TD Bank Currency Exchange

TD Bank CAD to USD/ USD to CAD Exchange Rate Overview

Non cash is for transfers, deposits, cheques, drafts, and other transactions in which no physical foreign currency is exchanged. TD Bank also uses the non-cash rate when you pay on your TD U.S. Dollar credit card balance.

Cash on the other hand is for the purchase and sale of physical foreign currency in cash. Non-cash rates are usually better for you than cash rates. This represents the costs and uncertainties of shipping, handling, and storing cash in foreign currency.

How does TD Bank’s currency exchange work?

- You buy foreign currency in cash from them

- They buy foreign currency in cash from you

- They receive a wire transfer or a cheque deposit in a foreign currency

As the bank says itself: How do we set our exchange rates? For each foreign currency purchase where we set the exchange rate, the exchange rate we use is a retail exchange rate

What they call the retail exchange rate is actually the mid-market rate plus a margin added on top for their profit. All consumer banks do this in order to make money on your currency exchange transactions.

Banks usually use a rate known as the mid-market rate to swap currency with other banks. However, they do not give this lower rate to their customers. Instead, they add a margin to the exchange rate to make a profit. They also tack on additional fees, such as a cash processing fee or an international transaction fee..

TD Bank offers three ways to order foreign currency.

Order through EasyWeb

Order by phone: call EasyLine

Order from a branch

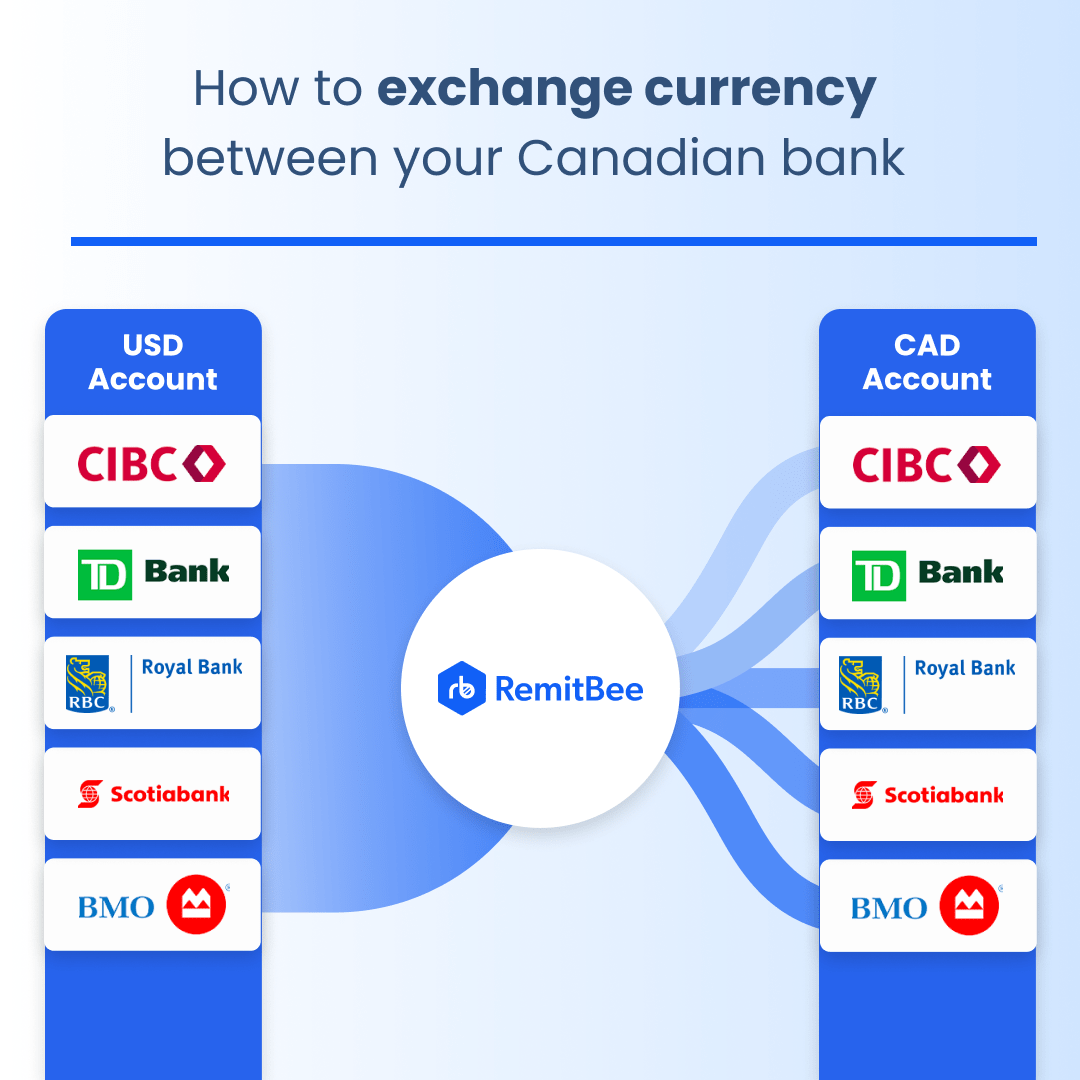

How to Exchange in TD Bank accounts with Remitbee

Create an account by entering your email address and selecting a password at https://www.remitbee.com/signup. You will be asked to confirm your Canadian phone number. Enter your Personal Information including name and address.

