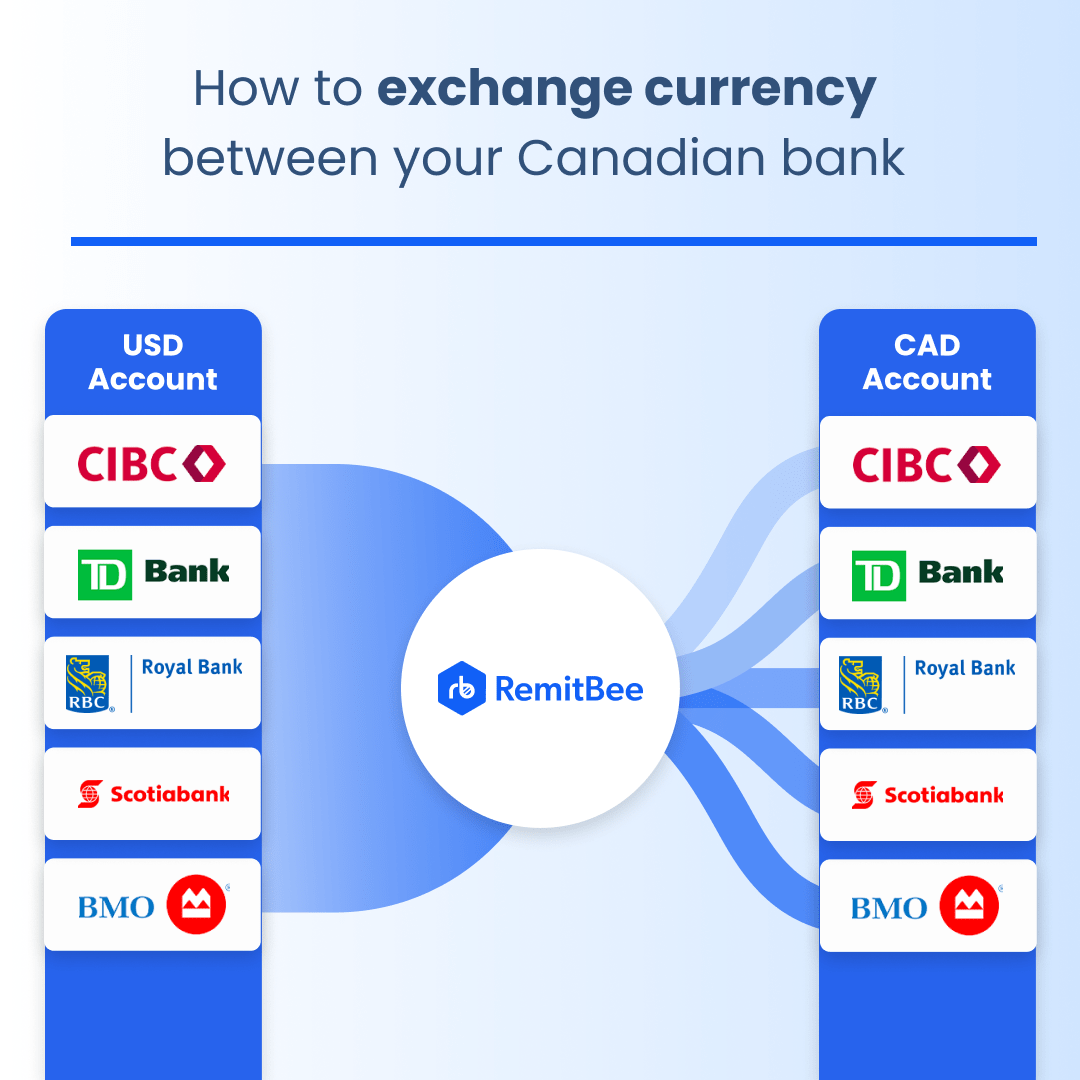

How to Exchange in Scotiabank accounts with Remitbee

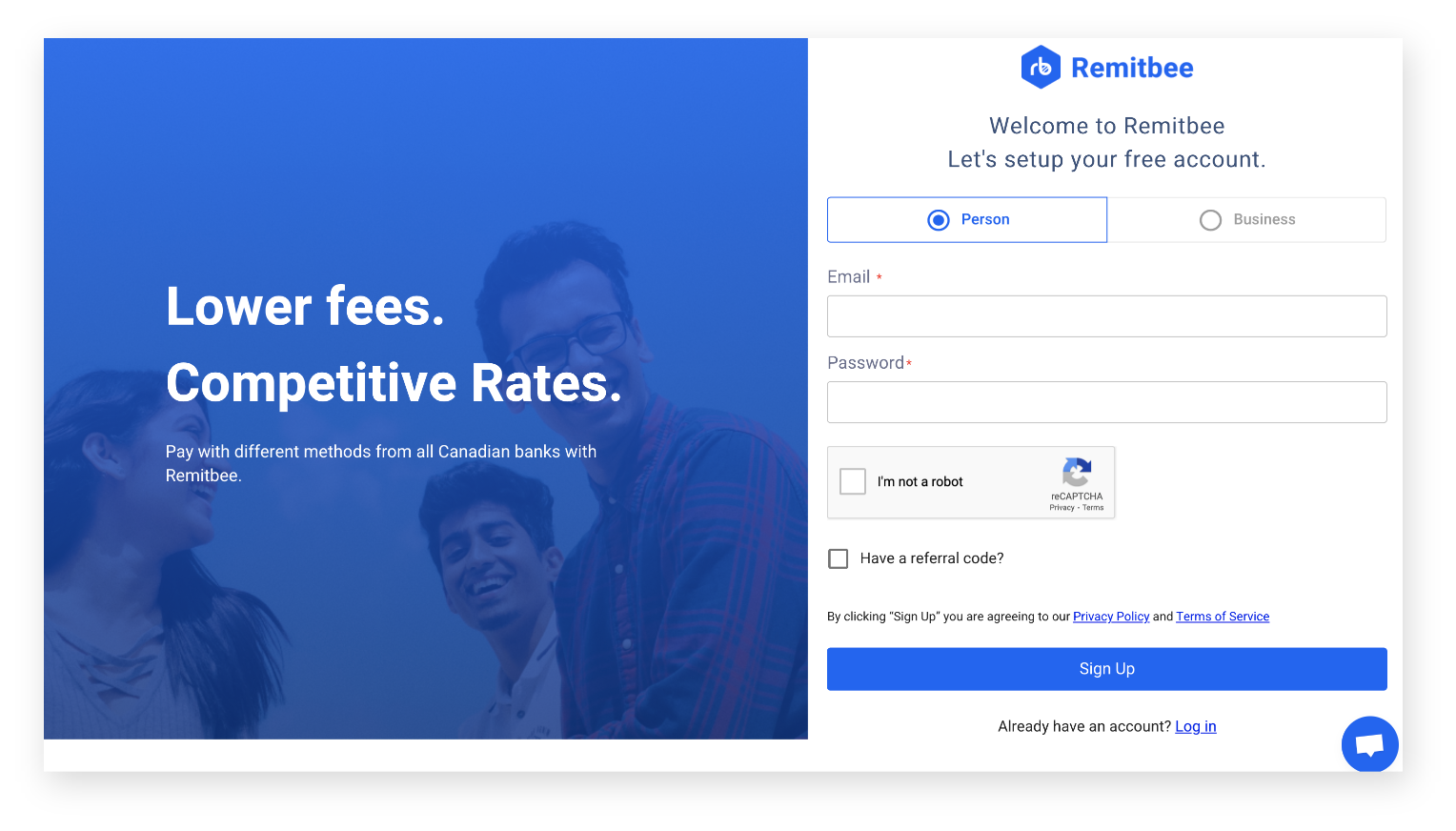

