CurrencyFair Money Transfer Review

Exchange rates, Payment methods, How to, Transfer fees and much more

Are you looking to transfer money abroad? Then you may be interested in CurrencyFair.

This international payment service allows you to exchange currency with other users. Using CurrencyFair, you can pay international tuition fees, buy or sell property, or even get an overseas pension.

There are many international payment providers out there. Before picking one, you need to know the answers to a few questions.

Are CurrencyFair’s costs competitive? How convenient is the service? Can you trust CurrencyFair with your money? These are all the factors that go into choosing the right service for you.

To find out everything you’ve ever wanted to know about CurrencyFair, keep reading.

So how does CurrencyFair work? After signing up, you can enter the details of the payment you want to send. The site or app then displays both the exchange rate and the fees that will be applied.

If you are happy with it, you can fund the payment with a bank transfer. CurrencyFair then pays out your beneficiary in whichever country they reside.

The peer to peer option

Now here’s what makes CurrencyFair different from other services. You can use the service like a marketplace. This means that you can choose your desired exchange rate. If there’s another customer also looking to exchange who accepts it, you’ll both get what you want.

The process is totally automatic. It’s also transparent, since you know exactly what you want to pay and what you’ll get.

Using the best available rate

There’s also a second option for senders who do not want to wait. A sender can choose to convert at the current best available rate in the marketplace. This means a transaction can happen immediately. These rates are competitive too, on average, only 0.35 % below the mid market rate.

In both cases, there’s a flat transfer fee of approximately 3 euros. In terms of time, expect one business day to transfer the money to CurrencyFair. Then one to two business days for the beneficiary to actually get the money. For some currency combinations, the process can take longer.

How to send money with CurrencyFair: Step by Step

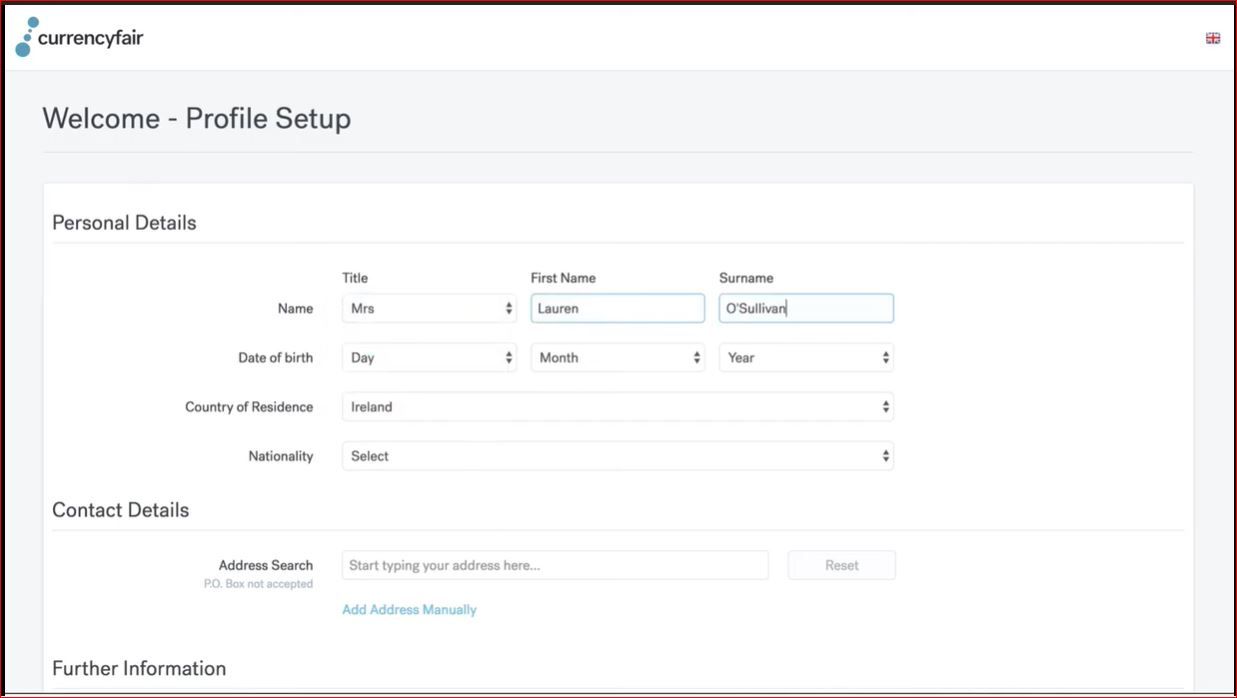

You can set up a CurrencyFair account and be ready to send in minutes. Go to www.currencyfair.com and register for a free account. There is a verification process as well.

