RBC USD Account Overview

Put your USD in a savings account with RBC and receive interest and free online transfers Curious? Keep reading!

RBC USD Account

The RBC USD account is for customers who need somewhere to keep their US dollars – or deposit money that they are paid in USD. If you use this account, you won't have to convert your cash to Canadian dollars, which could be a major advantage if exchange rates aren't favourable.

You can put your USD in a savings account with RBC and receive interest and free online transfers with RBC bank accounts. Curious? Everything you need to know about the RBC USD account is right here in this guide.

To sign up for a USD account with RBC you can fill out the application online.

Key features

The US High Interest eSavings is the best USD account to get with RBC.

Here are some of its key features:

Monthly Fees & Interest Rate & Minimum Balance

Monthly fees:

RBC charges NO monthly fees and allows one debit transaction each month

Interest rate:

Account holders benefit from a rate of 0.05% (subject to change)

Minimum Balance:

There is no minimum balance for the RBC High Interest eSavings account, so $0.

Offers

In addition to access to MyAdvisor, a digital advice service to help reach your savings goals, RBC also has a set of powerful benefits called RBC Vantage. It gives you benefits and rewards for everyday actions, and helps you save.

The program benefits work like this.

What’s more, if you switch to an eligible RBC account, you could get $300 cash. This offer ends August 31, 2021. This works best if you link your USD account to your usual everyday RBC banking account.

