PayPal Money Transfer Review

Exchange rates, Payment methods, How to, Transfer fees and much more

Two decades ago, consumers couldn’t imagine using the internet to quickly and easily move money from country to country. At that point, people were overpaying banks and Western Union to transfer money to family and friends abroad.

Then PayPal came onto the scene, disrupting the money transfer industry and allowing consumers the freedom to send money from country to country almost instantly.

With online payment and money transfer giant PayPal, fast transfers are the name of the game. In most cases, the recipient sees the money in their PayPal account just a few minutes after transfer was initiated, allowing them to utilize their funds right away.

You can send money quickly within your own country, or to someone in another country, using your computer, tablet, or mobile device. PayPal’s fees are higher than many other online money transfer services. These fees depend on where you’re sending money to, and how you’re funding the transfer.

How PayPal Money Transfers Work

Visit www.paypal.com and register for a free account.

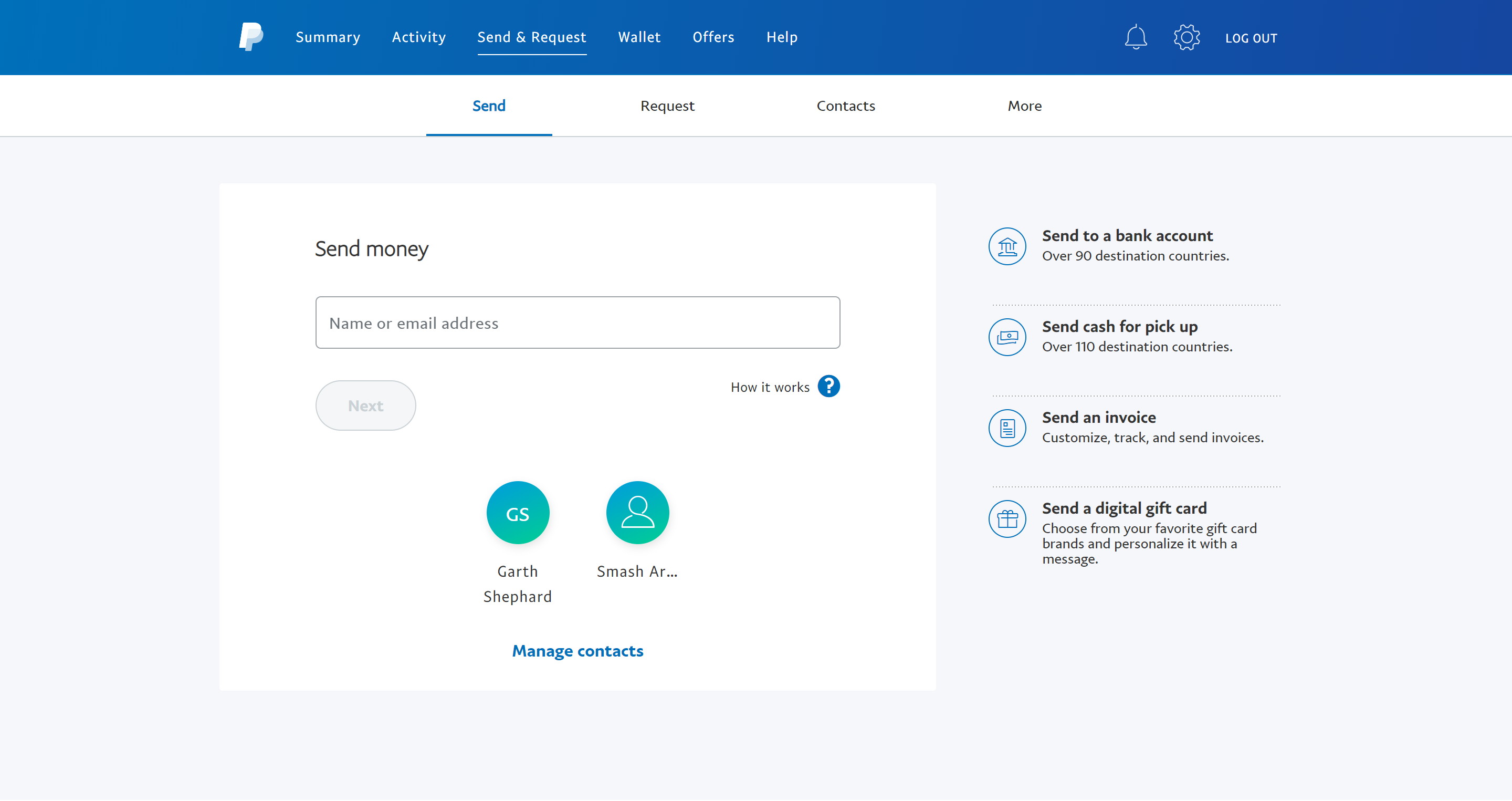

Select “Send & Request” at the top of the page. Enter the mobile number or email address of the recipient. If the person you are sending money to does not yet have a PayPal account, they will receive an invitation to open a free account.

