ATB USD Account Overview

You can benefit from a great interest rate and no need to have a minimum balance. Keep reading to find out more!

ATB USD Account

ATB US Dollar account is one of the best account options you can open if you are receiving payments in US Dollars. You can save your US Dollars in the account until such a time when the currency-exchange rate is favorable.

ATB USD account earns you attractive rates on the balances you have in your account and doesn’t charge monthly fees. Read on to learn more about the ATB USD account and why it is a good option for you.

Here is a simple procedure for signing up for anATB USD account.

Key features

By opening an ATB USD account, you can save, write cheques from your account, and transfer USD between your accounts.

Here are some of the key features of the ATB USD account:

Monthly Fees & Interest Rate & Minimum Balance

Monthly fees:

ATB charges ZERO monthly fees.

Interest rate:

ATB offers interest rates in three tiers.

$0-$4,999.99= 0.25%

$5000- $24999.99= 0.25%

$25,000 and over= 0.25%

Minimum Balance:

No minimum balance is required.

Offers

ATB USD has attractive offers of three different accounts with great benefits.

You can choose any of the three:

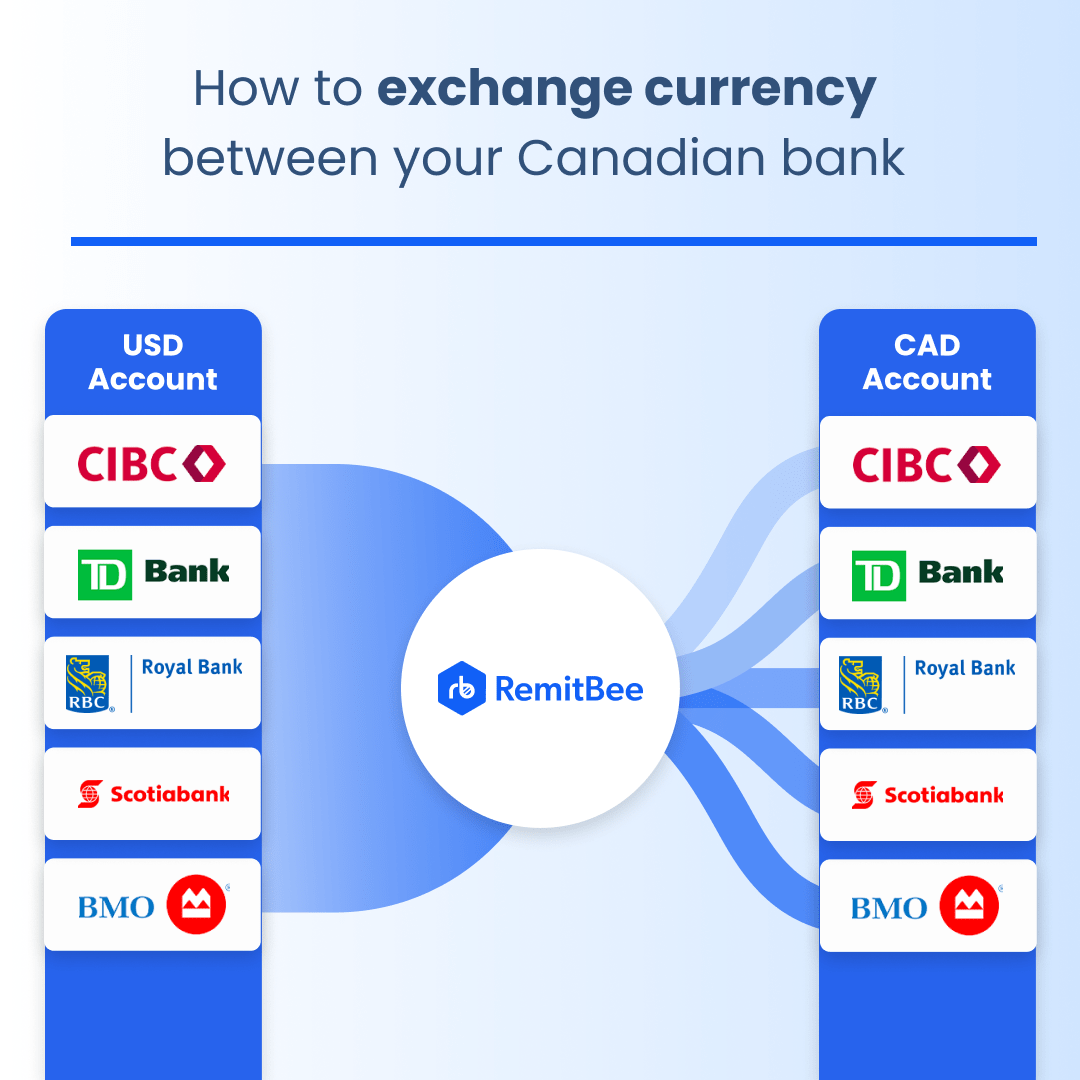

Currency Exchange Using USD Account

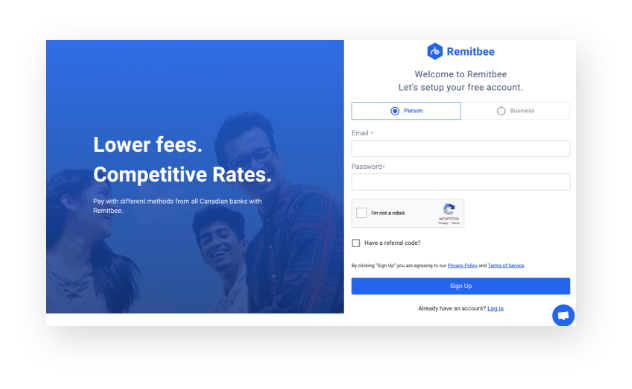

If you don’t have a RemitBee account, you’ll need to create one (https://www.remitbee.com/signup)

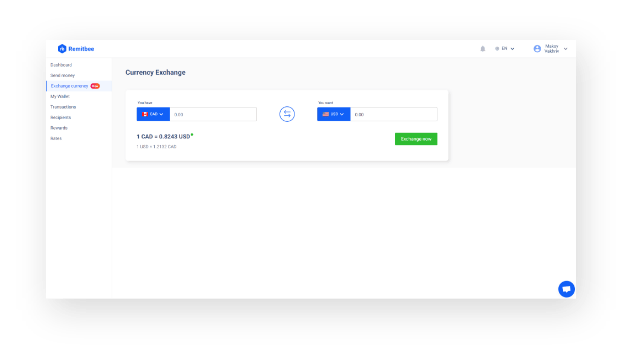

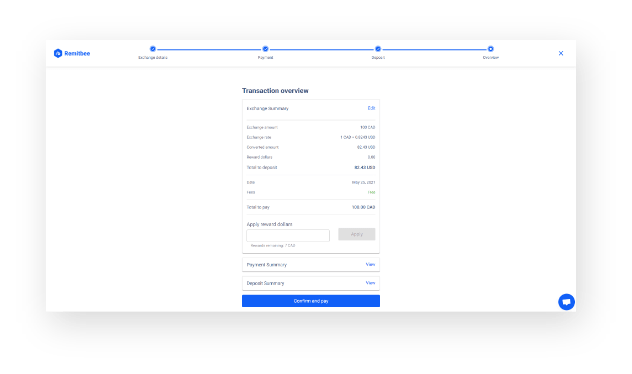

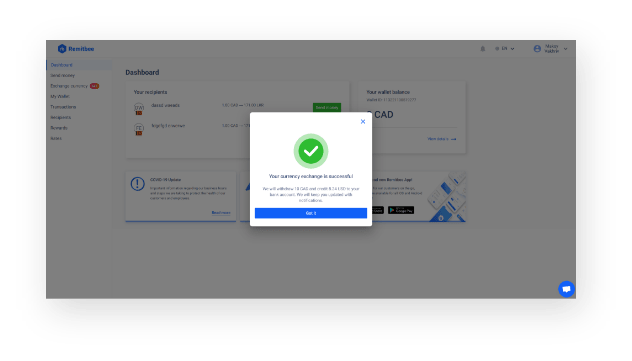

After signing up, go to the menu and select exchange currency. Enter the details of your currency exchange. You can move to the next step if no further verification is required.

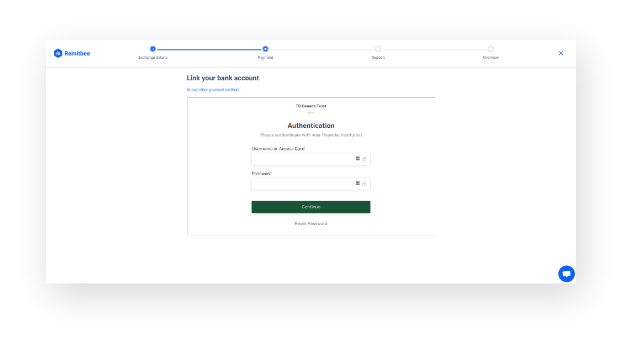

You can now link your CAD and ATB USD accounts.

Choose the amount and confirm your exchange rate. The transaction occurs between the two accounts via EFT.

Convert your money.

Other USD Accounts