Exchange currency in TD Direct Investing to buy US stocks

You've probably heard of TD Direct Investing if you're a Canadian investor looking to invest in US stocks.Whether you've used their platform previously or not, you'll see how inexpensive and straightforward it is to trade US stocks from Canada after reading this piece.

We'll begin by examining the benefits of investing in US stocks. Then, to optimize your earnings, we'll go over how to buy them online with TD Direct Investing, including how to convert your Canadian dollars to US dollars (CAD to USD).

The world's two major stock exchanges are the New York Stock Exchange (NYSE) and the Nasdaq Stock Market (NASDAQ). Investing in US stocks provides you access to some of the most powerful firms in the world, such as Microsoft and Apple.

Investing in US stocks can help Canadians diversify their portfolios.

Due to its intuitive trading platforms and advanced tools, TD Direct Investing was one of the finest ways to buy US stocks with a Canadian account until recently.

Your selection will be determined by whether you have a registered account (such as a TFSA) or a non-registered account. To begin, TD Direct Investing will convert your funds automatically if you have a registered account.

TD Direct Investing can convert currencies from CAD to USD at its discretion by trading Walmart shares (or any other US company or ETF for that matter). Then you accept TD Direct Investing's exchange rate, even if it isn't the most competitive.

This strategy is not the most cost-effective, despite its convenience (more on that later).

As a second option, you can trade US stocks on margin. Allow me to elaborate. You are essentially borrowing money when you trade on margin.

Even if you have CAD, TD Direct Investing will borrow the cost of Walmart in USD for you, and you will pay interest on that US dollar amount.

Let's say you have $5,000 in your bank account and want to invest $1,000 in Walmart shares. Even if you have enough money in your Canadian account to buy Walmart shares, TD Direct Investing will borrow US money and leave your Canadian account uncharged.

You'll have to pay for the money you borrowed, of course. This isn't the most cost-effective way to buy stocks in the United States. An alternative way to buy US stocks on TD Direct investing

Another way to buy US stocks is to use USD to fund your TD Direct Investing account.

To begin, you'll need a bank account in USD, which is easy to establish if you live in Canada. We've talked about a few options for opening a USD account from Canada.

A fee of 1.99 % may not seem like a big deal when you're trading for less than $10. However, once you get serious about trading, you'll kick yourself for not conducting much research in the beginning.

Rates of 1.5 percent -1.99 percent from TD Direct Investing may not appear to be much at first, especially when compared to what banks and credit cards charge (about 2.5 percent), but after trading $5000, you've already lost nearly $100. You're losing out on a wonderful meal for two because you don't know of another means to convert your CAD to USD.

You'll also be forced to use TD Direct Investing's CAD to USD exchange rate, which means you'll lose even more money. However, there is a way to save money on exchange rates. The newly introduced Remitbee Currency Exchange charges no fees and offers incredibly competitive exchange rates when changing your Canadian dollars to US dollars. Make your own comparisons between the CAD and USD exchange rates.

There are no hidden fees with Remitbee, and you can exchange up to $50,000 every day. The process takes about 2-3 business days to complete.