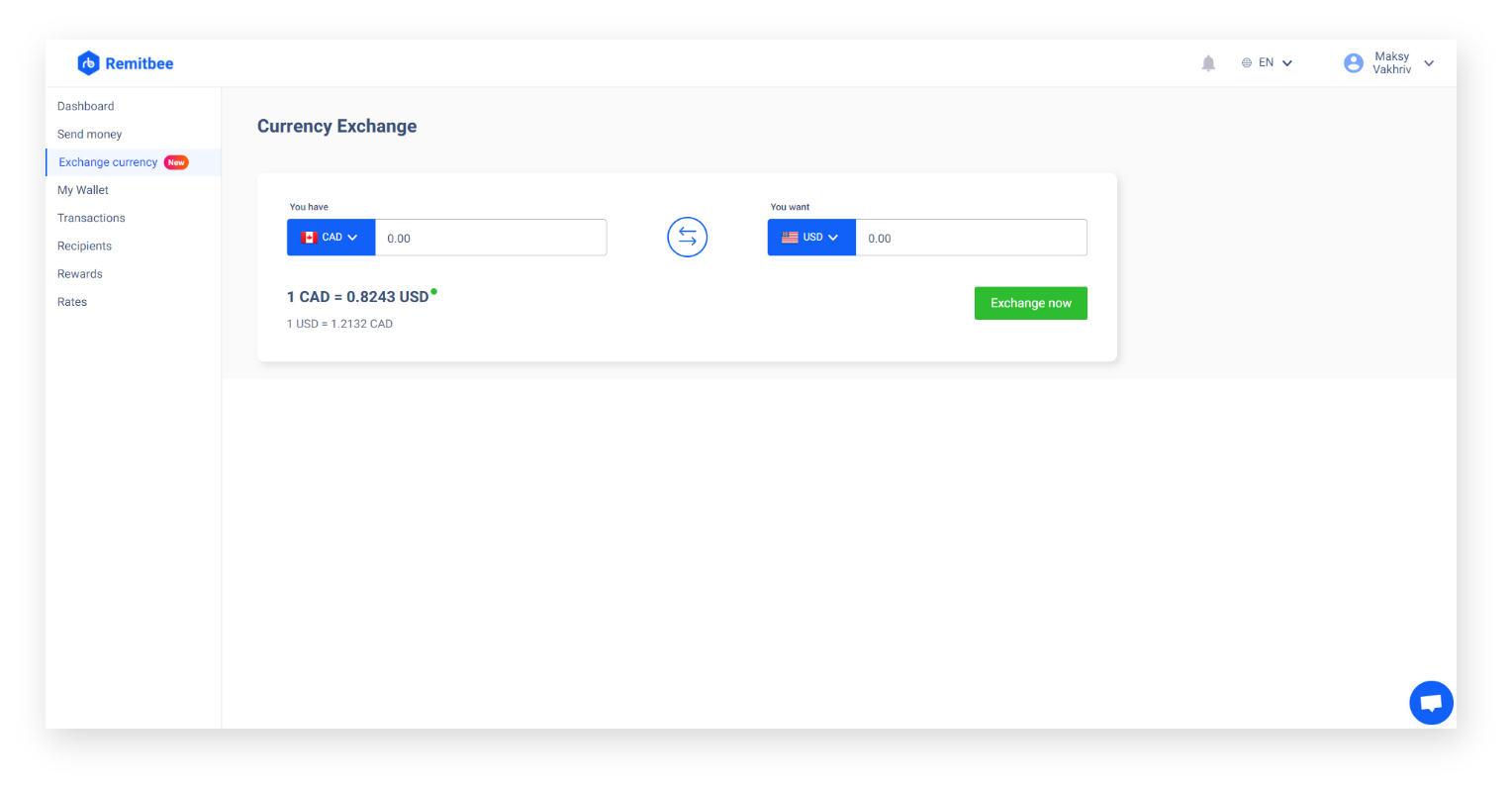

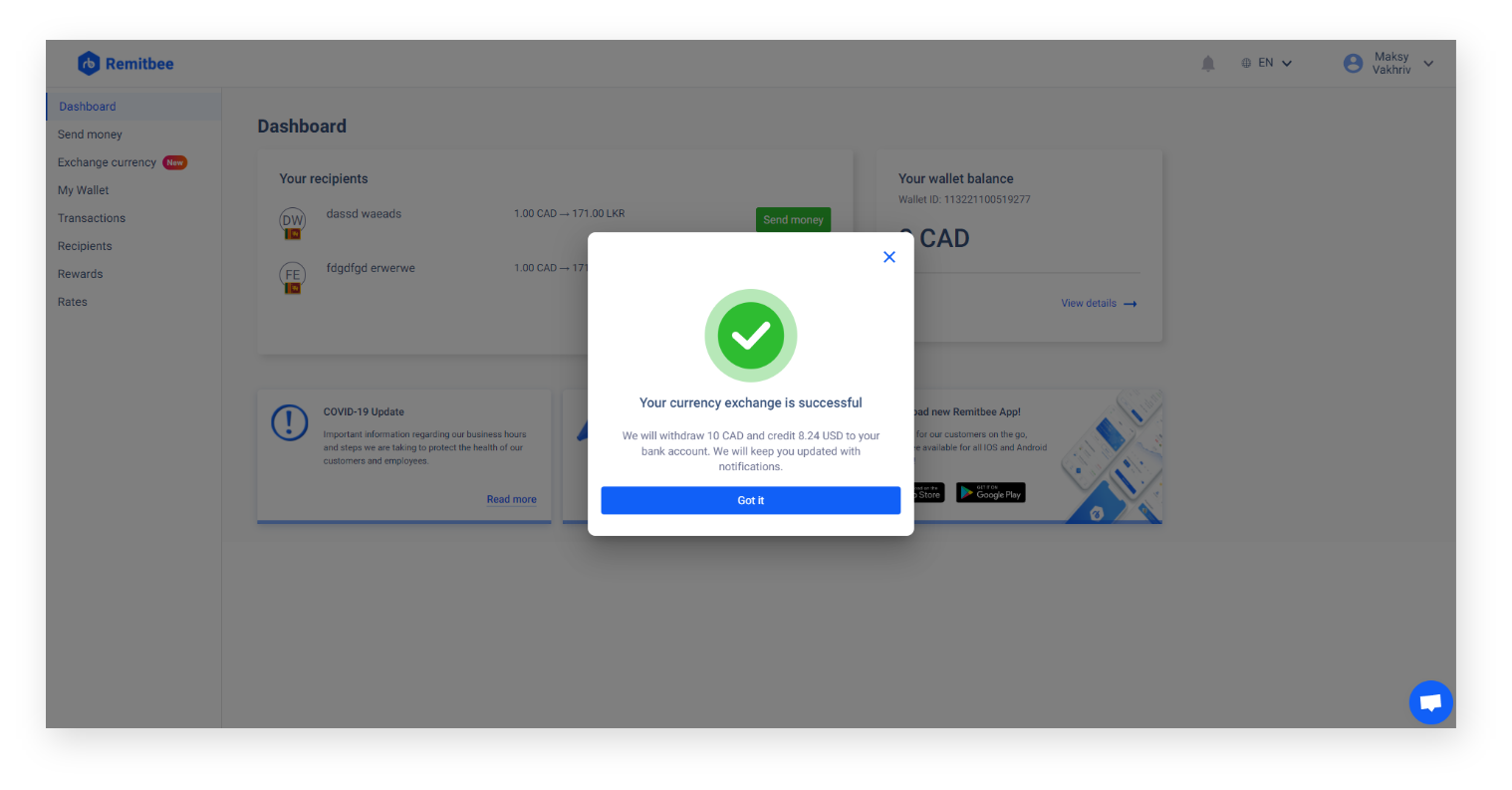

From the menu, select Exchange Currency. Now enter the details of your currency exchange, depending on your exchange amount further verification may be required.