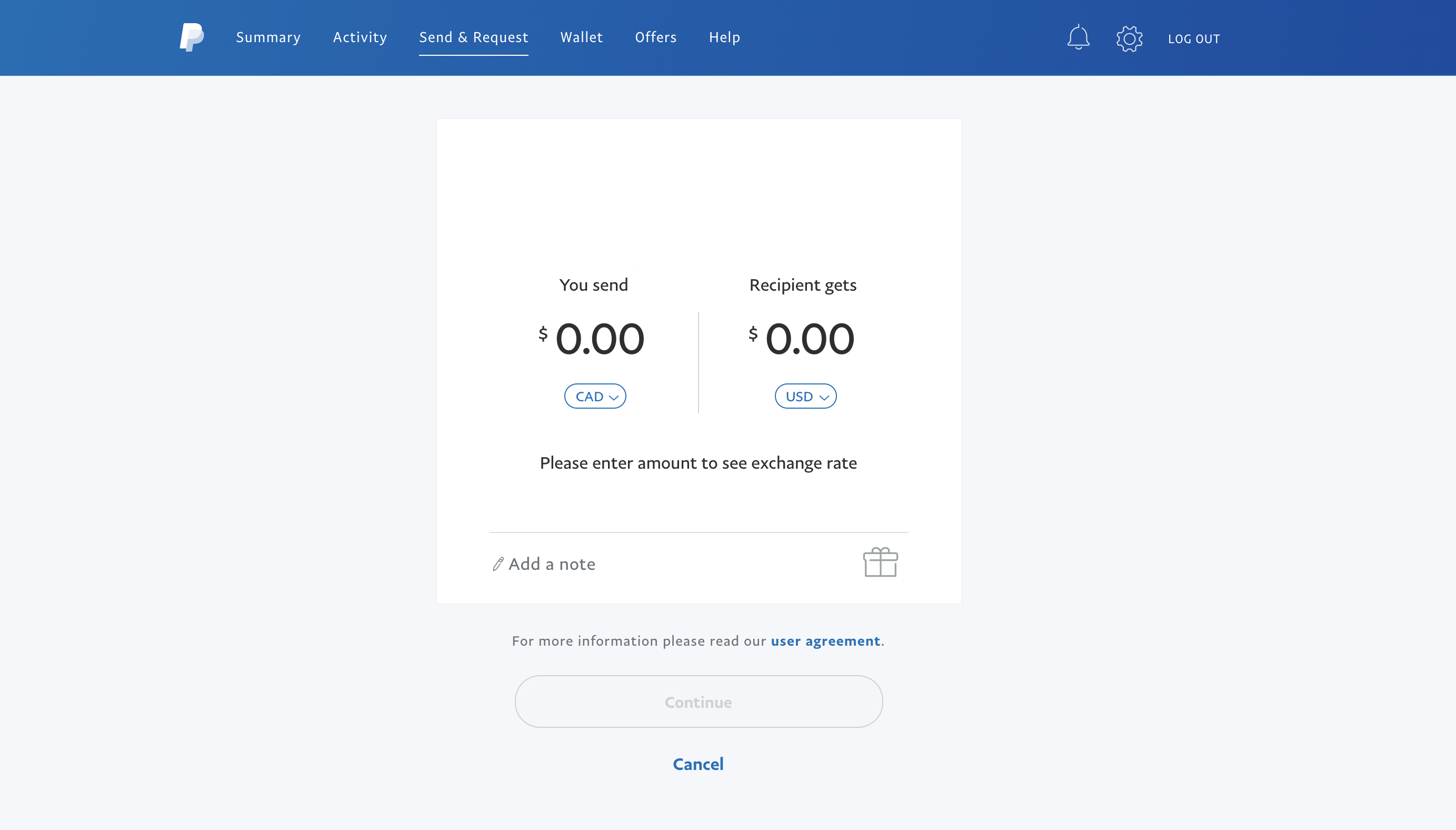

Enter the amount you want to send, and select the currency you’re sending money in. To avoid extra fees, select “Sending to a friend” (if sending domestically) or “Send to friends abroad” (if you’re sending to another country).