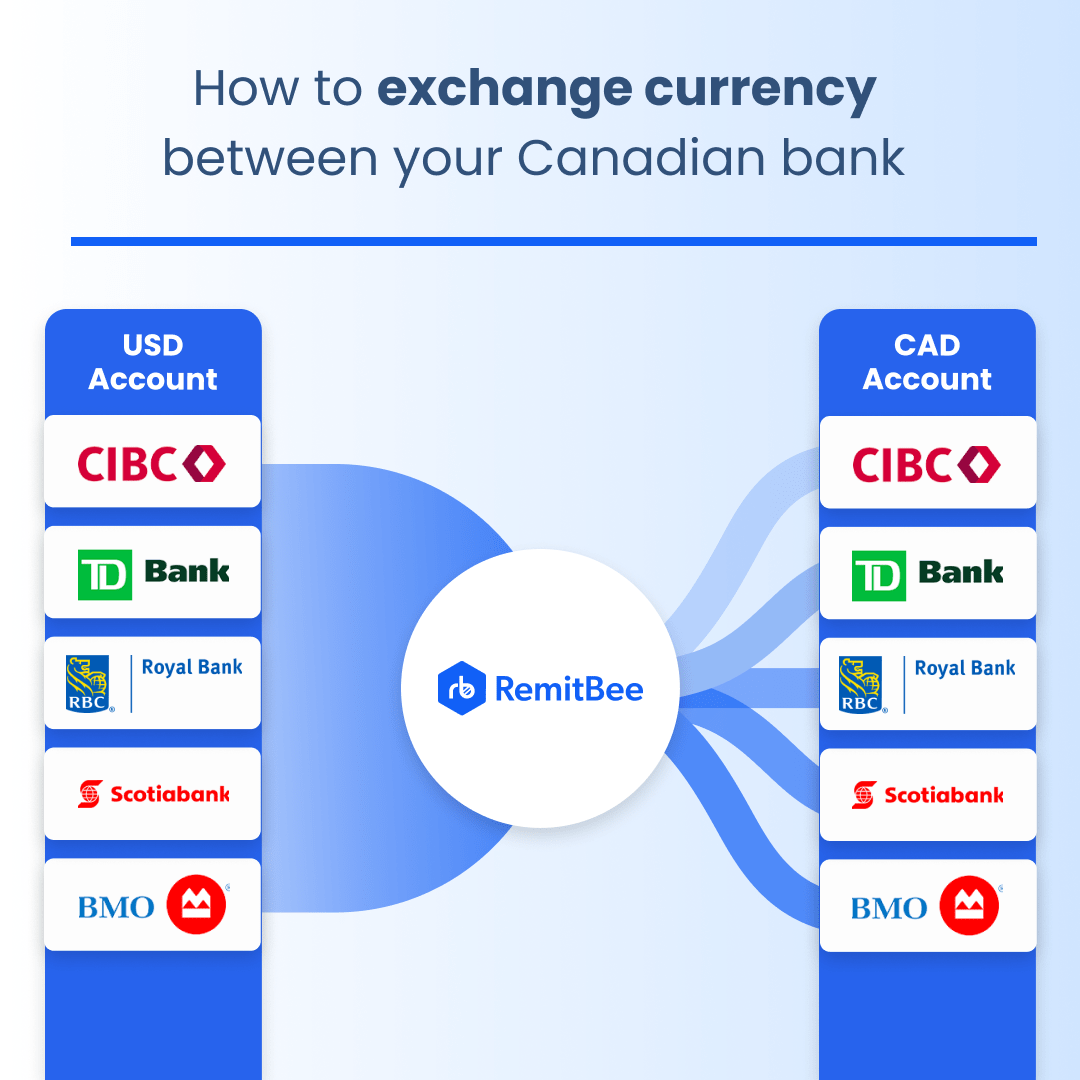

Currency Exchange Using USD Account

Sign up for an account at https://www.remitbee.com/signup by entering your email address and choosing a password. Your Canadian phone number will be required to be verified. Fill in your personal information, such as your name and address.

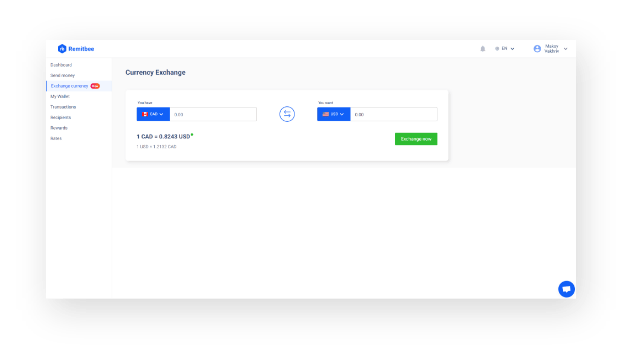

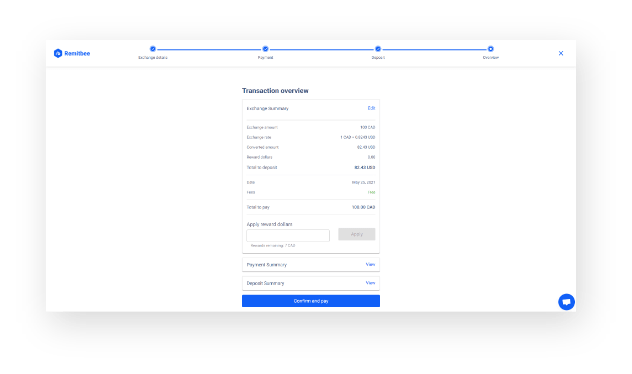

From the menu, select Exchange Currency. Now enter the details of your currency exchange, depending on your exchange amount further verification may be required.

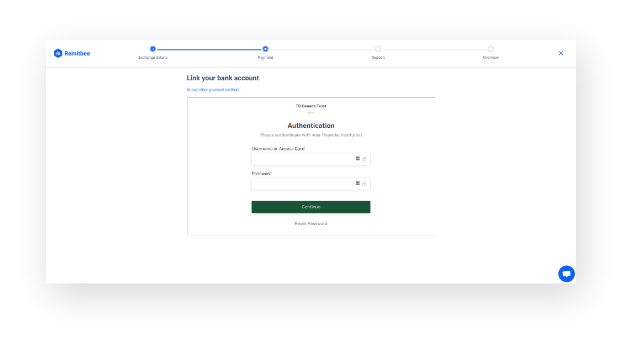

Connect your CAD and USD bank accounts

Choose the amount and confirm your exchange rate. The entire transaction takes place between your own two currency accounts via EFT

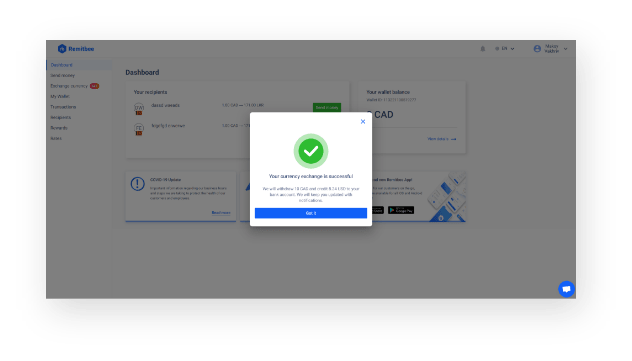

Convert your money! You can see all of your transactions in future by going to the Dashboard and clicking on the Transactions tab.

Other USD Accounts