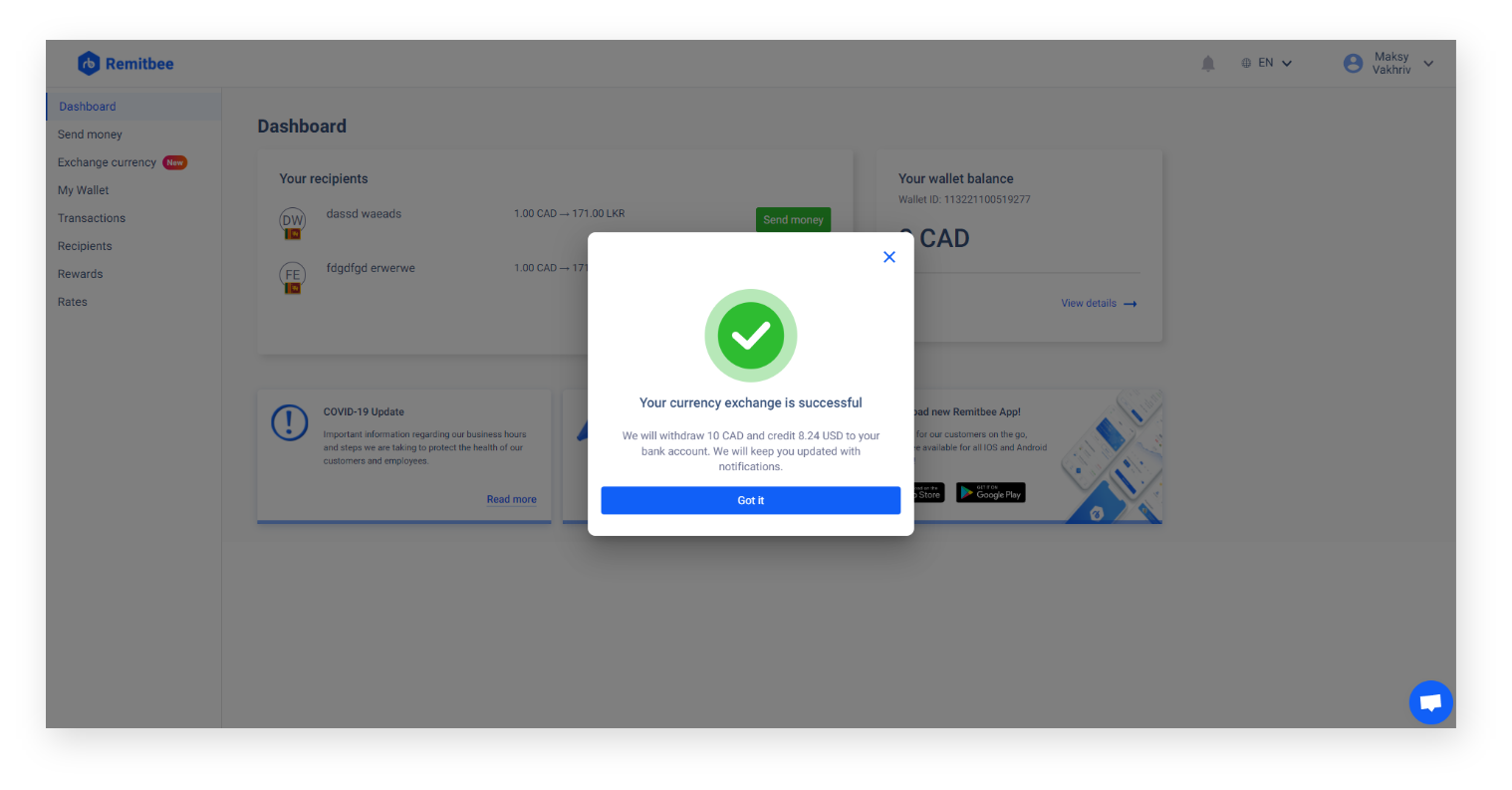

Create an account by entering your email address and selecting a password. You will be asked to confirm your Canadian phone number. Enter your Personal Information including name and address.

