Paypal Canada USD Account Overview

You can benefit from a great interest rate and no need to have a minimum balance. Keep reading to find out more!

Paypal Canada USD Account

Did you know that when you transfer your regular US dollars from Paypal to a regular bank account in Canadian dollars, you’re charged a further 2.5% exchange rate? That’s why most people prefer to transfer their USDs to a Canadian bank account for better currency exchange rates.

But connecting Paypal to a USD Canadian bank account is not possible. Unless the bank account is with the Royal bank. Keep on reading to discover how to transfer from Paypal cheaply.

You can open the RBC US High-Interest eSavings account by visiting their branch in person or online. But you must fulfill the following conditions,

Key features

You can use the RBC US High-Interest eSavings Account to withdraw USD from Paypal while avoiding the 2.5% exchange rate.

Some other key features for this account are;

Monthly Fees & Interest Rate & Minimum Balance

Monthly fees:

No monthly fees.

Interest rate:

You earn an interest rate of 0.25% on your dollars.

Minimum Balance:

No minimum balance is required.

Offers

After getting the RBC US High-Interest eSavings account, you can now open RBC Bank Preferred Money Market Savings Account. The account has more features like transferring to your RBC US High-Interest eSavings Account is free.

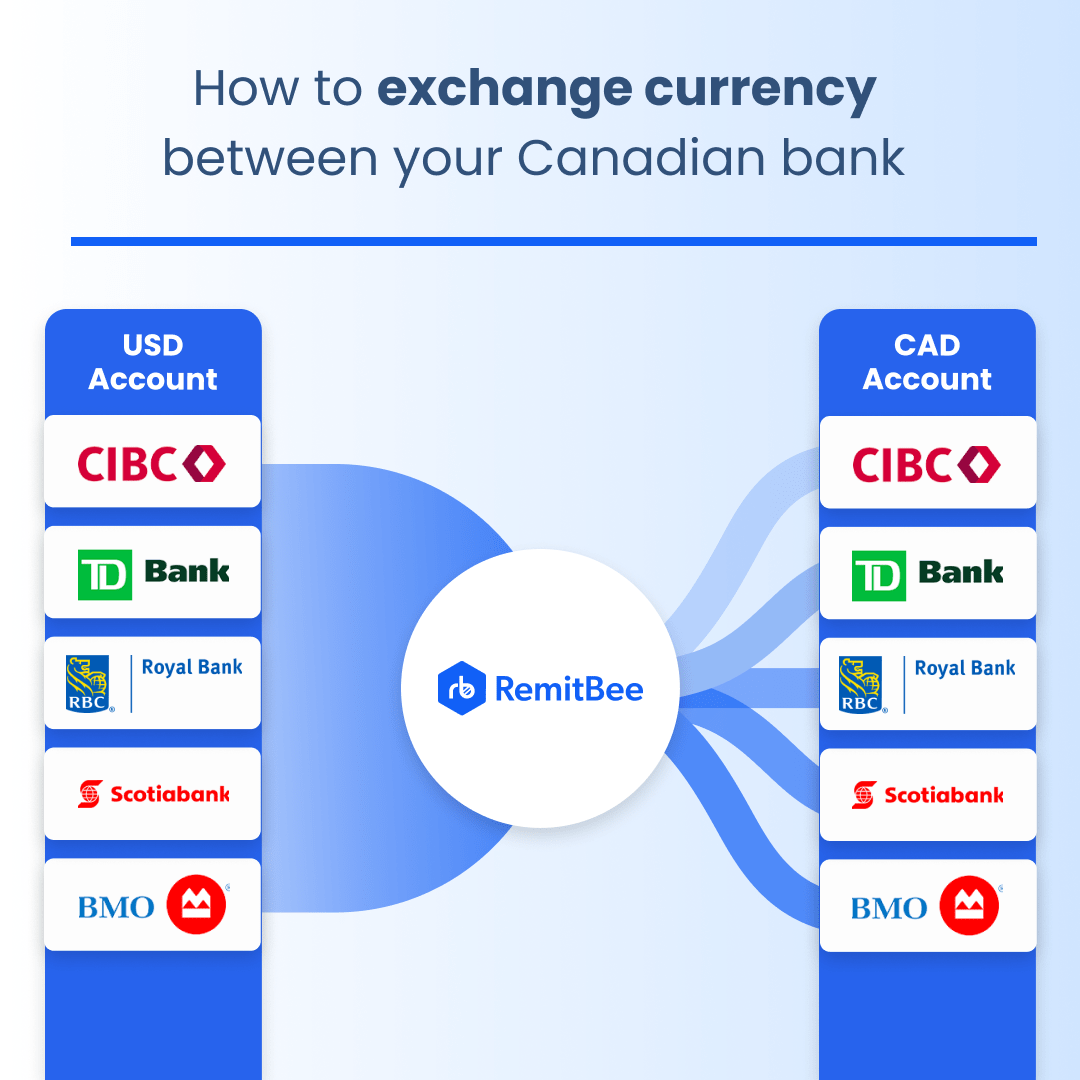

Currency Exchange Using USD Account

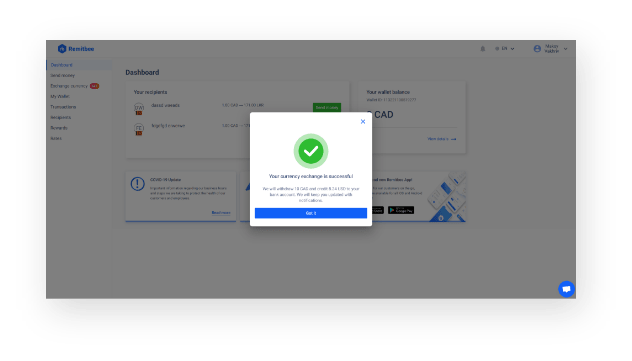

If you don’t have a RemitBee account, you’ll need to create one (https://www.remitbee.com/signup)

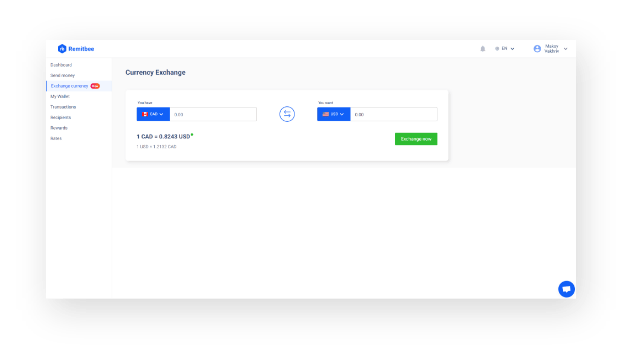

After signing up, go to the menu and select exchange currency. Enter the details of your currency exchange. You can move to the next step if no further verification is required.

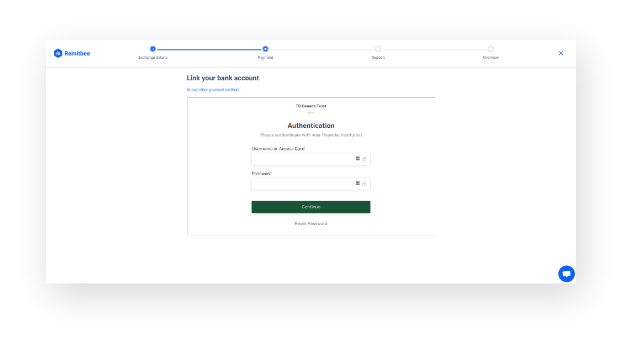

You can now link your CAD and RBC e-savings account.

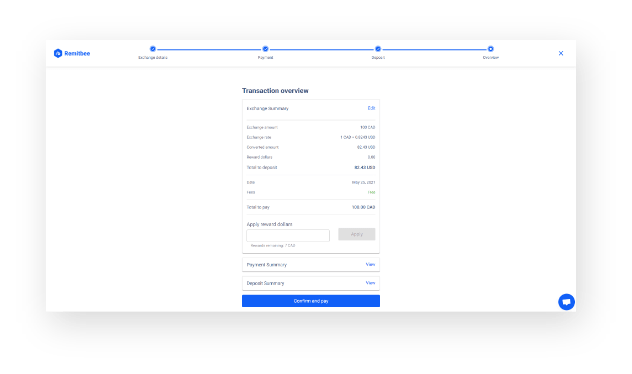

Choose the amount and confirm your exchange rate. The transaction occurs between the two accounts via EFT.

Convert your money.

Other USD Accounts