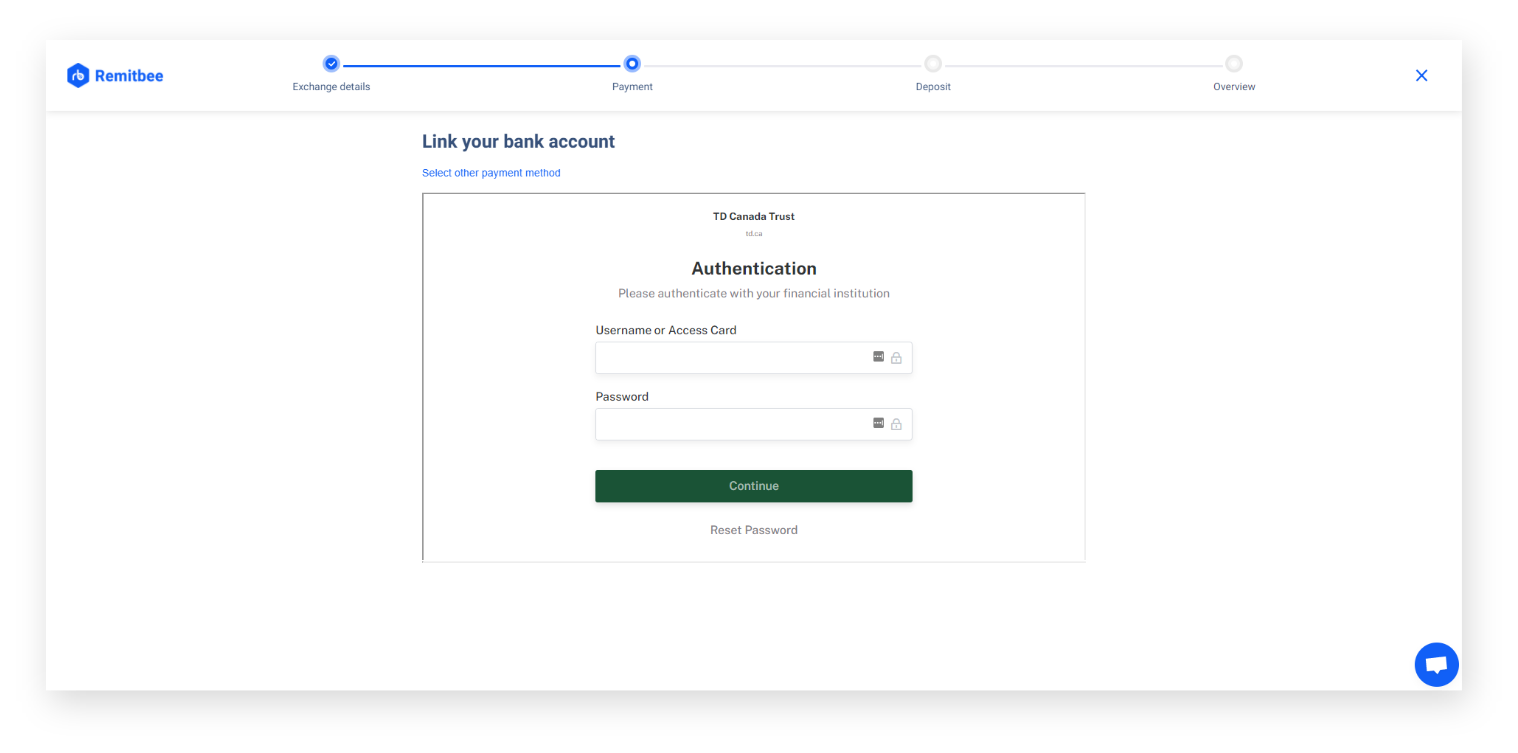

Connect your CAD and USD bank accounts

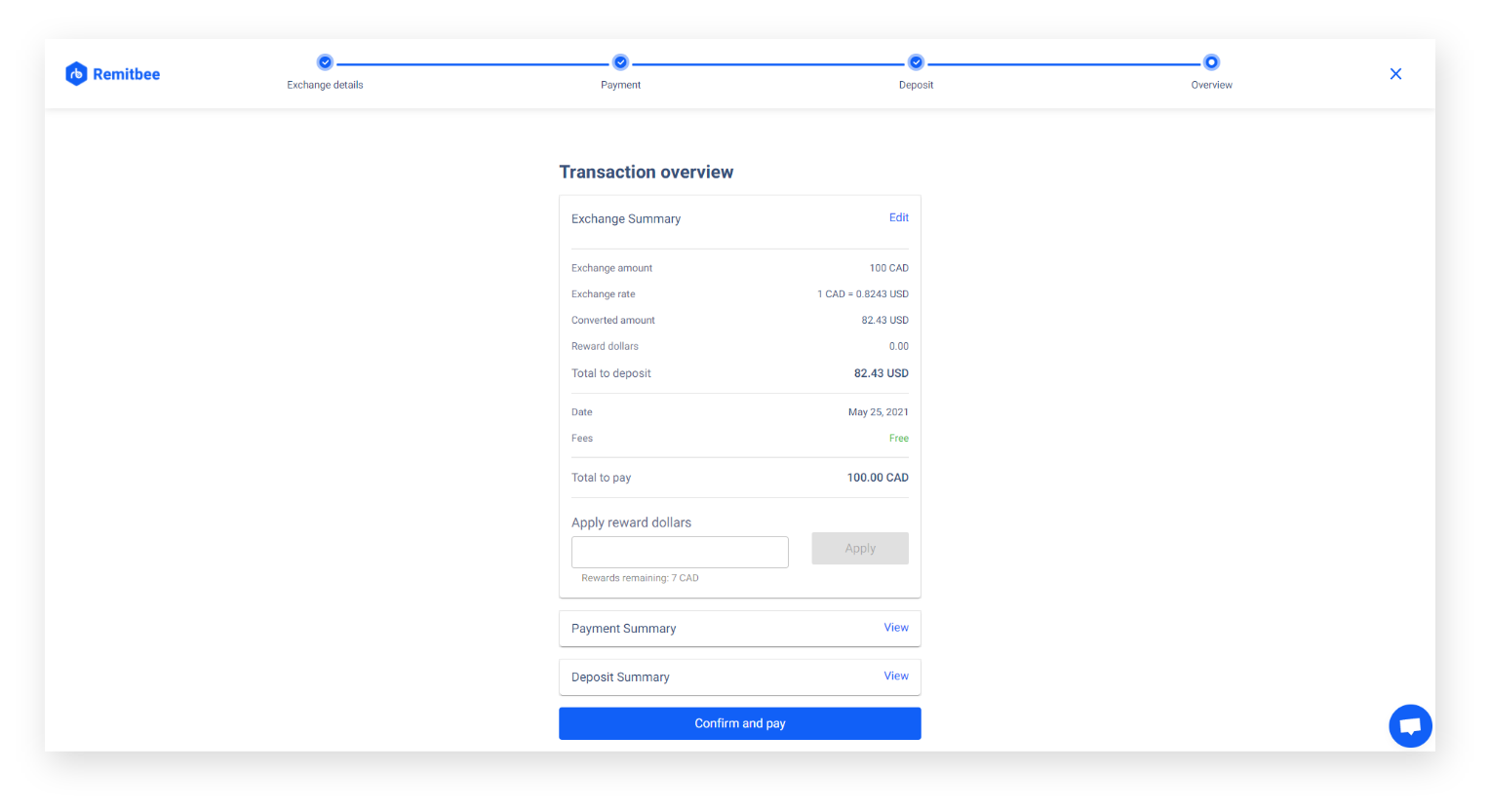

Choose the amount and confirm your exchange rate. The entire transaction takes place between your own two currency accounts via EFT

Convert your money! You can see all of your transactions in future by going to the Dashboard and clicking on the Transactions tab.

Wondering how much you can get? Try our currency exchange calculator!

Alternatives to TD Bank’s Foreign Exchange Rate

- Another Bank

- Online Currency Exchange

- Airport Kiosks or Stores

- ATMs in the US or Overseas.

Why is Remitbee the best place to convert?

- Better currency conversion rates than your bank

- It is safe and stable. FINTRAC regulates and audits Remitbee.

- From start to finish, the process is simple and fast.

Other Currency Exchanges

This is because customers haven't known any better for many years. Banks conceal their high exchange rates behind complex fees, leaving customers unaware of how much money they are losing.

Remitbee is on a mission to make our fees and exchange rates as straightforward as possible so that you can move money globally while knowing you're getting the best exchange rate possible. You'll really know how much you're paying and how much you're getting when you work with us.

Don’t just take our word for it. Check out our rates. If you sign up now you could start saving today.