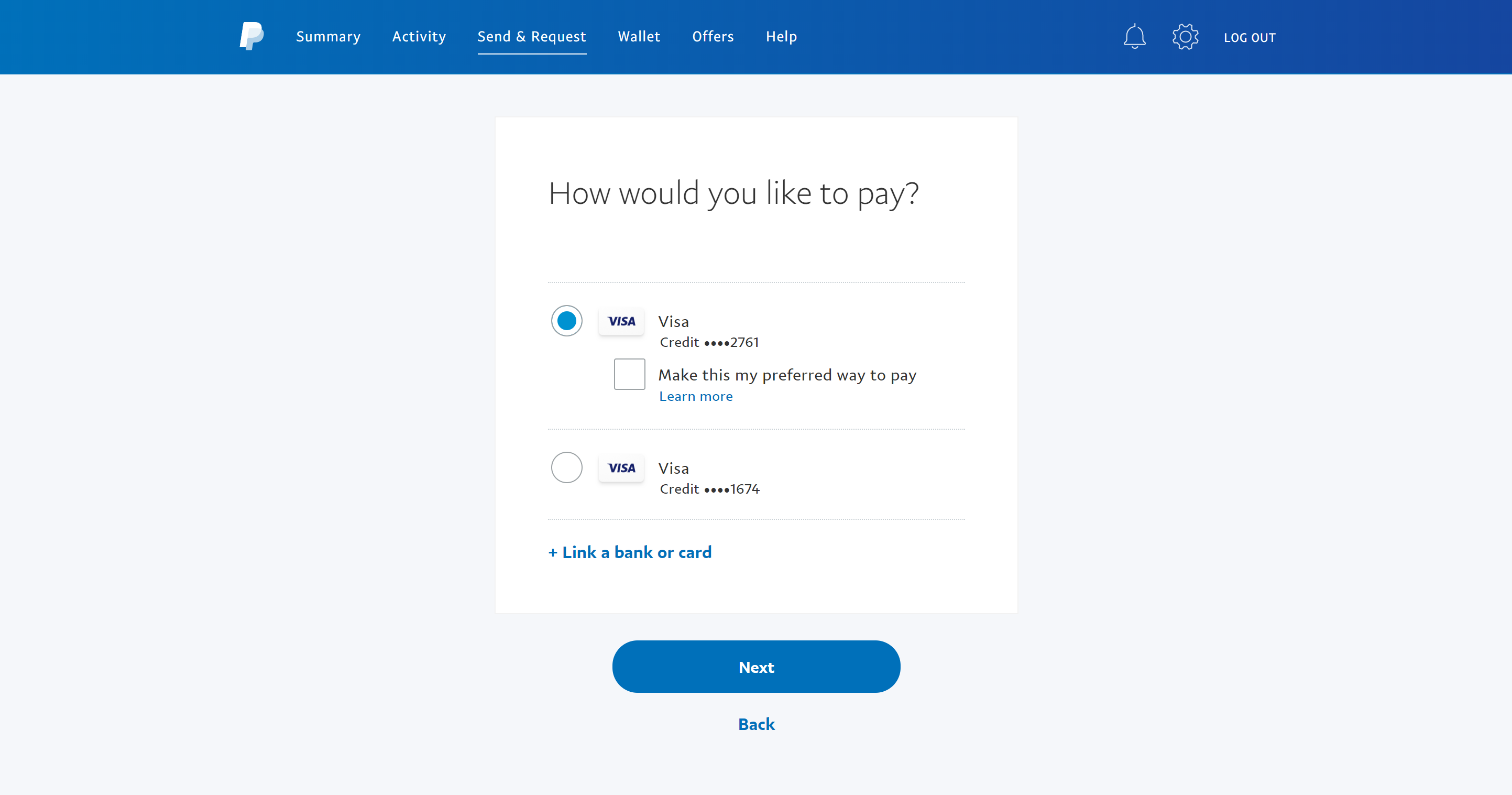

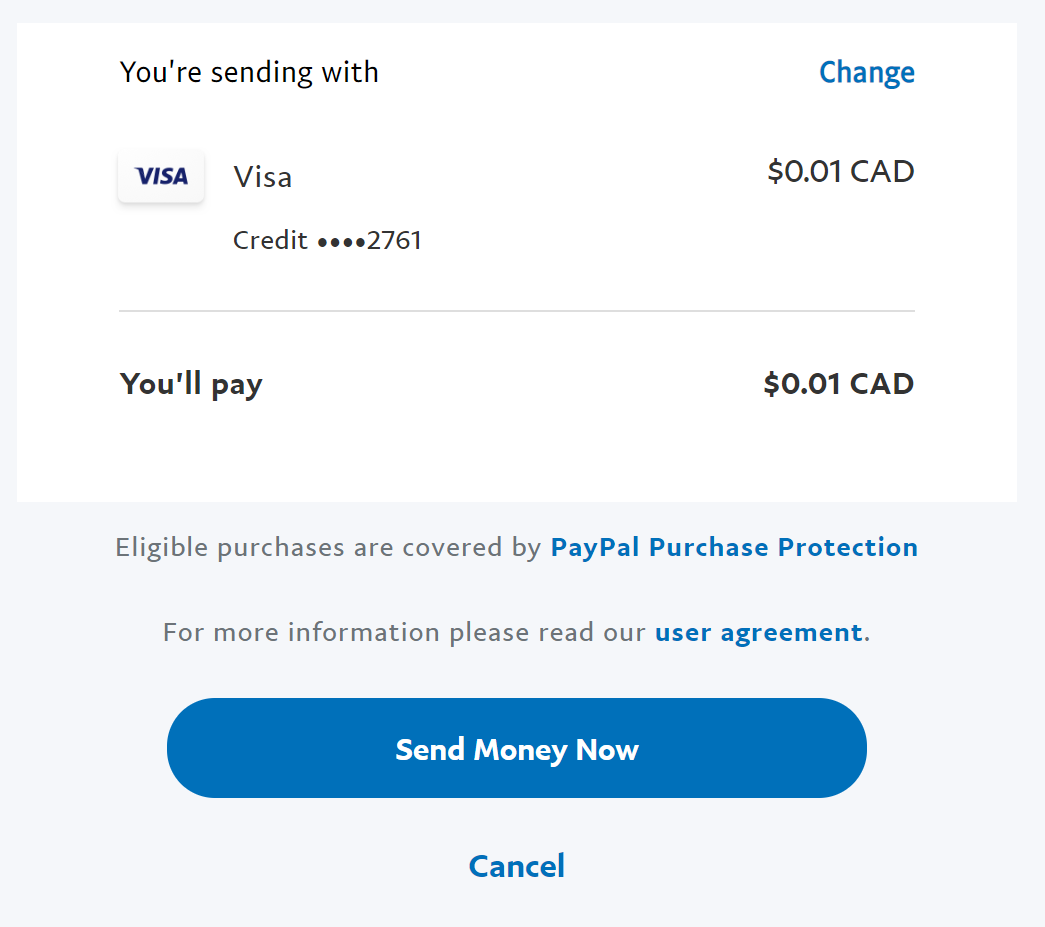

Choose how you want to pay for the transfer. You can use your PayPal balance, a linked bank account, debit or credit card.