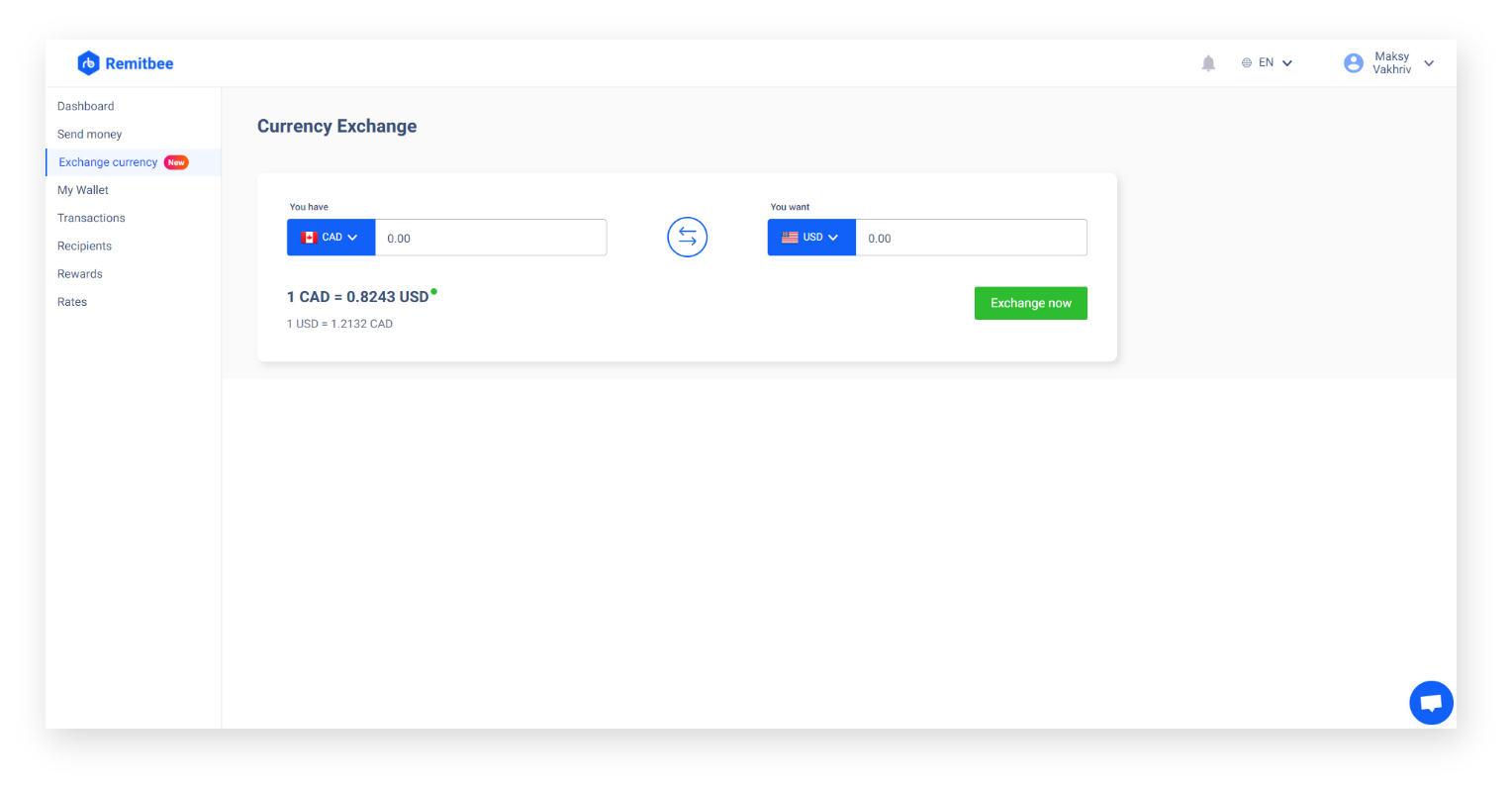

From the menu, select Exchange Currency. Now enter the details of your currency exchange to see how much you'll get right away.

