Want to exchange CAD for USD? Get the best Brossard Currency Exchange rates

Currency Exchange In Brossard

Similarly, if you want to transfer funds from Brossard your beneficiary can receive the funds sent via Remitbee in bank deposit; cash pick-ups are door-door delivery.

You are working in Canada and get paid in US dollars:

For context, you could be losing about $2,000 in currency exchange fees if you make 50k salary a year, and use currency exchange services through your bank.

You buy US stocks:

If you’re interested in investing and buying US stocks in Canada, you need to check out other options when it comes to exchanging currency.

With Remitbee currency exchange, you can get the most out of your trading. Questrate, which is a popular option for those converting CAD to USD, charges 1.5-1.99%. However, Remitbee Currency Exchange charges you zero fees.

Once you start to invest in the thousands, you could be losing a ton of money just on fees alone! For example: Consider the following compared to Questrade fees:

- $1000 worth of US stocks: You could be losing about $40 CAD.

- $50,000 worth of US stocks: You could be losing about $2,000 CAD

You are paying tuition abroad as a Canadian or American paying tuition:

If you choose a more traditional method to exchange currency like your bank, you could potentially be losing out on about $1200 USD per year.

You purchase property in Canada or the USA:

In 2020, the average house in Canada cost about 531,000 CAD. Using Remitbee currency exchange could allow you to save over $9,000 USD; much more than you would save from bank currency exchange services.

Why choose Remitbee FX in Brossard

Security

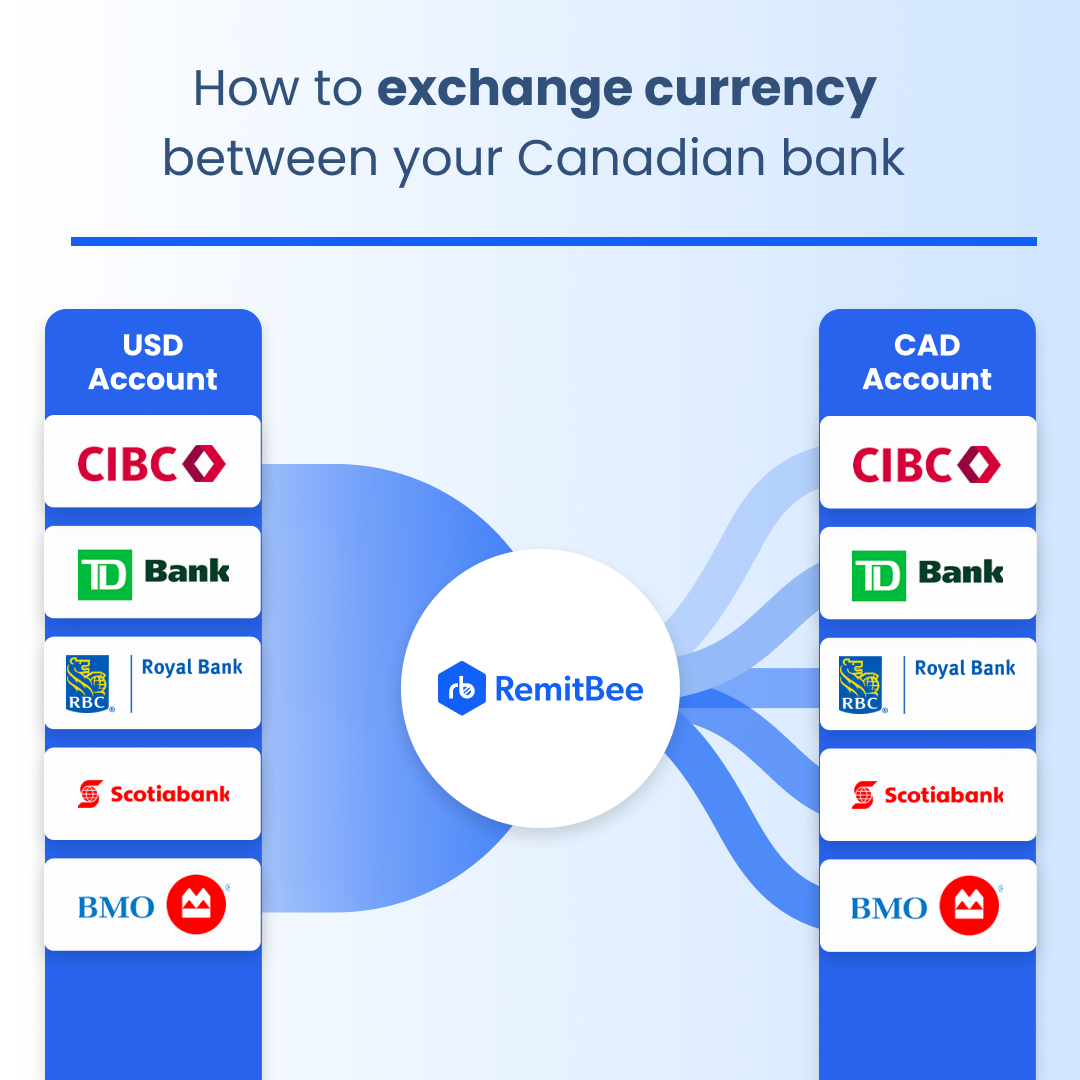

The FX broker is regulated by FINTRAC and has a separate account at major Canadian financial institutions.

Convenience

Remitee offers same-day delivery of funds to your desired destination.

Transparency

As you already know, with Remitbee, you'll get a written confirmation of the agreed Forex exchange rate before you send your funds.

No transaction fees

Any time you exchange a minimum of $10 between a currency pair, you enjoy zero fees!

Customer service

Remitbee understands that fast, efficient, and friendly service makes a difference. As such, their customer service is pretty smooth and swift.

Competitive exchange rates

Remitbee rates beat the bank's exchange rate. It can save you hundreds to thousands of dollars. Indeed, they normally call the banks daily to ensure their exchange rates are way better.

Remitbee Currency Exchange Rates And Fees

The advantage of using Remitbee in Brossard is that the first transaction you make is free of charge.

With Remitbee you need to pass different tiers of verification to be able to send higher amounts of money. To increase your sending limits you will need to provide your personal information and upload certain documents.

Here’s a selection of the rates Remitbee will charge:

Brossard-India: The margin is 0.50%

Brossard-Philippines: The margin is 0.55%

Brossard- France: The margin is 1.05%

Brossard-South Africa: The margin is 2.80%

Brossard-Australia: The margin is 1.32%

As you can see, the size of the margin depends mainly on the currency you want to exchange. Popular destinations like India, the Philippines, and Sri Lanka have the best exchange rates, while less frequented destinations like South Africa attract a higher exchange rate.

It gets even better: we offer money transfers in Canada to order 50 destinations!

Currency Exchange Near You