Remitbee Vs. iRemitX: Which is best? (2021)

When your family back home counts on receiving money from you, even the smallest delays are very frustrating.

There’s nothing scarier than sending a large sum of money and feeling it’s stuck in lingo only to be met with generic customer service responses.

When looking to support your family overseas, you want a money transfer service that proves to be dependable time and time again.

That’s why we’re creating a series of posts comparing some of the more well-known digital transfer services. Today we’ll compare Remitbee vs. iRemitX.When comparing money transfer services, there are twelve key factors you should consider:

So let’s now compare the two one by one.

Background

What’s iRemitX background?

iRemitX is proud of being a Filipino-owned remittance service provider. Its parent company started operations in 2001 and became iRemitX in 2018 when it started doing digital remittances.

iRemit was founded in the Philippines and its primary location is at Pasig City, Philippines. They have three branches in Canada, including Toronto, Calgary, and Richmond.

What’s Remitbee’s Background?

Remitbee is proud of the fact it was created by immigrants in Canada for immigrants in Canada. Everyone in the company has been in similar shoes to their customers. Remitbee was founded in Canada in 2015 and is located in Ontario.

Exchange Rates & Fees

{section4Text}

Exchange rates

Exchange rates fluctuate daily. Always be sure to check the exchange rate you’re being offered with the mid-market exchange rate for the specific currency pair. A simple google search will help you with this. For example, if you’re looking for the real exchange rate of 1 CAD to PHP, just type the following query into Google: “CADPHP”