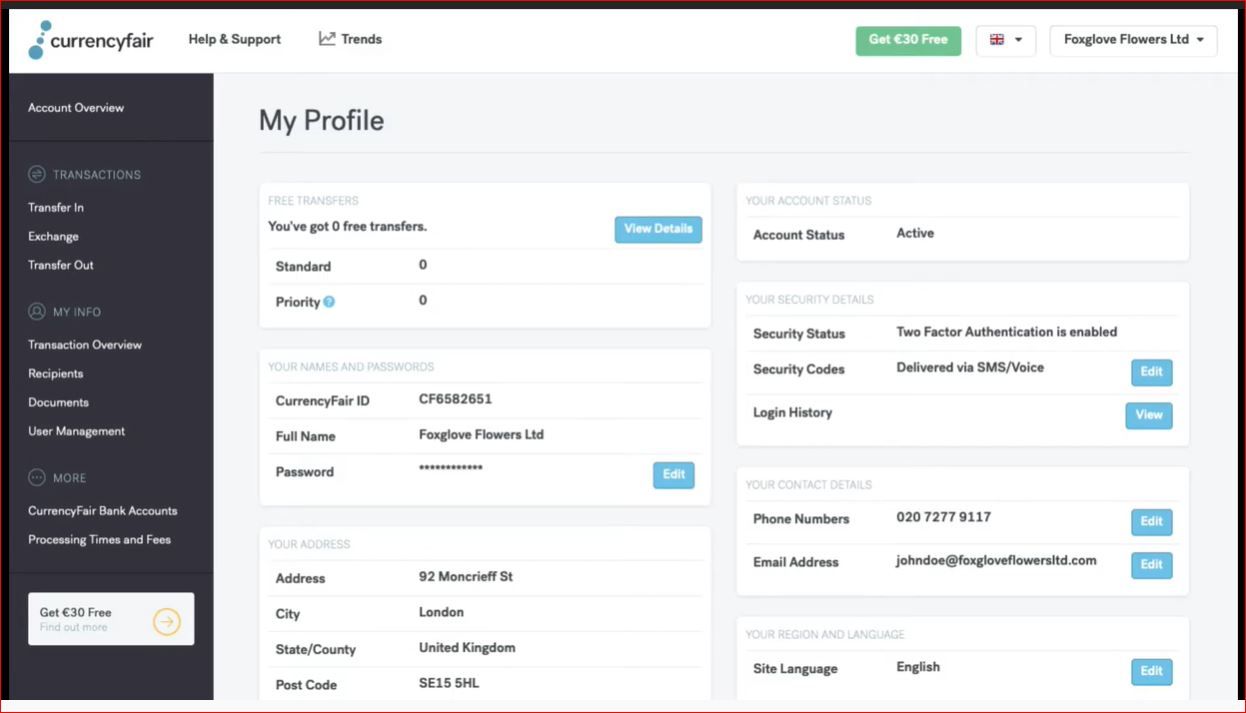

After you created your free account, you’ll need to provide more information about yourself. Your full name, residential address, phone number, and occupation will be required to initiate your first money transfer. It’s a mandatory government requirement, and there is absolutely no way around. Moreover, if you want to send larger amounts, you will need to provide certain documents and have them verified.

