iRemitX Money Transfer Review

Exchange rates, Payment methods, How to, Transfer fees and much more

iRemitX Money Transfer Review

Are you looking to send an international money transfer from Canada to the Philippines? One option you may want to check out is iRemitX. This online money transfer service is a new option for sending money to friends or family in the Philippines.

You may have questions before picking this service though. What is iRemitX? Is it safe to send money with them? How fast is it and how can your receiver pick up money with iRemitX? For answers to all these questions and more, keep reading to find out everything you need to know about sending money with iRemitX.

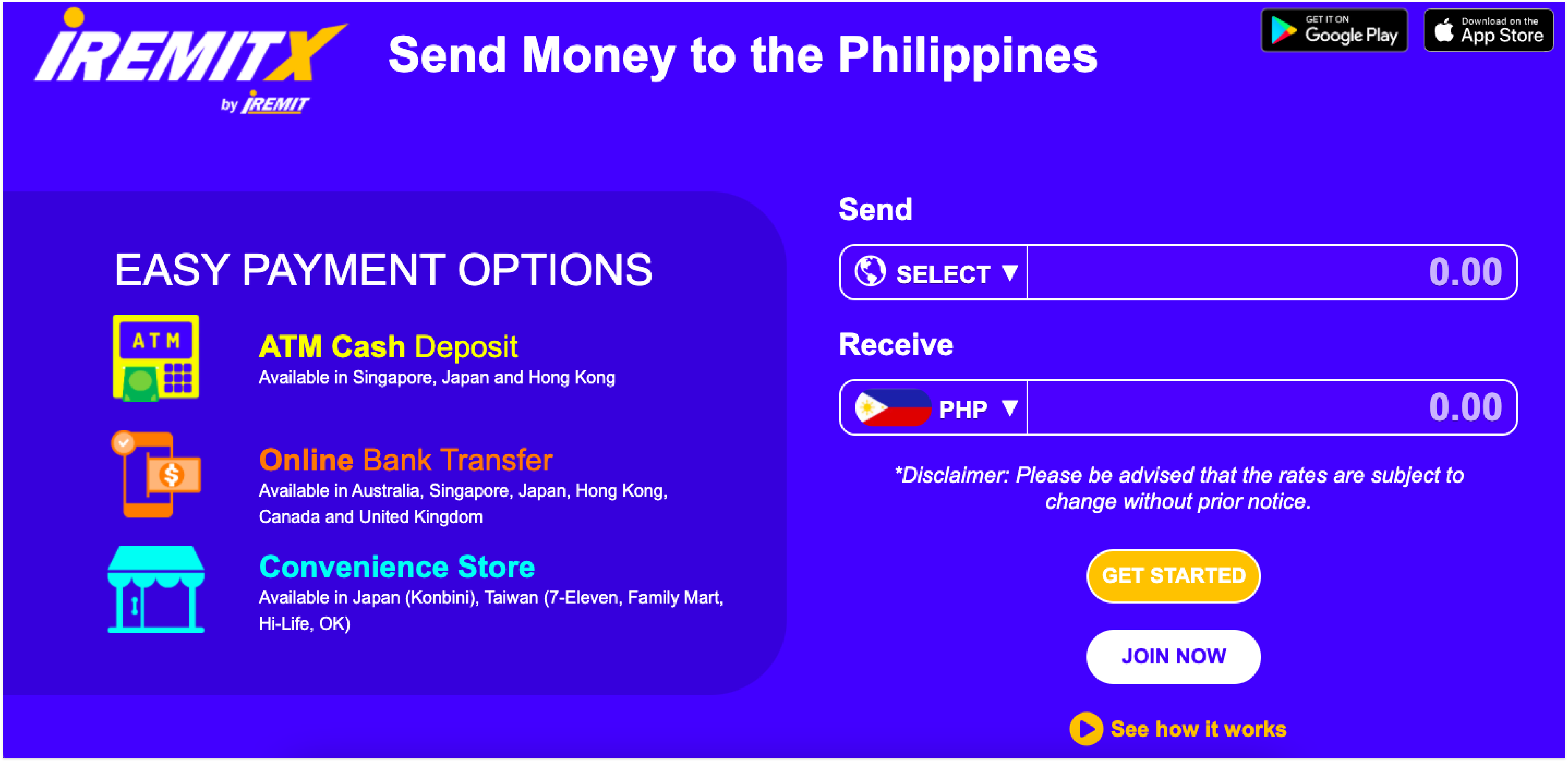

Payment Methods Available with iRemitX

If sending with iRemitX from Canada, you have two options. The first is using your online banking with your current bank account. The second is through the Canadian banking system of e-transfers, Interac.