As of January 21, the real exchange rate is 1.00 CAD → 38.07 PHP

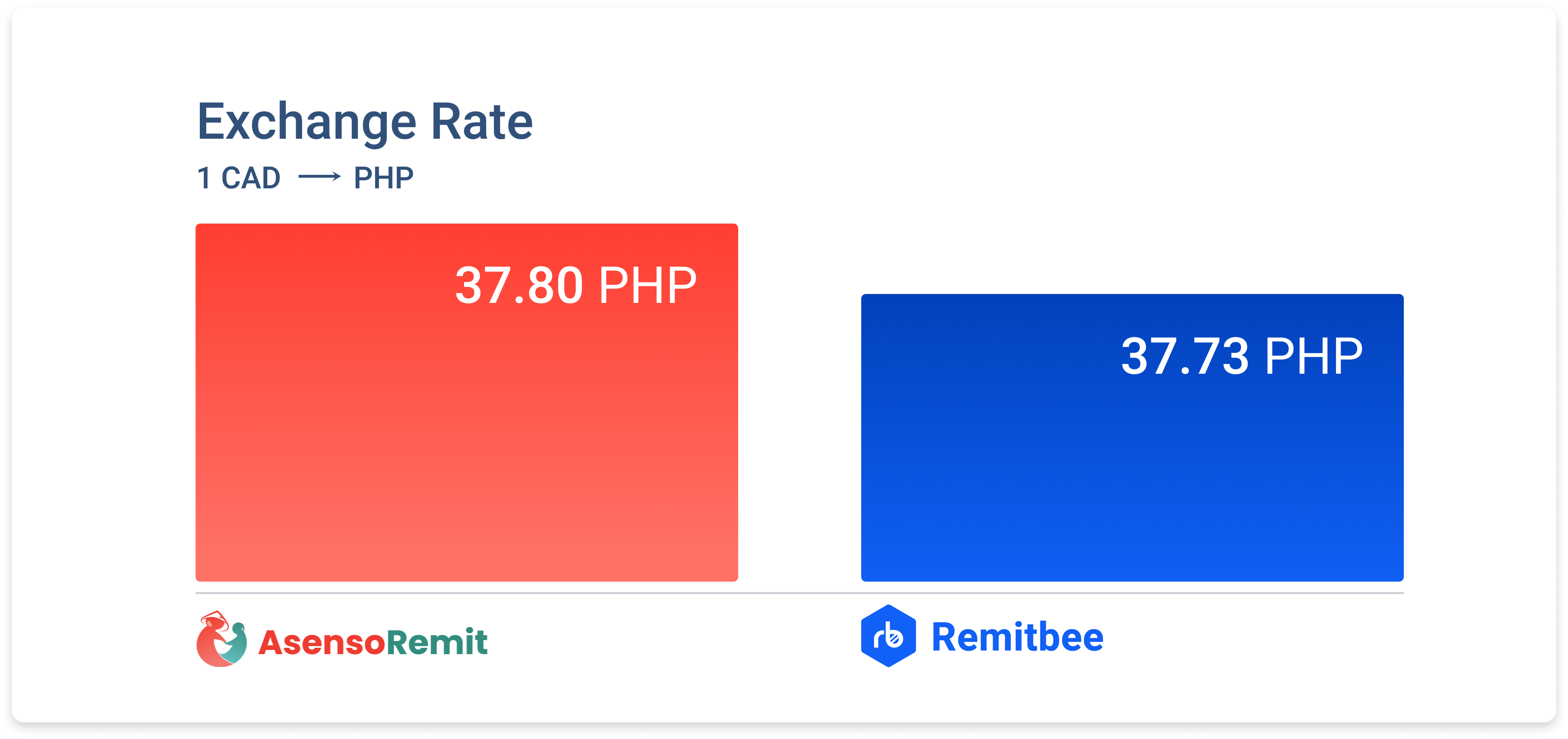

Now let’s compare the two as of January 21, 2021:

iRemitX’s exchange rate for CAD/PHP

1.00 CAD → 37.80 PHP

Remitbee’s exchange rate for CAD/PHP is

1.00 CAD → 37.9486 PHP

According to these numbers, Remitbee is closer to the mid-market exchange rate. Now let’s look at both services’ fees.

Fees

iRemitX

According to their website, iRemitX fees depend on the country that you are sending from and the mode in which you want the money received by your beneficiary.

Make sure to complete any transaction you begin by the end of the day because your rate will only be guaranteed until 23:59:59 (your timezone) on the same day that you confirm your transaction.

Their rates for the following are not listed because it apparently depends on varying factors: Interac Online, Interac E-transfer, Bills payment.