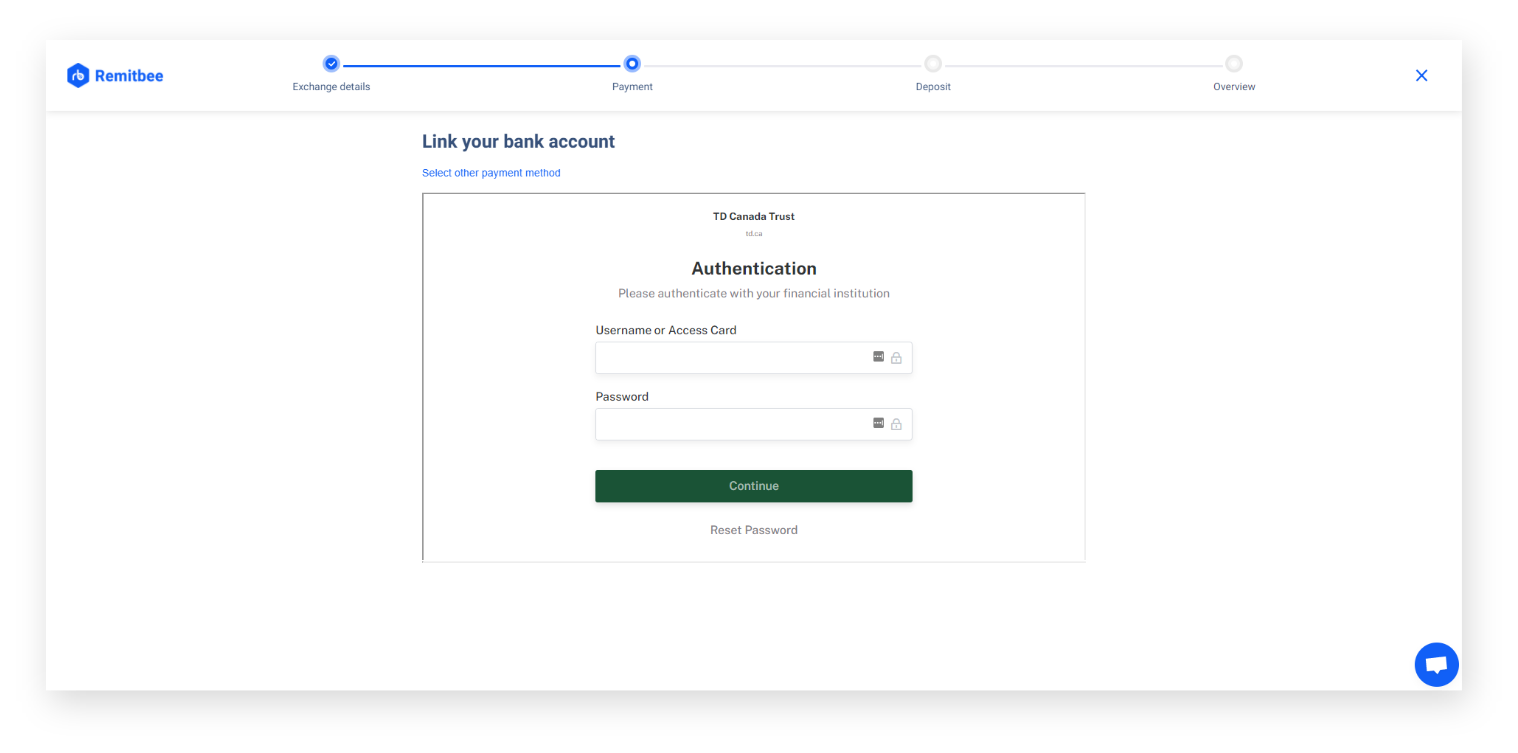

Connect your CAD and USD bank accounts

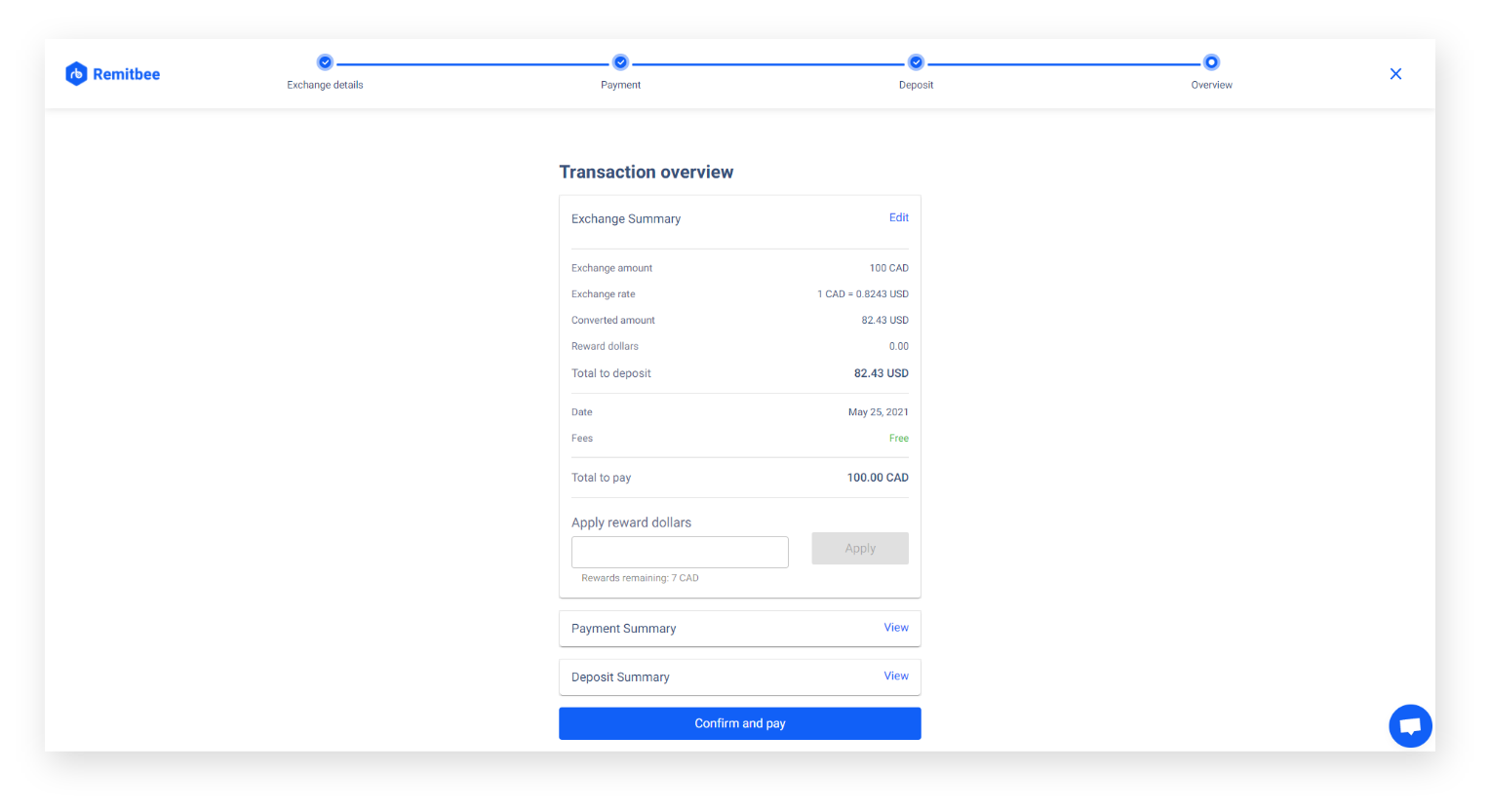

Choose the amount and confirm your exchange rate. The entire transaction takes place between your own two currency accounts via EFT

Convert your money! You can see all of your transactions in future by going to the Dashboard and clicking on the Transactions tab.

Wondering how much you can get? Try our currency exchange calculator!

Alternatives to Scotiabank’s Foreign Exchange Rate

- Other Banks or Financial Institutions

- Online Foreign Exchange Companies

- Airport Kiosks or Shops

- ATMs in the United States or Abroad .

Why is Remitbee the best option for exchanging money?

Remitbee offers better currency exchange rates than your bank.

FINTRAC regulates and audits Remitbee, ensuring that transactions are safe.

Remitbee makes exchanging money simple so you can get on with your day.

Other Currency Exchanges

This is because for a long time customers haven't known there are other options. Customers are unaware of how much money they are spending because banks conceal their high exchange rates behind a maze of fees.

Our goal at Remitbee is to make our payments and exchange rates as clear as possible so you can exchange currencies around the world at the best price. You'll know just how much you're spending and how much you're getting when you choose us.

Take our word for it, but don't take our word for it. Take a look at our prices and make a comparison. You will start saving right away if you sign up now.