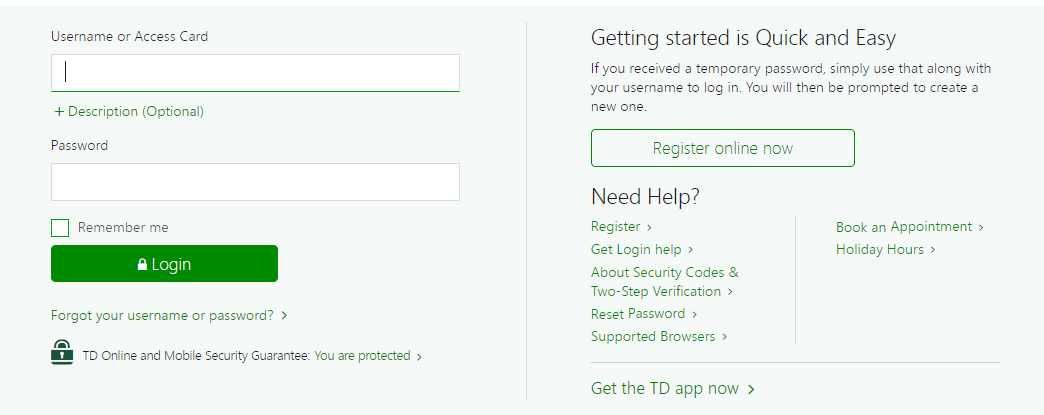

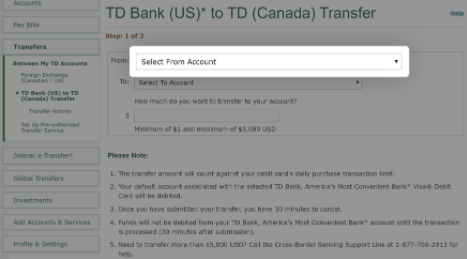

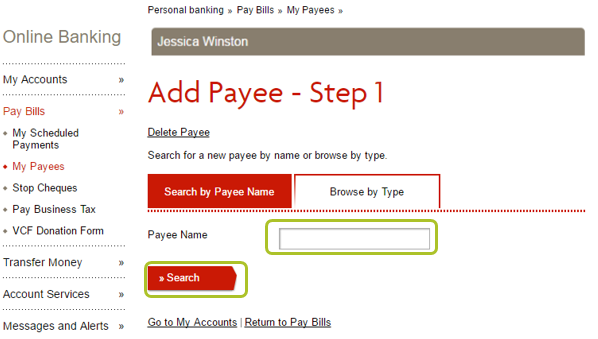

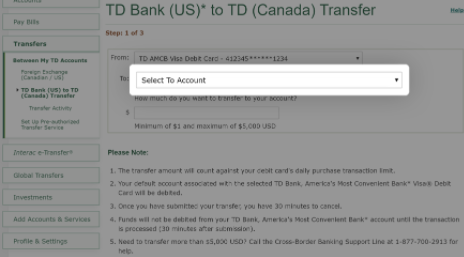

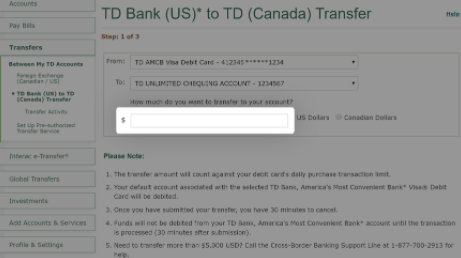

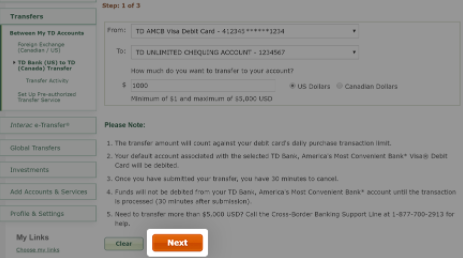

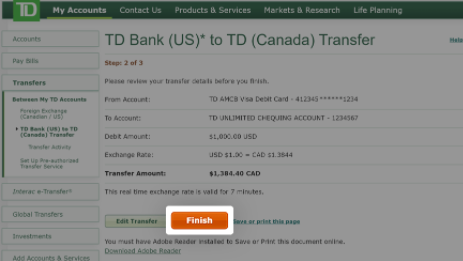

Here's how to link your USD account to TD Direct Investing so you can start making money while trading US stocks. This is the case if you've created a US bank account and used Remitbee to transfer money from your Canadian account. (Note that this example uses a TD bank account, as well as the process if you bank with other financial institutions.)

Step-by-step tutorial: Connect your USD account to TD Direct investing