Remitbee

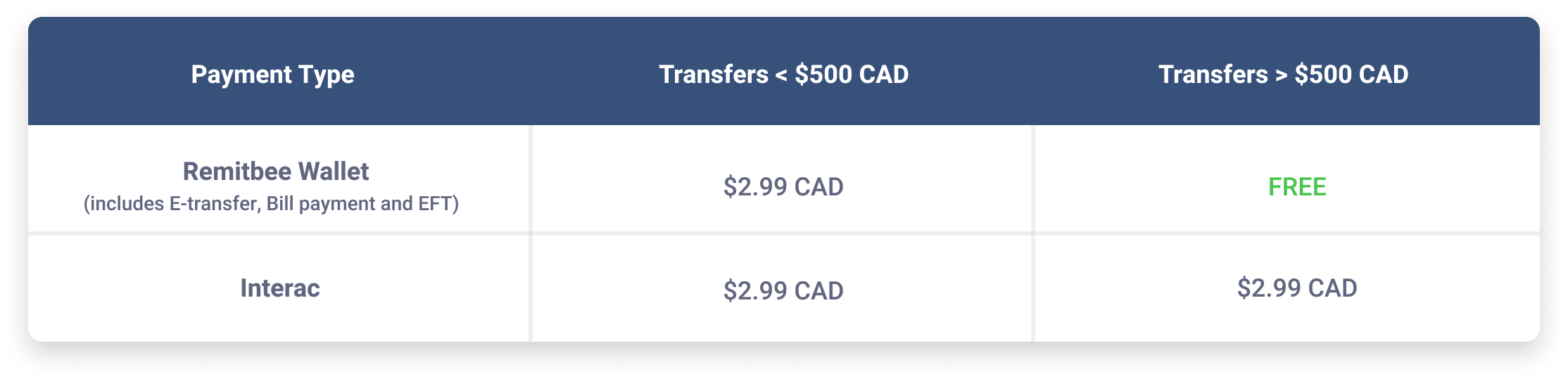

Remitbee is very transparent about their pricing. They even have a handy fee calculator that’s super easy to use. You simply drag the button to show how much you are planning to transfer, and it tells you how much the fees will be for each of the following methods: Wallet, Interac, debit.

Something noteworthy about Remitbee’s fees is that when you send over $500 with Remitbee Wallet, your transfers are free (Remitbee Wallet itself is also free).

They’ve recently come out with new fees for Visa Debit/ Mastercard Debit:

And here are their fees when you use Remitbee Wallet and Interac.

{section8Text3}

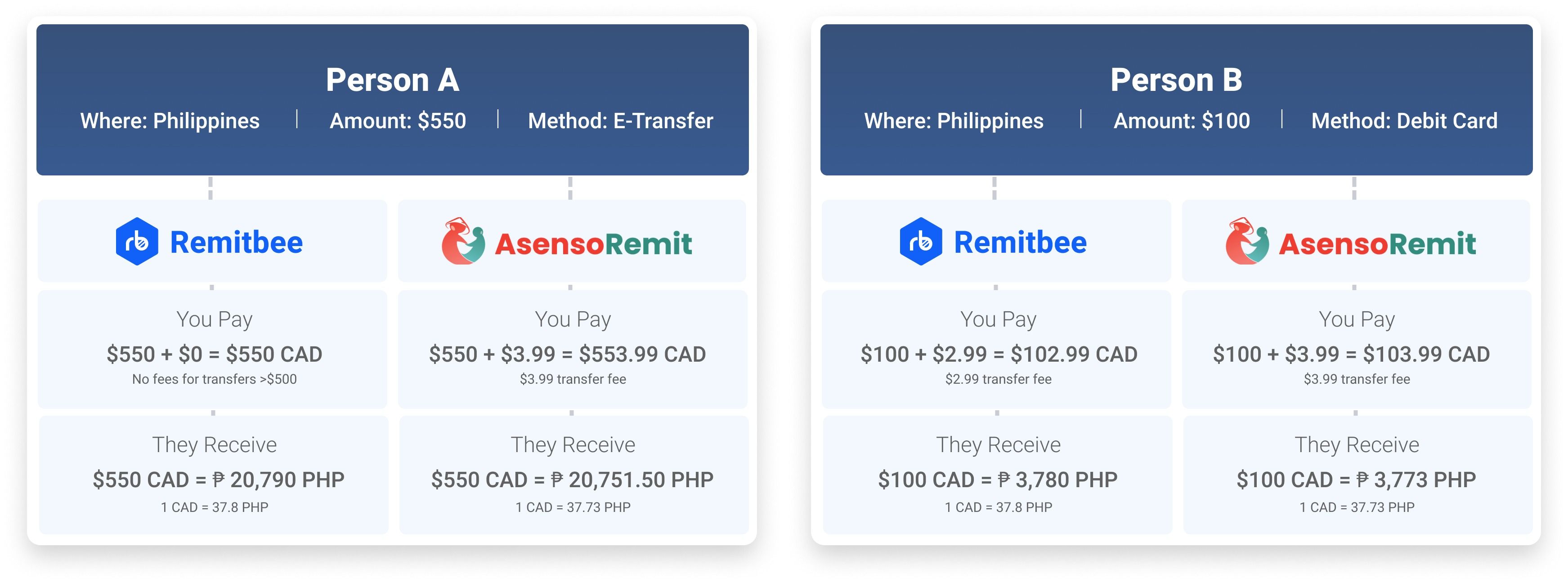

Sending 1000 CAD to Philippines

Let’s compare how much PHP the receiver will get when you send $1,000 CAD with each of the two services:

iRemitX:

$1000 CAD= 37,800 PHP (not including fees)

Though fees are not shown, the amount your receiver would be getting when you send 1000 is 148.60 PHP less than through Remitbee before fees. Considering Remitbee has a no fee option (through the Remitbee wallet) Remitbee would be the better option between the two.