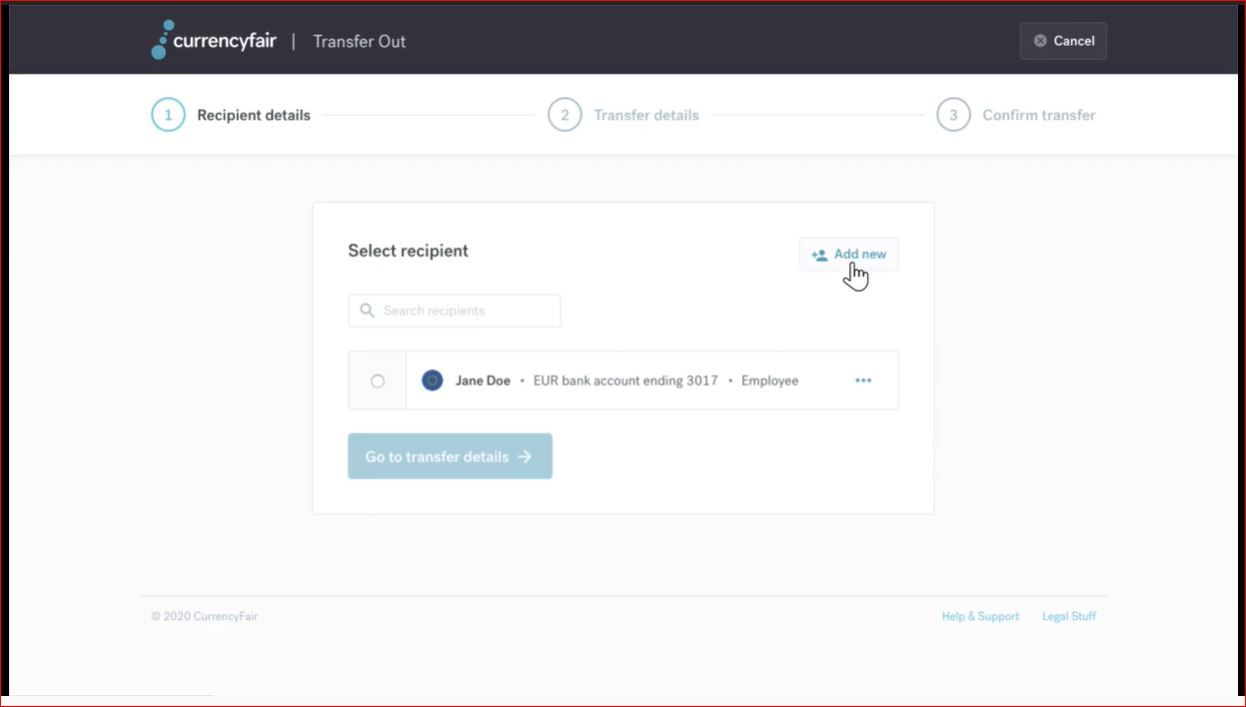

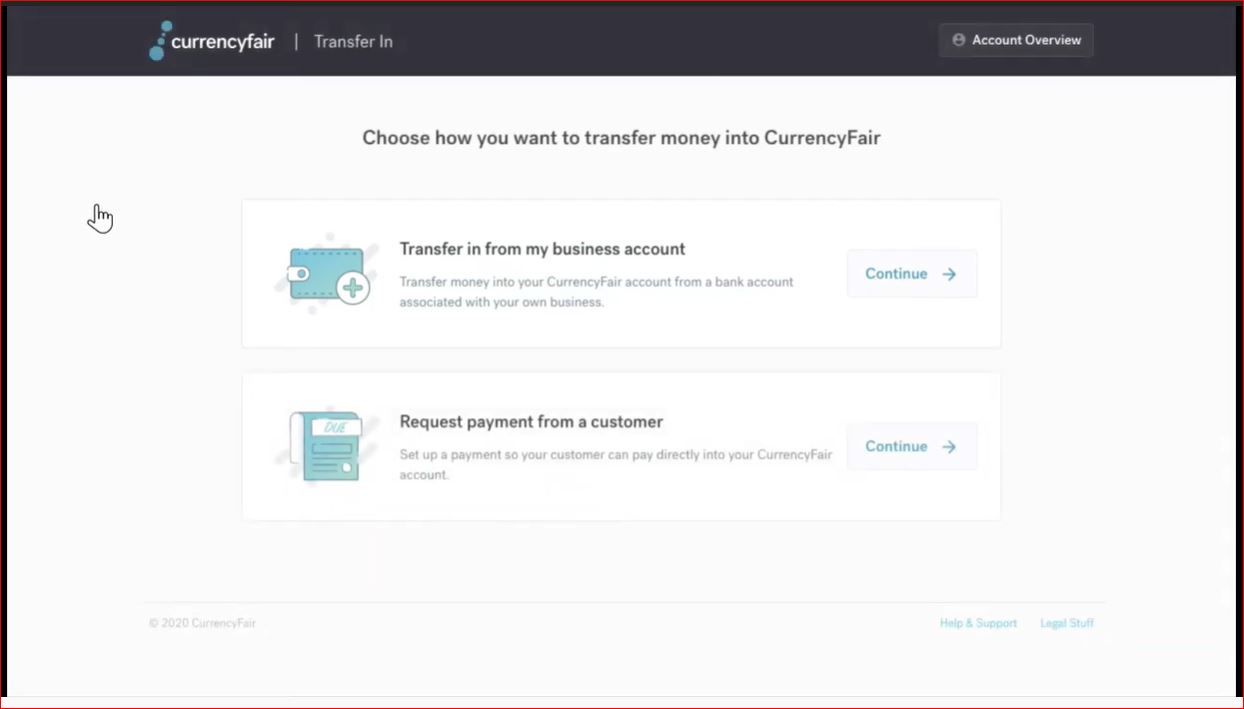

Next you’ll need to enter the transfer details Enter the amount of the transfer and the beneficiary. You’ll also need to choose how you want to pay for the transfer.

