How to Exchange Currency with Interactive Brokers to buy US Stocks

Are you a Canadian with an interest in US stocks? Then you’ve probably heard about the brokerage Interactive Brokers.

Maybe you’re already using their services or haven’t started yet. Either way, after reading this guide, you’ll know how simple and cheap it is to trade US stocks from Canada.

Let’s start by exploring the benefits you get from investing in US stocks. Then we’ll dig into exactly how to buy these stocks online with Interactive Brokers, as well as how to change your Canadian dollars for US dollars (CAD to USD) to get even bigger profits.

Firstly, the US is home to the two biggest stock markets worldwide — the NYSE and NASDAQ.

Investing in American stocks means you can have a piece of the world’s biggest companies, like Tesla or Microsoft. US stocks can help Canadians diversify their investment portfolios.

Up until recently, Interactive Brokers was one of the best ways to buy US stocks using a Canadian account. This was mainly because of its strong research and tools as well as a large investment selection.

The type of account you have, whether registered (like TFSA) or non-registered, matters.

If you have a registered account, Interactive Brokers will convert your money automatically.

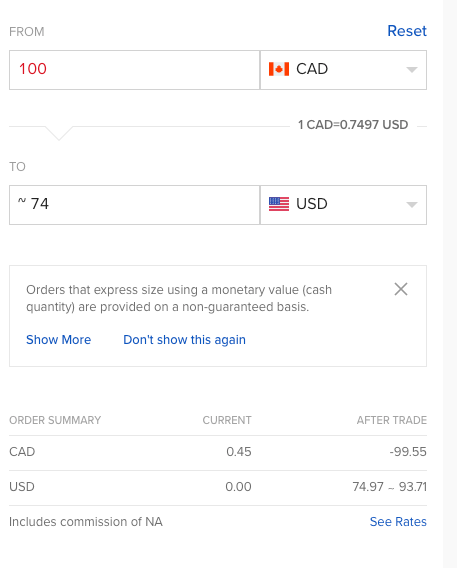

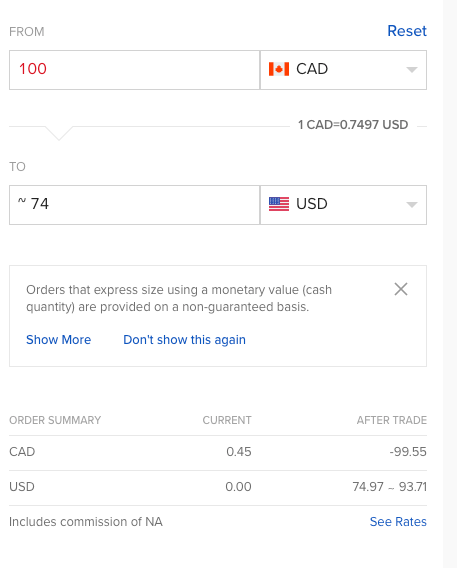

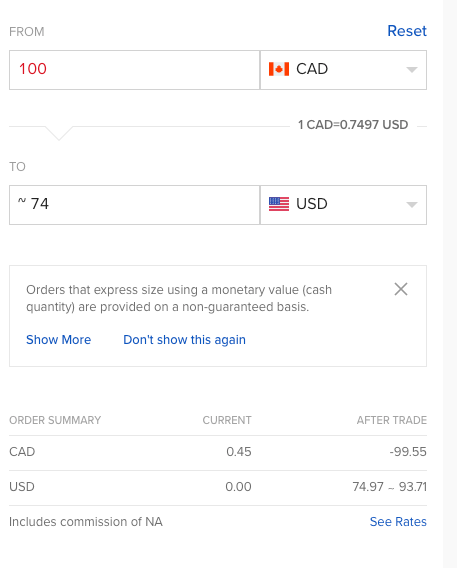

When you trade Walmart stock, or any US stock actually, you allow Interactive Brokers to convert the funds from CAD to USD at whatever their exchange rate may be. In general, you can expect a margin of 1.5% to 1.99%. You must accept whatever rate Interactive Brokers offers, even if it isn’t the best rate out there.

Although this approach is extremely convenient, it is not the most cost-effective (more on that later).