If you plan to send from a country other than Canada, here are your options:

How Much I Can Transfer With iRemitX?

iRemitX is not clear about the maximum you can send in a single transfer. However, past senders have noted in iRemitX reviews that the most you can send in each transfer is PHP 50,000.

iRemitX Transfer Fees

Fees for using iRemitX to send vary according to payout method. The company is not transparent about their fees, so the best way find out for your specific transaction is to use their cost estimator on the iRemitX website. The fees can range from $6.99 to $10.00 depending on if you send online or in person.

How To Open An Account With iRemitX

In order to sign up you will need a form of ID from the list below.

The information provided when you sign up must match the ID document exactly. You will also have to provide your occupation, nationality, Canadian address and phone number.

Upon submitting your details, iRemitX will require a final step of you uploading a selfie and your identification document. Unlike other services, it is difficult to get started creating an account. The user experience is poor, and for some senders can be too much hassle.

Pros And Cons Of Using iRemitX

Pros

Variety of payout options for Filipino receivers

Can send through mobile app on the go

Money can be available instantly with Visa card option

Cons

Customers have reported transactions being cancelled

Fees are not transparent

Bad user experience in both apps and website version

Poor customer support

No referral or loyalty programs

Lack of features, only does money transfers

Cannot view rates, fees and transfer details without full verification

Long delivery times, up to 6 business days

How Does iRemitX Work?

Online banking

Interac e-transfer

Other Money Transfer Providers

iRemitX Exchange Rates

You can see the daily exchange rate on the iRemitX website. To see it, you will need to do a cost estimate. Senders benefit from a locked-in rate that is valid until midnight on the day they start the transaction. For example, if you send CAD 1000 the recipient will get 37,600.00 pesos. This breaks down to an exchange rate of 1.00 CAD = PHP 37.60. This is a worse rate than the daily mid-market exchange rate, which is 1.00 CAD = 37.95. If the real mid-market rate was used, the receiver would have gotten more money, i.e., 37,952.10 pesos.

(Rate checked 2:35 p.m. 5 January 2021)

How Does iRemitX Make Money?

iRemitX makes money both on charging senders fees and using a margin on the exchange rate. If you compare the rate that you find in Google for the Philippines Peso (PHP), you will see there is a difference. Companies like iRemitX make money on giving customers a slightly worse exchange rate than the real, mid-market exchange rate. The mid-market exchange rate is the one used among banks for large transactions.

Platforms Where iRemitX Is Available

As iRemitX was created to make it easy to send money online, it is available as an app for both Android and iPhone users. iRemitX is rated a good 4.3 out of 5 stars by users on the Google Play Store, while on the App Store it only has 2.5 out of 5 stars for its app.

Is iRemitX Secure?

If you are wondering how secure the iRemitX company is, it’s good to know that it is regulated by Bangko Sentral ng Pilipinas and the Securities and Exchange Commission. It uses blockchain technology to send money, through its partnership with American fintech company Ripple. In Canada, the company is registered with FINTRAC under the name I-Remit International Remittance (Canada) LTD.

iRemitX Allows You To Transfer Money To The Following Countries

At the moment, iRemitX is a Filipino-only company. It is primarily for transfers to the Philippines.

How To Contact iRemitX

Email Support - [email protected]

Telephone Alberta: 1-403-800-7705 / 1-780-800-0462, Manitoba: 1-204-800-4282, British Columbia: 1-778-785-6842, Ontario: 1-647-846-7369

Contact form https://iremitx.com/pages/ContactUs.aspx

Traditional banks

Online banks

Traditional Money Transfer Providers

Transferwise

is an award winning online money transfer company. It allows senders to benefit from the real exchange rate. It does charge fees, but they are transparent and you know the amount up front. If you choose Transferwise, your receiver will have to receive the money to their bank account.

Online Money transfer companies like Remitbee

History Of iRemitX

iRemitX started as an offshoot of money transfer company iRemit. It was created so that people would no longer have to visit an office in person in order to send money. As an online money transfer provider, it operates as a standalone company separate from iRemit but working closely with it all the same.

iRemit had been a major player in the Philippines before, and was in fact the biggest remittance company on the country’s stock exchange. Across Asia and the rest of the world, its partnerships allow it to boast of more than 1,000 branches.

So what is a iRemitX in a Nutshell?

Unfortunately it's difficult to know the real cost of a transfer with iRemitX. As there is no transparency on fees before registering, you have to create an account to find out the real total cost. If you send money to the Philippines often, there may be better services out there. To find out more, read our reviews on the Remitbee blog.