CurrencyFair is flexible when it comes to funding your transfer. You can make a local bank transfer or pay by card. When it comes to what CurrencyFair does with the money, there’s two options. The first option is to deposit money into your account. Later, you can make a transaction using the peer-to-peer or instant option detailed above. The other option is to do an Auto-Transaction. That way you don’t have the money sitting in your account.

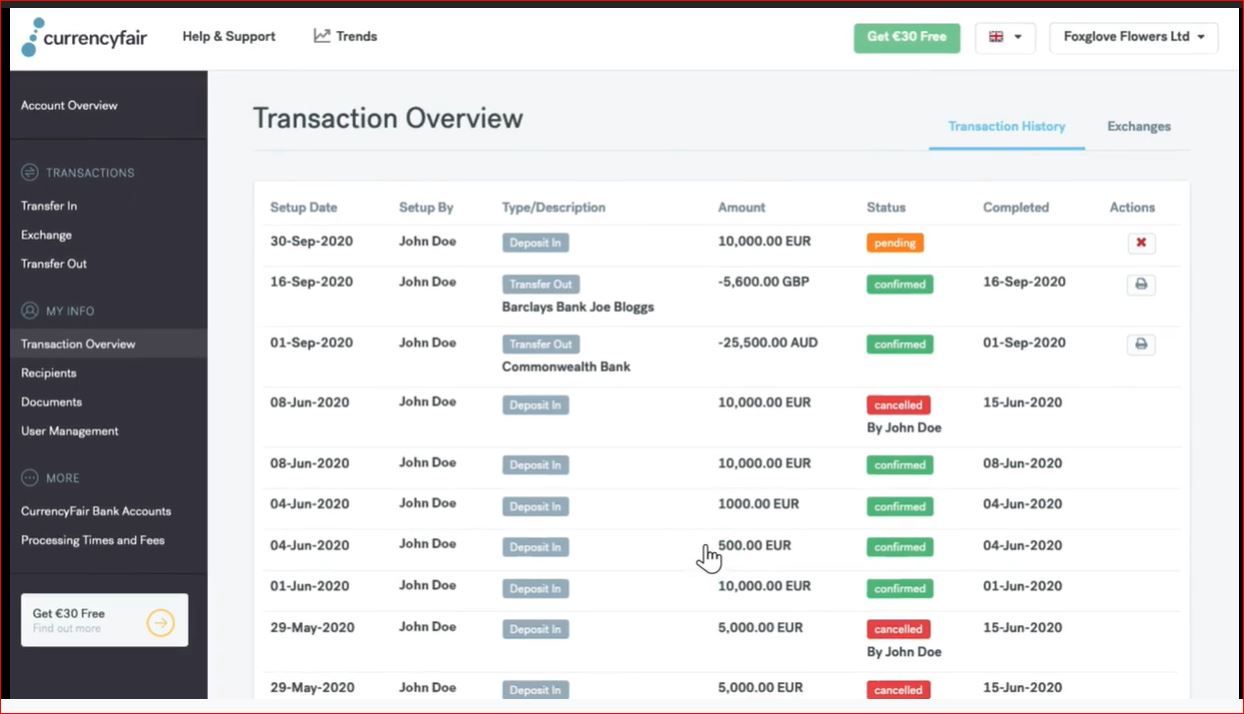

CurrencyFair will convert the money and pay out the beneficiary. You can track the status through the app or website.

No matter which option you choose, you can use theCurrencyFair service through their website or mobile app (on Android and iOS). Service is accessible from anywhere, and at any time.

Auto Transactions with CurrencyFairIt’s a good idea to know more about the Auto-Transaction option with CurrencyFair. This automatic and simple way to transfer money abroad is the most convenient option for most senders. Take a note that it only works if you don’t currently have money in your account.

First, confirm how much money you want to send, which currency, and the account of your beneficiary. Then make your bank transfer. Once CurrencyFair has the money they will exchange it automatically at the best available rate.

Your beneficiary will receive the transfer without you having to do anything more.

Getting Verified With CurrencyFair

Verification with CurrencyFair is an important step in the transfer process. The company has to verify your identity in order for you to easily make a transfer. You will be required to provide:

- Passport number

- Photo or scan copy of your ID - driver’s license, national ID or passport

- Proof of address - license with address showing, bank statement, credit card statement, tax notice, or household insurance document

For the ID and proof of address, it’s possible that you will be asked for two forms of each. For example, to prove your address you may need to provide a utility bill and a bank statement.