You can also trade US stocks on margin as an alternative. Allow me to explain. When you trade on margin, you are essentially trading with borrowed funds. Despite the fact that you have CAD, Interactive Brokers will borrow the cost of Walmart in US dollars on your behalf, and you will pay interest on the US dollar balance.

Suppose you have $5000 CAD in your account and decide to purchase $1000 in Walmart stock. Even if you have funds in your Canadian account to purchase, Interactive Brokers will borrow US funds while leaving your Canadian account untouched.

You will, of course, be charged interest on the borrowed funds. Again, this is hardly the most cost-effective approach to invest in US stocks.

Let's explain how.

To begin, you'll need a US bank account, which is simple to obtain if you live in Canada. We've discussed several possibilities for opening a USD account from Canada .

When you're solely trading a few dollars, 1.99% in fees may not seem like a significant issue. However, once you get serious about trading, you'll kick yourself for not doing your homework at the outset.

Interactive Brokers' rates of 1.5% to 1.99% may not appear to be much at first glance, especially when compared to what banks and credit cards often charge (about 2.5%), but if you've traded $5000, you've already lost roughly $100 in profit. That's a nice supper for two you're losing out on because you don't know another way to convert your CAD to USD.

You also have no choice but to use the Interactive Brokers CAD to USD conversion rate, which means you will lose even more money.

Fortunately, there is a way to save money on conversion fees. When converting Canadian dollars to US dollars, the newly launched Remitbee Currency exchange charges no fees and offers highly competitive exchange rates. Have a look at the CAD to USD exchange rates for yourself.

Remitbee allows you to exchange up to $50,000 every day with no hidden fees. And the exchange takes only 2-3 business days to complete.

