How to Pay USD Bills in Canada

As the world becomes more dependent on the Internet, even shopping online has become the norm wherever in the world you may be. Statistics show that e-commerce worldwide has become an integral part of the global retail framework. In 2020 alone, over two billion people bought goods and services online which has resulted in over 4.2 trillion US dollars of e-retail sales worldwide. The number of digital buyers has been on a steady upward incline.

Nowadays, it has become a norm for Canadians to buy goods and services in the USA. The question though is, how do you pay your US bills while you are in Canada? Some Canadians pay their US bills using their normal Canadian credit card while others use their USD credit cards. Others pay their US bills through their US-based bank account, US-based debit card, cheques from their US-based bank account, PayPal, or wire transfer or bank draft from a Canada-based USD or CAD bank account. Which one do you use?

In this article, you will learn why you should use your USD credit card and ditch your Canadian one when paying your US bills in Canada.

Why Pay Your US Bills with Your USD Credit Card?

The answer is fairly simple: Canadian banks give crappy foreign exchange rates on top of expensive additional credit card fees. When you use your Canadian credit card to pay for your US bills, you are adding more costs to your bill. Most Canadian credit cards charge a foreign transaction fee of 2.5% on US purchases and payments.

Note too that currencies are fluctuating. So, there will be instances the Canadian dollar is lower when your US bill payment gets posted which will make your expenses higher.

On the other hand, when you pay your US bills with your US-based credit card, you avoid paying additional currency conversion fees. Your payments are also faster and more secure. Having a US-based credit card is also advantageous in case the store based in the US you are shopping from does not accept foreign credit cards.

The Best No Fee US Dollar Credit Cards and Free USD Account in Canada

Now that you’ve seen the advantage of using your USD credit card when shopping at US online stores in Canada, here are no fee US Dollar credit cards and free USD accounts in Canada that we recommend you apply for to that you save more and maximize your money’s potential:

USD Credit Cards

BMO US Dollar Mastercard

The BMO US Dollar Mastercard has an annual fee of $35 USD. If you spend at least $1000 USD in a year, your annual fee will be refunded in the next year. You also get an extended warranty that doubles the manufacturer’s warranty and purchase protection for 90 days.

Scotiabank US Dollar Visa

The Scotiabank US Dollar Visa also has a $35 USD annual fee but you won’t be charged any annual fees for supplementary cards. There is also no USD currency conversion for this card. Once you avail this, you also get purchase security and extended warranty protection on your purchases. You can also get up to 25% discount on Avis and Budget car rentals.

Meridian Visa US Dollar Card

You can use your Meridian Visa US Dollar Card when buying in the US and other countries that use USD as their official currency. With this card, you can earn 1 reward point for every $1 you spent on all your card purchases with no restrictions. For the first year, you don’t need to pay the annual fee, but in the succeeding years, a $65 annual fee will be charged to you.

US Dollar Accounts

Tangerine US Dollar Account

Tangerine Bank is known for its best high-interest savings and free chequing accounts in Canada. They also offer a free US dollar account, the Tangerine US Dollar Savings Account. This account has no monthly fee and no minimum balance and offers an interest rate of 0.10%. They also offer free unlimited transactions.

TD US Daily Interest Chequing Account

The TD US Daily Interest Chequing Account has no monthly account fee and pays interest on balances of $1,000 and above. This type of USD account requires a transaction fee of $1.25 but this fee will be waived if you keep a minimum of $1,500 balance at the end of the month. This type of TD Canada Trust US Dollar Account pays interest up to 0.01% on your balance.

EQ Bank US Dollar Savings Account

This USD savings account is a no-fee account that offers a 1.00% interest rate on every dollar. Transferring CAD or USD to this account from a linked Canadian institution is also free. If you plan on sending USD to the USA or other parts of the world, you can do it with Wise directly from your EQ Bank US Dollar Savings Account but you will have to pay a competitive fee. Before you can apply for this USD savings account, you should first get a free Savings Plus Account at EQ Bank.

