Alternative Ways to Fund Your Startup: Crowdfunding, Angel Investing, and More

Launching a business is thrilling but costly. Entrepreneurs often need help finding the right financing options.

But not all startups need bank loans or venture funding. That's where alternative forms of financing come in!

In this article, we'll examine these alternative startup financing options, review their advantages and disadvantages, and help entrepreneurs choose the right one.

By the end of this post, you'll understand how alternative forms of financing can help you turn your startup dream into a successful reality.

How To Fund Your Startup—Beyond Banks?

1. Crowdfunding

Crowdfunding is a modern and innovative way to raise funds for startups, businesses, and creative projects. It involves a large group of people contributing small amounts of money to fund a particular project or business idea.

There are four main types of crowdfunding:

Reward-based

Backers receive non-financial rewards such as a product or service in exchange for their contribution.

Equity-based

Investors receive a company share in exchange for their financial contribution

Debt-based

Investors lend money to the company, which is repaid with interest over time.

Donation

Contributors and investors receive no cash return. Donations support a cause.

Crowdfunding offers numerous benefits to startups, including access to a large pool of potential investors, increased visibility, and early validation of the business idea.

However, there are also some disadvantages to crowdfunding. The success of a crowdfunding campaign is not guaranteed, and the process can be time-consuming and labor-intensive.

In addition, startups may have to give up equity in the company or repay debt with interest, which can be a high cost. Despite these potential drawbacks, crowdfunding has been a successful funding option for many startups.

For example, Oculus VR and Pebble Time raised millions of dollars through crowdfunding campaigns.

2. Angel Investing

Angel investment is when wealthy people invest their personal money in startups or early-stage companies in exchange for equity. Startups can benefit from angel investors' industry expertise.

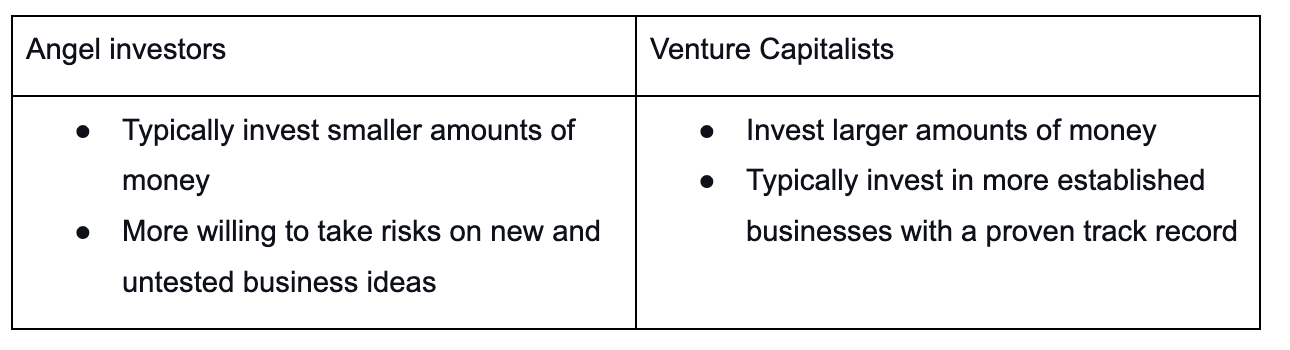

While similar to venture capital, key differences exist between angel investors and venture capitalists.

There are several advantages to angel investing. Startups can receive funding and access to valuable expertise and connections from angel investors.

Angel investors are also more likely to take a long-term investment approach. They may be more patient with the startup's growth and development.

However, angel investors often invest smaller amounts, which may not fully support a company. Angel investors may also have a smaller network than venture capitalists, limiting the startup's resources.

Successful angel investments include companies like Google and Alibaba, which received early-stage funding from angel investors.

3. Other Forms of Alternative Financing

In addition to crowdfunding and angel investing, several other alternative financing forms are available to startups. These options include peer-to-peer lending, revenue-based financing, and royalty-based financing.

Peer-to-Peer Lending

Peer-to-peer lending is where individual investors lend money to a borrower through an online platform. The platform facilitates the lending process and charges fees for their services.

Peer-to-peer lending can be a good option for startups that may not qualify for traditional bank loans.

Revenue-based Financing

Revenue-based financing is a form of financing where investors provide funding to a startup in exchange for a percentage of the company's revenue over a set period.

This option appeal to startups with a steady revenue stream but may not have the assets or collateral to secure traditional bank loans.

Royalty-based Financing

Royalty-based financing is similar to revenue-based funding, but investors receive a percentage of the company's profits instead of a percentage of revenue.

This option appeal to startups with a strong potential for growth and profitability.

While these alternative forms of financing can offer advantages such as flexibility and access to funding for startups that may not qualify for traditional bank loans, there are also some disadvantages to consider.

Peer-to-peer lending can come with higher interest rates and fees, while revenue-based and royalty-based financing can limit the startup's ability to use its revenue or profits for other business purposes.

Factors to Consider When Choosing Alternative Financing

When considering alternative forms of financing for a startup, there are several important factors to consider.

Stage of Business

Crowdfunding and peer-to-peer lending may be more appropriate for early-stage startups, while angel investing and revenue-based financing may be more appropriate for later-stage startups that have established a track record of revenue and growth.

Amount of Funding Needed

Crowdfunding and peer-to-peer lending may be good options for startups that need to raise smaller amounts of money, while angel investing and revenue-based financing may be more appropriate for startups that require larger funding.

Investor Relations

Crowdfunding and peer-to-peer lending may involve more individual investors, which can be more challenging to manage than a small group of angel investors. Startups should also consider the expectations and preferences of their investors, as well as the level of involvement they want from their investors.

Exit Strategy

Investors will want a clear plan for how they will exit their investment and realize a return. Startups should consider whether to go public, acquire, or buy out their investors.

Industry and Market Trends

Some forms of financing may be more popular or successful in certain industries or markets. Startups should consider the trends in their industry and market, as well as the competitive landscape when choosing a form of alternative financing.

The Bottom Line

Entrepreneurs need to consider alternative financing options because traditional forms of financing, such as bank loans, may not always be available or suitable for their needs.

By exploring alternative forms of financing, startups can access capital, gain exposure, and attract investors who share their vision and values.

At RemitBee, we also empower entrepreneurs to achieve their goals and build their dreams. That's why we have launched the RemitBee Financial Empowerment Fund, which provides financial support to startups and small businesses.

If you're an entrepreneur looking for funding, check out the RemitBee Financial Empowerment Fund and other alternatives.

and...if your business sends money overseas or works with CAD and USD be sure to check out RemitBee Business

With the right support, anything is possible!