Review the details and check the PayPal’s exchange rate if you’re sending money in a different currency. Once you’re ready, click “Send Money Now.”

PayPal offers a few options for funding your transfers:

- PayPal balance

- Linked bank account

- Credit card

- Debit card

The recipient has three options for using their money:

- Paying for goods and services using their PayPal balance (This only works at merchants that accept PayPal as payment)

- Transferring the money from their PayPal account into a bank account

- Request money to be sent to them via check, which can take 5-10 days, and include a fee

If you are sending money within your country, PayPal doesn’t add any fees for the transfer with your PayPal balance or linked bank account. However, there are fees for using your credit or debit card domestically.

However, when sending money abroad, PayPal charges a fee for all the transfers.

This fee is lower when you transfer money from your PayPal or bank account. In the same time, fees are way higher if you’re using a credit or debit card to fund the transfer. In addition, PayPal also charges a flat fee for all transfers funded with a credit or debit card.

PayPal does not charge fees for withdrawing money unless you want to get a paper check. So, there shouldn’t be any cost to your recipient to receive their money.

PayPal’s exchange rates are calculated using the mid-market exchange rate. PayPal then subtracts a 2.5% to 4.5% margin from the mid-market rate, depending on the sender’s country and the receiving currency.

Their exchange rates also differ based on how you’re funding the transfer.

PayPal offers one exchange rate for international currency transfers completed with your PayPal balance. This exchange rate is often better, as PayPal doesn’t charge as high a markup on the transaction.

If you are using a bank account, credit card, or debit card to fund your transfer, however, you will be charged a different exchange rate. Paying this way may mean you pay a higher exchange rate because PayPal marks up this rate more than if you’re just paying with a PayPal balance.

Because of this, PayPal’s exchange rates are not as good as you may find with other money transfer companies.

Pros and Cons of PayPal

Pros

They’re a big and well-known name in the industry, meaning they have high trust.

Easy-to-use website and mobile apps.

Sending money is nearly instant.

PayPal balance allows you to keep money for easy transfers.

Directly pay for goods and services through PayPal, or transfer money to a bank account.

Variety of options for funding your transfer.

Widely available, allowing you to send and receive money from all over the world.

Cons

They don’t have the best exchange rates, meaning you send less currency for the money you spend.

Fees for sending a transfer with a credit or debit card can be quite high.

Large amount of poor customer reviews.

PayPal makes profit by charging fees to send money to other countries, and to send money when using their credit or debit cards. Moreover, they usually charge a 2.5%-4.5% margin on exchange rate difference.

How much you are charged depends on how you’re sending money and the country where you’re sending money to. If you fund the transfer with your PayPal balance or your bank account, you will be charged less than if you pay with a credit or debit card.

Among the online money transfer services, PayPal’s fees are often higher. This makes PayPal among the more expensive choices when considering online money transfer services.

Other Money Transfer Providers

PayPal is considered a very secure way to send money online. It is one of the most well-known ways to pay bills and send money online. The company also has been in business for over 20 years.

The customer’s funds are held in pooled accounts separated from the company’s own accounts, so money is never used for PayPal expenses. Additionally, PayPal has a dedicated security team that monitors transactions 24/7 to prevent theft, fraud, and phishing.

All PayPal transactions and customer data are secured with state-of-the-art encryption and security measures. The company also is regulated and monitored by various international financial agencies.

Because of these strict security measures, some PayPal customers have complained that their money is held for a time for security and compliance reasons. However, the majority of these complaints come from merchants doing business through PayPal, and not usually from individuals who send money.

Because PayPal is so ubiquitous, its customer review profile is very mixed.

On review site Trustpilot, for example, the company has more than 9,000 reviews, with the vast majority of those reviews rating the company “bad.” Many of the reviewers experienced issues with transactions related to goods and services, not money transfers.

However, one common customer complaint about PayPal is its poor customer service.

Reviewer Luci W., for example, complains that PayPal customer service representatives never provide helpful information when she’s called, and the company had shut down her account for “security reasons.”