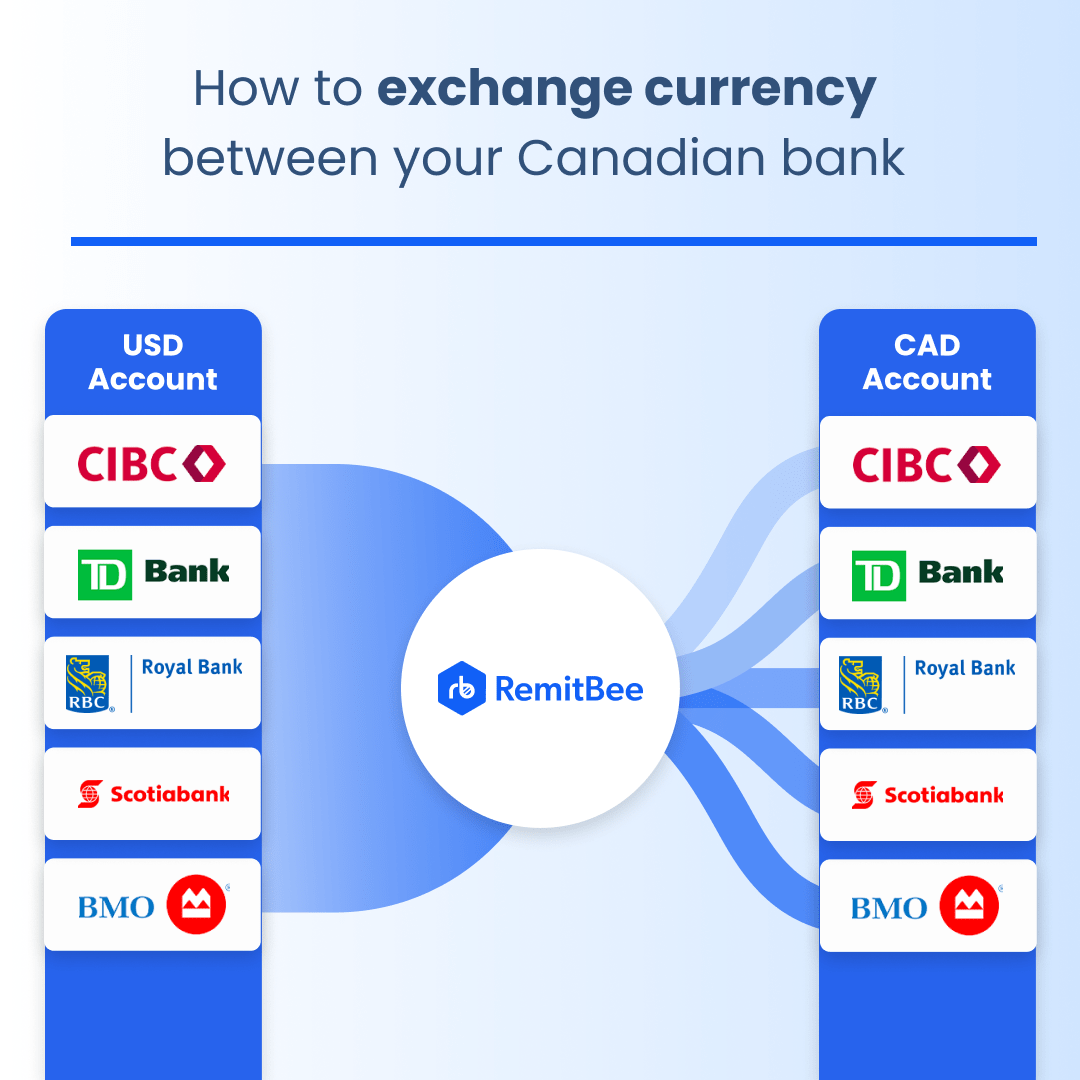

The Best Currency Exchange Service Provider in Canada: RemitBee

If you use your USD credit card to pay for your US bills, you need a USD account to pay for it. Sadly, not all financial institutions in Canada give reasonable currency exchange rates. But don’t be sad. The good thing is RemitBee offers sting-free currency exchange service that is 100% online and free! You can use our services to fund your USD account with US dollars. When you convert currencies with us, you can do so anytime, anywhere and you get the best CAD to USD conversions. Plus, you don’t need to pay any fees, we promise! You can convert up to $1,000,000 a day and all the funds you exchanged and transferred are 100% insured.

If banks normally charge around 3 to 5 percent per conversion, RemitBee only adds a margin of only 0.03 to 0.06 percent so you can save more when you exchange currencies with us! If you regularly convert currencies, you can save up to $50 a month or up to $500 a year!