Manulife USD Account Overview

You can benefit from a great interest rate and no need to have a minimum balance. Keep reading to find out more!

Manulife Bank USD Account

Manulife bank started the USD Advantage Account, which is available to Canadians with a USD at a Canadian Financial Institution. The account is for those with US dollars who want to earn interest and get attractive rates during currency exchange.

The account offers a reasonable interest rate but works differently than a regular USD account. Learn more about the account and how you can get maximum benefits.

If you are not an existing client of Manulife bank, you will need to first register. Here is the procedure you will need to follow:

Key features

Opening a Manulife USD account means your dollars earn more money.

Here are some key features of this account:

Monthly Fees & Interest Rate & Minimum Balance

Monthly fees:

No monthly fees.

Interest rate:

An interest rate of $0.20% on every dollar deposited into the account.

Minimum Balance:

No minimum balance.

Offers

If you have excess money in your dollar account or would like to earn good interest, transfer them to your Manulife USD Advantage Account.

You also enjoy some great benefits, as you shall see below:

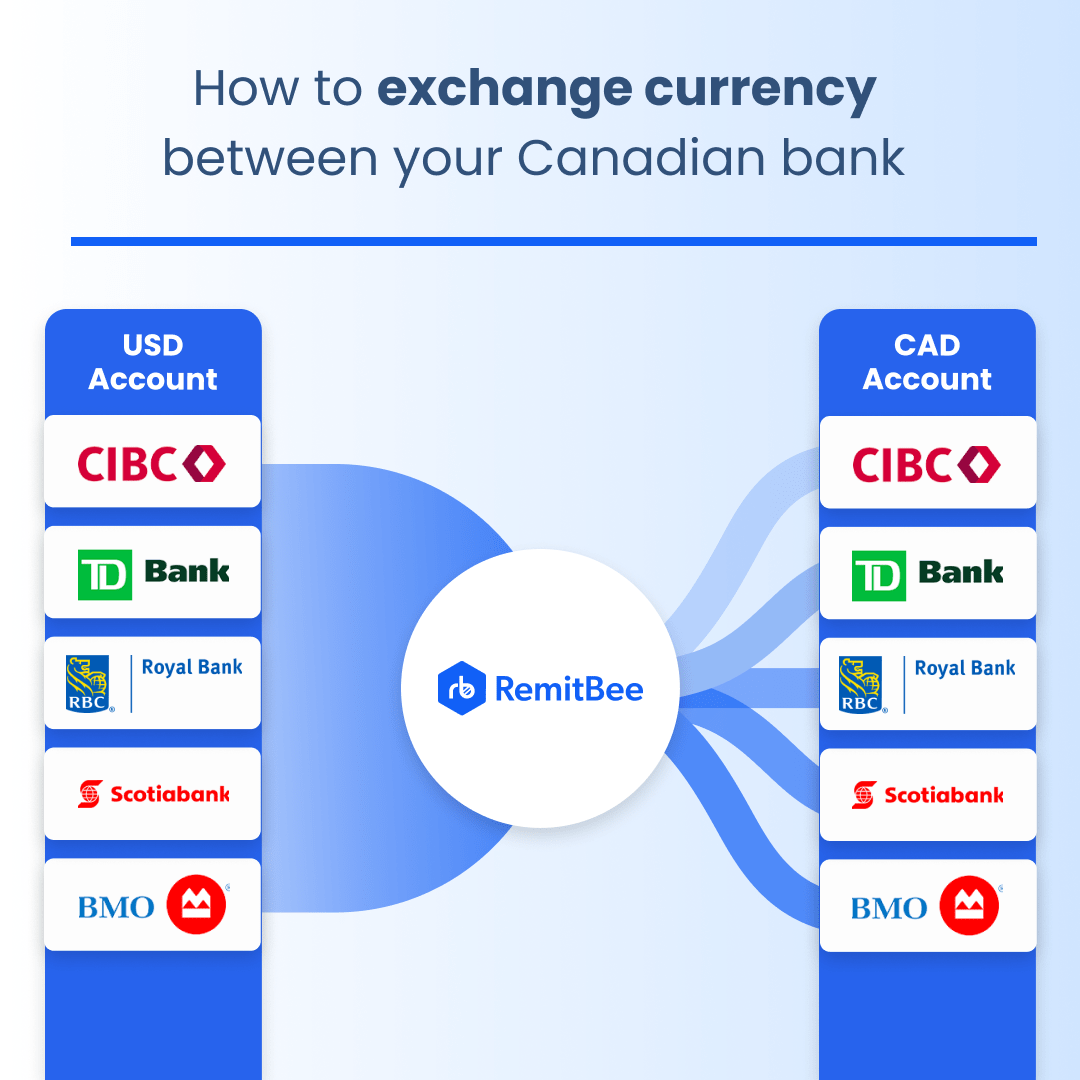

Currency Exchange Using USD Account

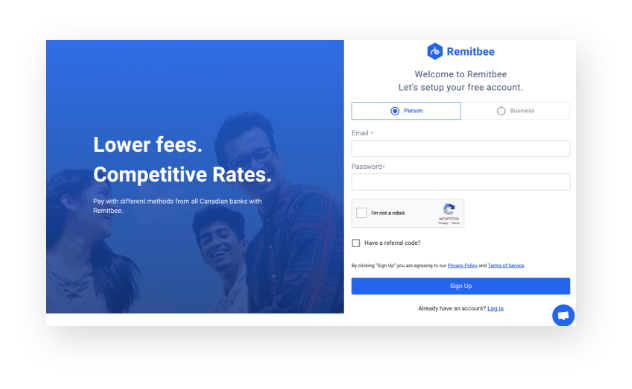

If you don’t have a RemitBee account, you’ll need to create one (https://www.remitbee.com/signup)

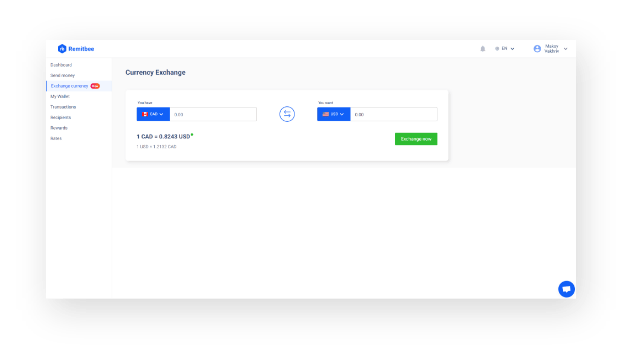

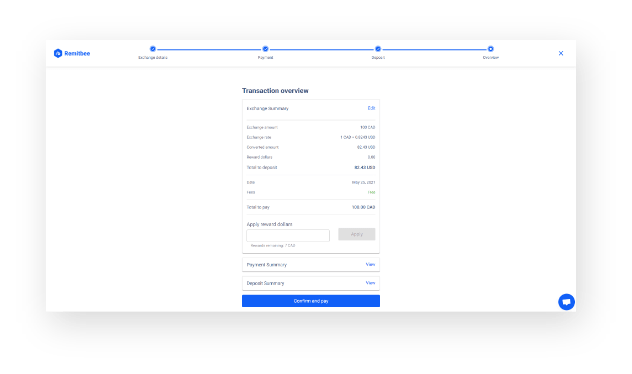

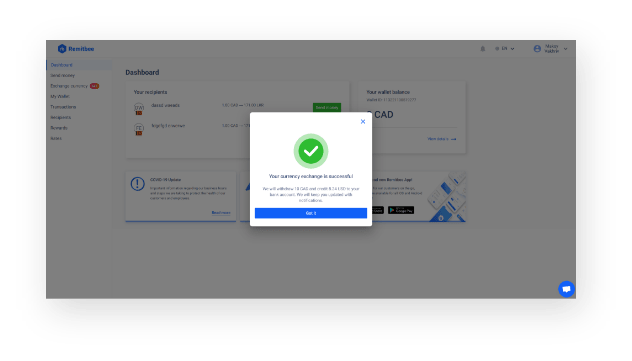

After signing up, go to the menu and select exchange currency. Enter the details of your currency exchange. You can move to the next step if no further verification is required.

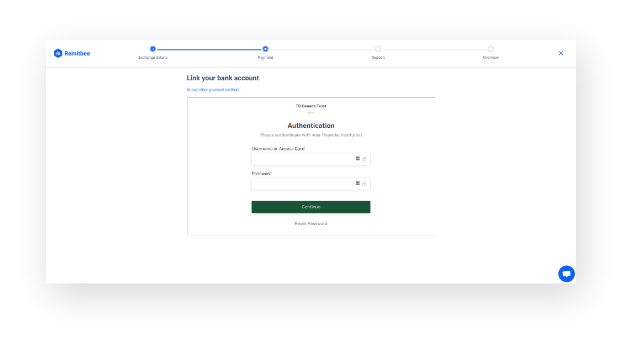

You can now link your CAD and Manulife USD account.

Choose the amount and confirm your exchange rate. The transaction occurs between the two accounts via EFT.

Convert your money.

Other USD Accounts