The good news is that in many countries you can sign up in minutes with electronic verification. This applies in Australia, Canada (if you’re an immigrant), France, Ireland, Italy, New Zealand, Poland, Spain, Switzerland, and the UK.

A large part of the choice in transfer companies comes down to fees and exchange rates. Here’s what CurrencyFair will charge you to send a money transfer.

Transfer feesThere is a flat fee for sending each transfer from your CurrencyFair account. It is approximately 3 euros, $4 CAD or $5 USD. As a result, it’s easy to calculate up front what your total cost will be. It also means large transfers don’t get charged more.

Pro tip: you can choose a currency to pay the fees in to get the best rate. For example, let’s say you have accounts with CurrencyFair in both pounds and USD. You can pick which account to use to pay the transfer fee, depending on what is the best option for you.

Exchange rates

CurrencyFair’s exchange rate margin is a large part of the cost you’ll pay to send a transfer. There is an advantage in that you can choose your own exchange rate. In theory, this means you can get a better deal than the mid-market exchange rate. This is the midpoint between the buy and sell rates of any given currency pair.

The issue of course, is that this only works if a user accepts the rate you offer. You can choose to not go peer-to-peer and accept the best available rate. This will usually be a good deal. Estimate around 0.35 percent below the mid-market rate.

Does CurrencyFair charge Other fees?

Beware of intermediary bank fees when sending money abroad with CurrencyFair. These apply if you are sending money to or from accounts that are not in local currencies. For example, a GBP account held in Sweden.

Most of the CurrencyFair’s accounts are held locally in the country’s currency. Say you are transferring from a UK. CurrencyFair will give you the details of a British account to send money to, so you effectively are making a local transfer.

Unfortunately, this does not apply to or from the following countries and currencies:

- United States Dollar

- United Arab Emirates Dirham

- Candadian Dollar

- New Zealand Dollar

- South African Rand

- Israeli Shekel

CurrencyFair Pros and Cons

Pros

Exchange rates are excellent

Fast speed of transfer

Responsive customer service

Wide range of countries and currencies

Excellent reviews from customers

Low transfer fees

Cons

Signup process can be unclear

Can only fund transfer with bank transfer and sometimes debit card

Verification documents to open account can be burdensome (though electronic verification is available in some places)

Other Money Transfer Providers

The history of CurrencyFair started in 2009. There were a few disgruntled immigrants who had personal experience with moving countries and trying to send money as a result. International bank transfers are known to have both bad exchange rates and high fees.

Four founders, David Christian, Jonathan Potter, Sean Barrett, and Brett Myers, got together. Their idea was to create a marketplace where people who wanted to exchange money could do it amongst themselves. Now, they have achieved their goal of helping people avoid expensive international transfers.

Over $5 billion has already been transferred with CurrencyFair. Since it was founded the service has been used by hundreds of thousands of customers. The company also employs staff in a number of countries and has been covered in international media outlets. It is regulated by the Irish Central Bank. The money used for CurrencyFair’s operations are kept separate to client monies.

Overall, CurrencyFair is a safe place to trade currencies and put your money in.

What Countries Is CurrencyFair Available In?

Currently you can exchange in between 20 currencies. Nearly all have the advantage of having accounts in local currencies. So transferring money to CurrencyFair should be free.

You can see all the countries you can transfer money TO using CurrencyFair on their website. These include countries as diverse as Australia, India, Mexico and South Africa.

You can transfer money from a large number of countries as well..

Transferwise

could be a good alternative to CurrencyFair for international money transfers. It offers the real mid-market exchange rate. There are fees associated with it though. Unlike CurrencyFair you don't get the option to choose what rate you want. Transferwise has a limited number of countries compared to CurrencyFair too. It is worth checking to see if your country or currency is on the list.

Transfergo

is another international money transfer service. It offers the option of super quick transfers, your beneficiary can get money in as little as 30 minutes. It’s a flexible service that offers more than one way to fund your transfer. On the other hand, if you want to pay less TransferGo can take up to 3 days to transfer money. It's also not available for senders in the United States or Canada.

Remitly

is a well-trusted service for transferring money. It has a huge banking network. This means that both sender and beneficiary are likely to have a bank near them that they can use with Remitly. Unlike CurrencyFair, there's more than one payout method available. However, Remitly is not always the cheapest money transfer option. It’s best to go on their site and see what your specific transfer may cost.