Remitbee:

$1000 CAD= 37,948.60 PHP (not including fees)

With the free Remitbee Wallet, there are no fees with this transfer. You would simply put in $1,000 CAD and they will receive $37,948.60 PHP.

Transparency

As mentioned previously, it’s a common practice for services to markup the exchange rate a lot and boasts about no fees or low fees. They’re able to profit off no fees because they, in fact, hide their high profit margins with a higher exchange rate.

They get away with this because they know that most people won’t question the exchange rate they’re being offered. This is something to always be mindful of when deciding on a transfer service.

With that said, let’s talk about transparency.

iRemitX

iRemitX mentions that fees vary by a few factors and to use a cost estimator, but does not provide a link to that cost estimator. It’s also very hard to find the cost estimator, if they still have it visible to the public.

They don’t list their fees, as a result. You have to get in touch with a representative to learn more about a few things.

One thing to note is that iRemitX is on the Philippine Stock Exchange and because of this, they’re forced to be transparent about a lot of things like financials.

Remitbee

Remitbee prides itself on its transparency and is very transparent about their business model. They don’t have any hidden fees and don’t highly markup their exchange rates in the way banks are known to do. Everything you need to know is on their website.

Ease of use

Many people have complained about their app being buggy and having trouble logging in. It seems this is something that they are continually working to improve.

iRemitX

{section15Text2}

Remitbee

Remitbee offers many easy to follow guides on how to use the service. Getting authenticated and sending repeat transfers is a very straightforward and smooth process.

It also offers biometric authentication for your security and convenience making repeat logins fast and easy.

Remitbee’s ease of use is backed by many positive reviews commenting on this specific factor.