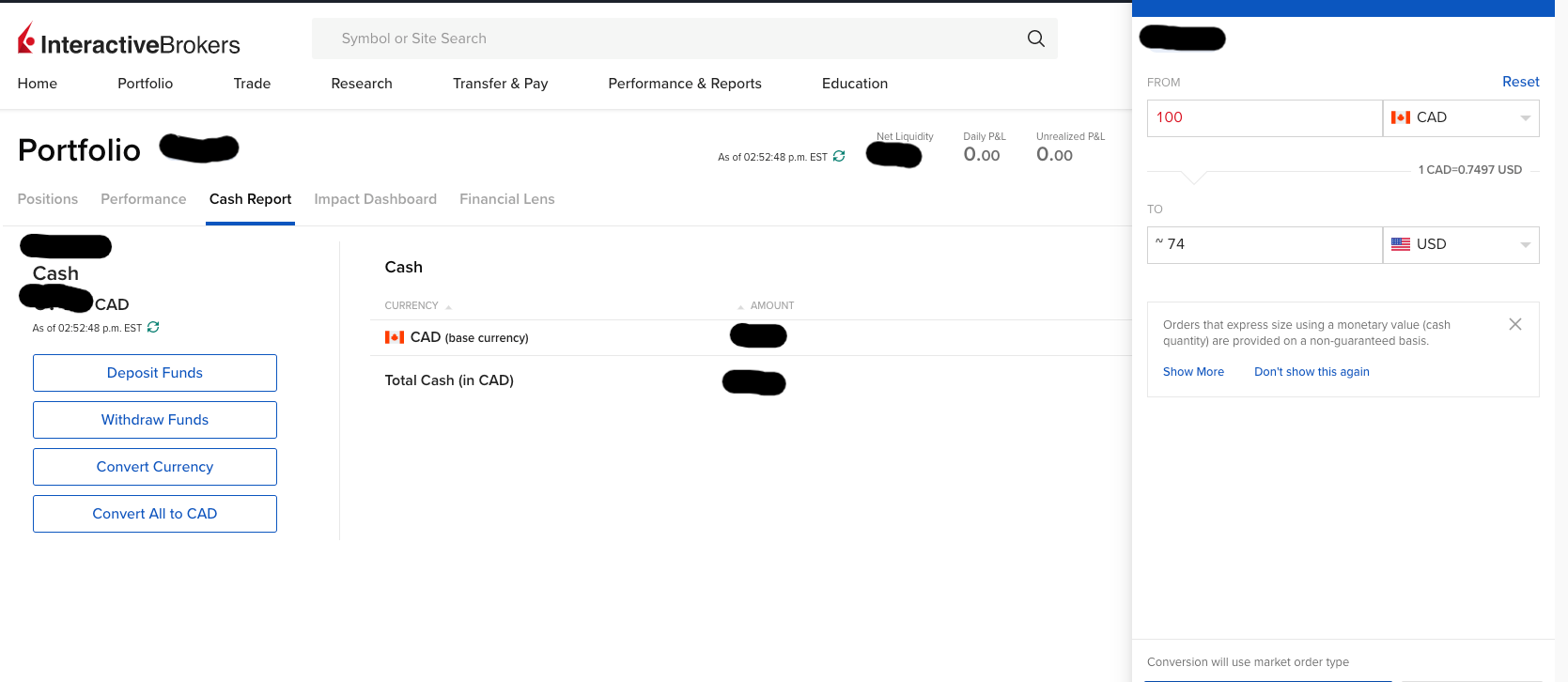

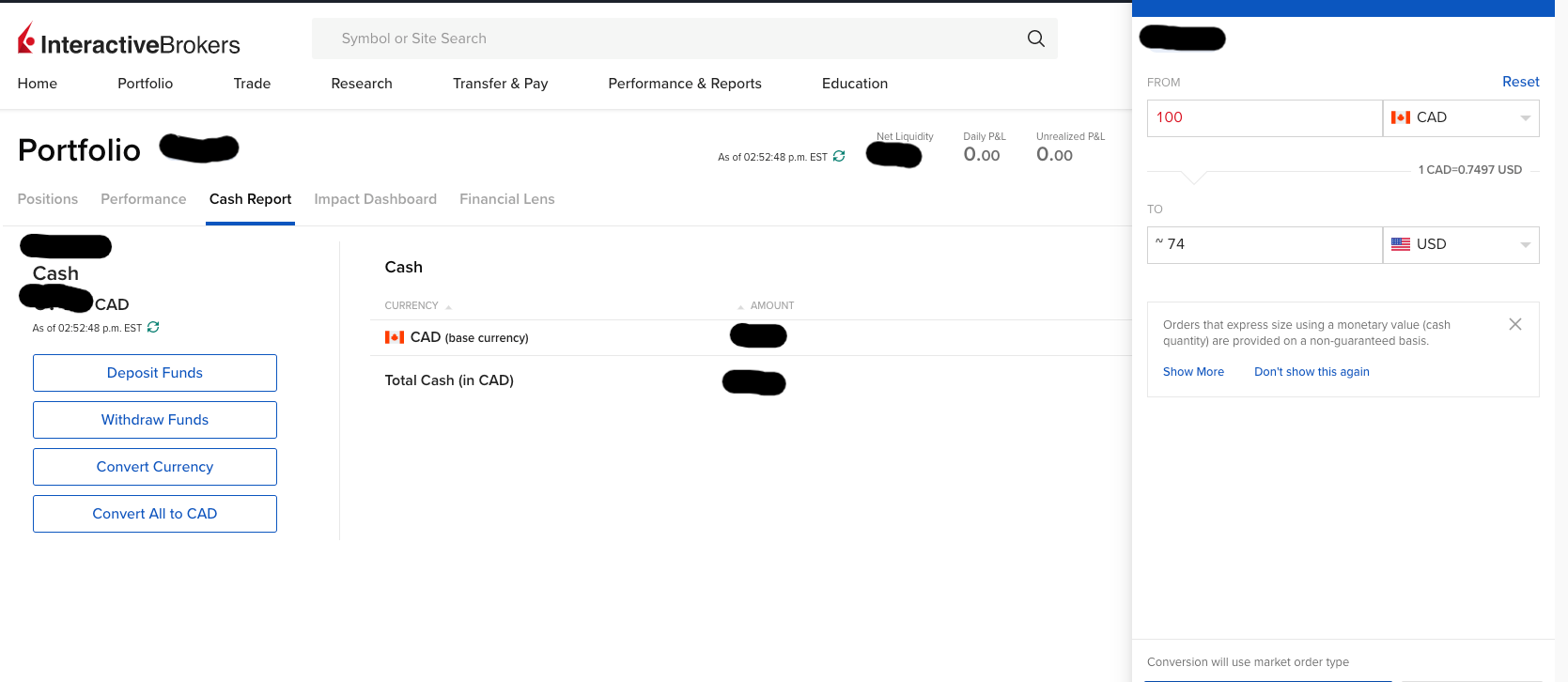

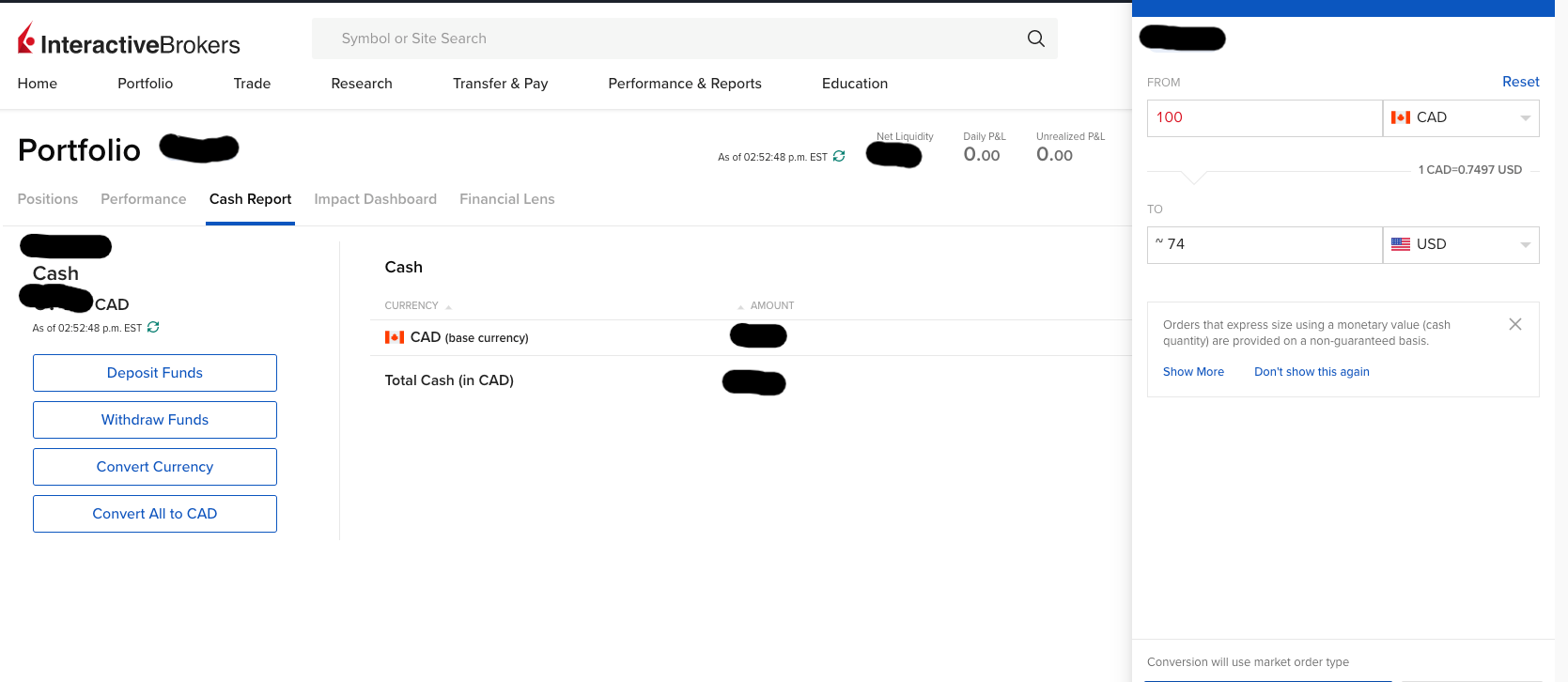

Once you've opened a US bank account and transferred funds from your Canadian account via Remitbee, here's a step-by-step guide on how to connect your USD account to Interactive Brokers and begin optimizing profits while trading US stocks. (Note: this example shows the identical EFT or electronic funds transfer process for any Canadian bank or institution.)

Step-by-step tutorial: Connect your USD account to Interactive Brokers