User TyQuita W. recently tried to send money from the United States to Barbados. She was never advised the transaction would be held for 30 days and, after speaking with three different representatives who told her they’d be releasing the money, she’s still waiting for the transaction to clear.

Not all reviewers are displeased with PayPal’s service.

Customer Manish R. has been using PayPal to send and receive money for some time. He said he has always received his payments on time and, when he has had to utilize customer service, he has found them helpful.

Customers can message PayPal and file claims using their website or contact them through the phone:

Customer Service Phone:(888) 221-1161

What Countries Does Paypal Allow You To Send Money To?

PayPal was founded in 1998 by Elon Musk, Peter Thiel, Max Levchin, Luke Nosek, and Jack Selby. It was launched as an e-wallet service that would allow merchants to take and process payments, and to allow individuals to send money back and forth.

The company went public in 2002 and was quickly acquired by eBay. After the acquisition, PayPal grew rapidly, eventually generating up to 40% of eBay’s total revenue.

PayPal and eBay split in 2015, and PayPal then acquired money transfer company Xoom.

Globally, PayPal has more than 250 million active account holders, and has transacted more than $450 billion. The company has more than 18,000 employees.

Banks

However, because you have to use a specific bank branch to transfer and receive money through a bank, it’s not the most convenient option for travelers. Banks also charge higher fees than other online money transfers and drive up the cost of a transfer.

Online money transfer companies such as PayPal are way more accessible and convenient for users. You can send and receive money right from your phone, anywhere in the world.

Traditional Money Transfer Companies

These companies allowed customers to walk into a location, hand over cash, and send money to someone in another country. After that, the recipient can walk into their nearest agent store and pick up their money.

However, this convenience comes at a price. Many of them restrict how users can send and receive money. They also charge high fees for transfers, causing many people to avoid using the services due to cost.

Online money transfer services such as PayPal, on the other hand, offer even more convenient than traditional money transfer services. They allow a wider range of payment and delivery options for greater flexibility. Additionally, they tend to charge lower fees for the transfers, meaning that more people have the ability to send money overseas.

Other Online Money Transfer Companies

Without having traditional storefronts, services such as PayPal, WorldRemit, Transferwise, Remitbee, and Xoom don’t have the high overhead found at banks and brick-and-mortar transfer companies. They don’t have to pay rent and maintenance on buildings, and they don’t have to employ thousands of people. Moreover, they don’t need to spend tons of money for enormous bonuses for the management and CEOs.

Lower expenses and operating cost allows them to charge lower fees and offer better exchange rates for customers. These things are making online money transfers more affordable for consumers all over the globe. While PayPal may not be the least expensive option, they are definitely faster and less expensive than banks or other money transfer services like Western Union.

While you cannot completely avoid paying fees on international money transfers with PayPal, there are some things you can do to decrease the fees you pay.

PayPal’s lowest exchange rates and fees come when you send money from your PayPal balance. If you do not already have money in your PayPal account, you can add funds using a linked bank account, then processing the transfer from your balance.

This method does take a few days to process, but it can save you a considerable sum if you’re not sending money in a hurry.

How much you will pay in fees with PayPal depends on a few factors, including:

- How much money you are sending

- Where you’re sending money to

- The method you’re using to fund the transfer (PayPal balance and bank accounts will be less expensive, while you’ll pay more to use a credit or debit card)

When you begin your transaction, you will see how much you will be charged in fees for your transfer. This allows you to know how much your transfer will cost you in total.

If a payment you’ve sent is still unclaimed, you can cancel it by logging into PayPal and navigating to the “Pending” section of your account. From there, you can cancel the payment.

For transfers that are completed and claimed, you are not able to cancel them. You have to contact the person to whom you sent the money and request a refund.

If the person doesn’t agree to a refund, you may be able to open a dispute with PayPal in the Resolution Center.

PayPal is one of the largest, most well-known companies in the online money transfer industry, boasting millions of users and billions of transactions. While it is far from the least expensive option for sending money overseas, it is widely accepted as safe and trusted by many users.

In many cases, money can be sent between users in a matter of minutes, making them one of the quickest, most convenient methods to send money overseas.