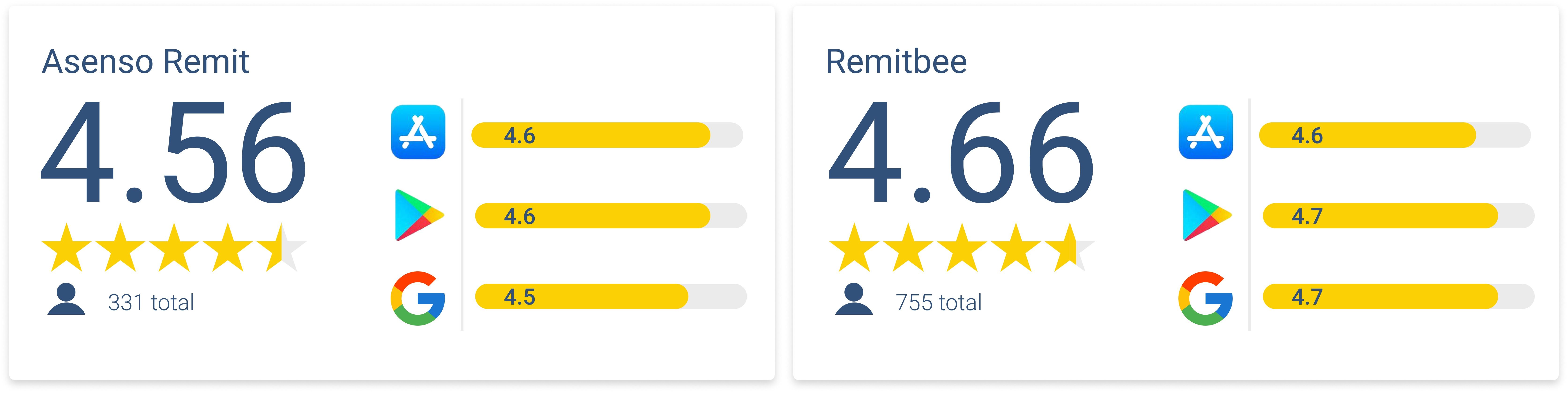

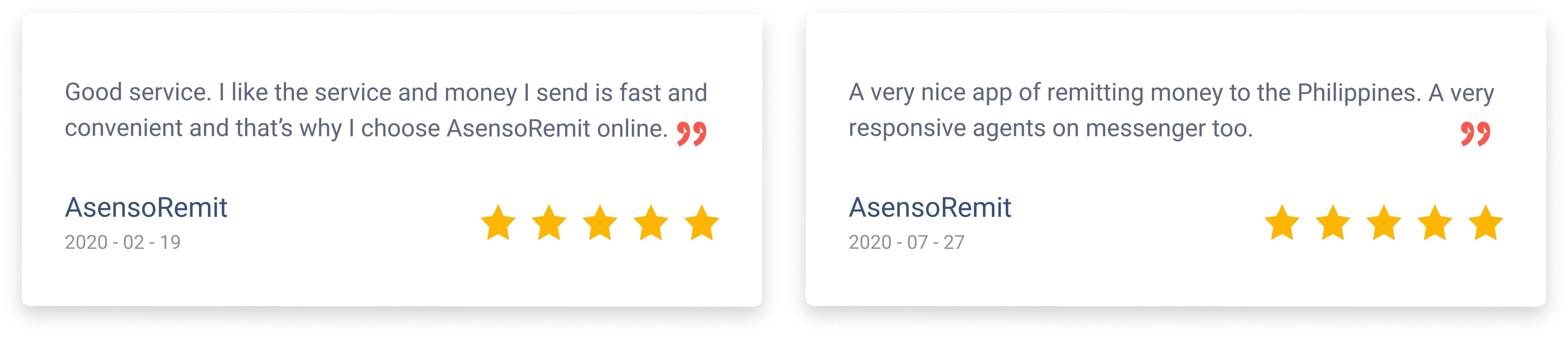

Customers reviews

Let the people vote. Hear what other people like you have had to say. It seems like Remitbee is definitely a fan favourite.

Ratings

Reviews

iRemitX

Remitbee:

Features and functionality

iRemitX

iRemitX offers a few good features, including:

Remitbee

Remitbee offers a few exciting features, including:

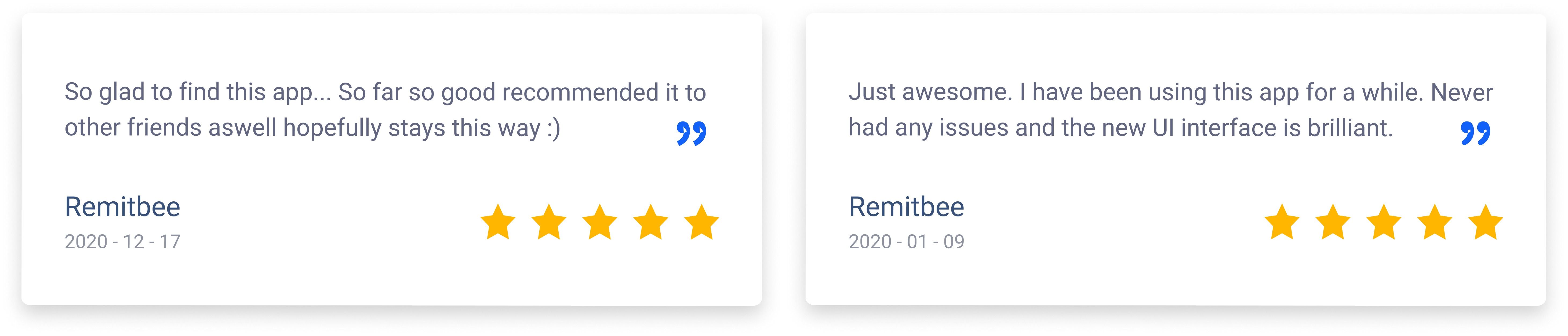

Payment methods

iRemitX

From Canada, iRemitX supports:

Remitbee

Remitbee’s payment methods include:

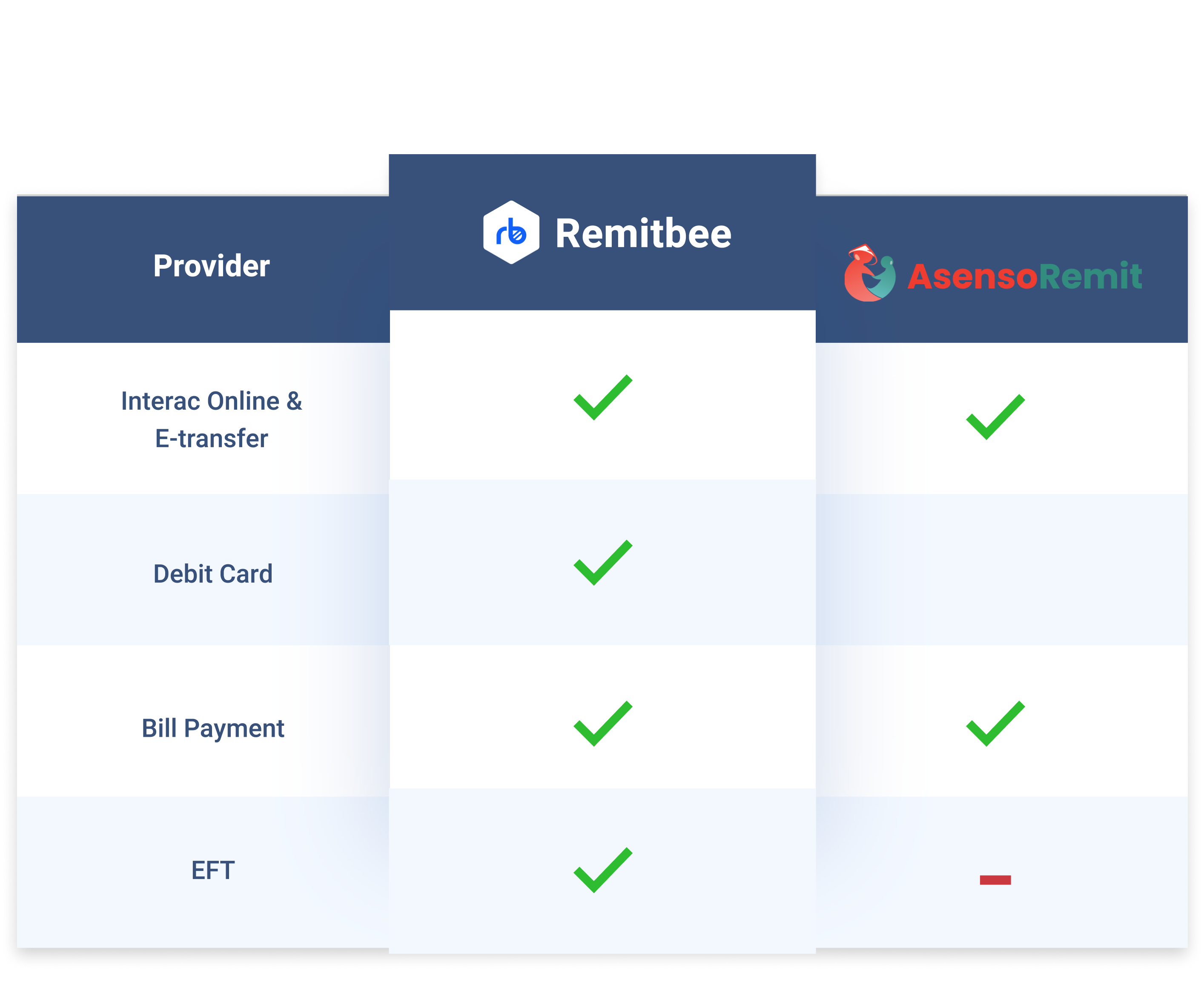

Speed of transfers

iRemitX

With iRemit Visa card, they boast that transfers can be sent in minutes. With all other methods, 1-2 banking days.

Remitbee:

The fastest option to send money once your card is connected is EFT. These transfers are typically completed within one business day, usually within a few hours.

Credibility and security

{section33Text}

iRemitX

iRemitX is regulated by Bangko Sentral ng Pilipinas (the central bank in the Philippines) and the Securities and Exchange Commission (SEC). They are also the only remittance company listed on The Philippine Stock Exchange.

Their parent company has been around since 2001 meaning they’ve been in the money transfer business for a long time. They started as an in-person service and in 2018 started offering digital options.

Remitbee

Remitbee is regulated and audited by the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC). Your personal details and transaction records are protected by SHA-256 RSA encryption for dependable privacy and security.

Remitbee’s credibility is backed by thousands of happy customers and all the good reviews online. On top of that, they work with all the major Canadian banks including Scotiabank, CIBC, and Bank of Montreal (BMO).

Service & Coverage (countries, currencies, delivery methods)

iRemitX

iRemitX offers a variety of services to send money to the Philippines including:

Remitbee

Remitbee offers many services and covers many areas to send CAD to including:

France, United Kingdom, Switzerland, Australia, Singapore, United States, Vietnam, Malaysia, Norway, Germany, Czech Republic, Denmark, Hungary, Poland, Sweden, Spain, Netherlands, New Zealand, Luxembourg, United Arab Emirates, Hong Kong, Japan, Mexico, Saudi Arabia, South Africa, Thailand, Turkey, Andorra, Belgium, Austria, Cyprus,Estonia, Finland, Greece, Ireland, Italy, Malta, Monaco, Montenegro, Portugal, San Marino, Slovakia, Slovenia, Qatar, China

Customer support

iRemitX

There are mixed reviews online regarding iRemitX’s customer support. Though they boast of 24/7 customer service, a few people have commented that they’ve not been able to get in touch.

If you want to get in touch, their email address is [email protected] and their 24/7 customer service number is (+63) 917 822 2205. They also have call center locations in Alberta, Manitoba, BC, Ontario, Blacktown, Perth, Singapore, UK.

Remitbee

One of the things that stands out about Remitbee’s customer support is that they back it up with a 100% Money Back Guarantee (including any fees paid) as a commitment to their customers. Remitbee also maintains good reviews on Google, Google Play, the Apple app store, and Trust Pilot.

If you want to get in touch with Remitbee, you can do so in the following ways:

Promotions

The Verdict

Now that you know more about IremitX and Remitbee, you need to consider which is right for you.

Here are our thoughts:

Weighing the discussed factors together, we feel confident saying Remitbee is the best choice mainly due to its reputation online and its competitive rates. Read the reviews for yourself.

If you’re ready to get started with a reliable and quick way to send money to your loved ones, the team at Remitbee has created a simple guide on how to get started with Remitbee.

Disclaimer: All third-party trademarks (including logos) referenced by Remitbee Inc. in this article remain the property of their respective owners. Unless specifically identified as such, Remitbee's use of third-party trademarks does not indicate any relationship, sponsorship, or endorsement between Remitbee and the owners of these trademarks. Any reference by Remitbee to third-party trademarks is to identify the corresponding third-party goods and/or services and shall be considered nominative fair use under the trademark law. Furthermore, we are not responsible for any inaccuracies identified in the article's content, and that information can be verified by contacting the respective third parties directly mentioned in the article.