Everything You Should Know About Home Equity Loan

A home equity loan can be an excellent financial strategy for a growing family or a more manageable alternative to a mortgage in the event of an emergency occasion, but are they the best option for you? Let us find out.

What is a Home Equity Loan?

Home equity loans are loans that allow homeowners to borrow against their home's equity. The loanable amount is determined by the difference in the present market value of the home and the owner's mortgage balance.

Variable-rate home equity lines of credit (HELOCs) are less popular than fixed-rate home equity loans. This is because fixed-rate home equity loans offer borrowers a single lump sum, whereas HELOCs provide debtors with revolving lines of credit.

Home Equity Loan vs Line of Credit

Home equity loans and HELOCs are two loans largely dependent on the equity in a debtor's home. A home equity loan has payment obligations and an interest rate that remains constant throughout the loan's time frame.

On the other hand, HELOCs are revolving credit lines with variable interest rates and, consequently, varying minimum payment amounts. Since home equity loans and HELOCs use one's property as security, their interest rates are typically lower than those of personal loans, credit cards, and other unsecured loans.

As a result, both options are incredibly appealing. But even so, debtors should exercise caution when using either. Because failing to pay off your HELOC or home equity loan can lead to the loss of your home.

Types of Home Equity Loans

When most people think of home equity loans, they only consider getting either a fixed-rate loan or a HELOC. But, unknown to some, a cash-out refinance is another way to use home equity to access cash. Here's a quick summary of what are these three types of home equity loans:

Fixed-rate loans are pretty straightforward. The lender makes a single lump-sum payment to the borrower, which will be paid back with a fixed interest rate over time. Fixed-rate home equity loans have agreements ranging from five to fifteen years and must be repaid in full if the sale takes place.

The interest rate on a HELOC is changeable and will rise or fall, relying on the market rates, which means that rates may increase throughout the credit line term. Monthly payments will differ depending on the sum taken and the current interest rate.

Mortgage refinancing is repaying a present mortgage loan with a new loan from the same or a different lender. A cash-out refinance allows a borrower to pay off their current mortgage debt for much more than they presently owe and afterward cash out the difference.

Home Equity Loan Requirements

Home equity loan requirements are usually the same regardless of which type of loan you take. And even though each lending institution has its requirements, to get approved, most debtors will typically require the following:

- A specific amount of equity in their home (more than 20% of the home's value)

- Excellent credit (more than 600)

- Low Debt-to-Income ratio (DTI)

- Sufficient earnings (verifiable income history for two or more years)

- Dependable payment history

Although it is possible to obtain a home equity loan without having all these specifications, you should expect to be charged a much greater interest rate if you choose a lender with high-risk borrowers.

Home Equity Loan Interest Rates

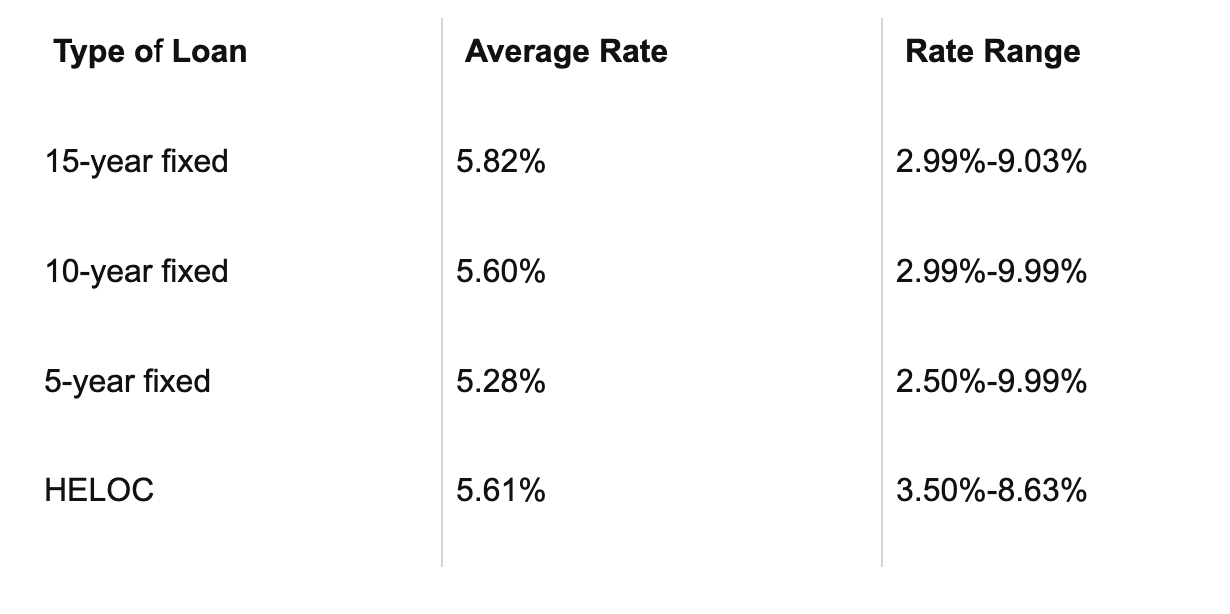

To better understand home equity loan rates, take a look at the table below:

The rates above are based on a loan sum of $25,000 and an 80 percent loan-to-value ratio. HELOC rates are based on the interest rate when the credit line is established, and rates can shift depending on market conditions.

How does a home equity loan work?

Note that a home equity loan is like a mortgage. Thus it's often called a second mortgage. The lender uses the home's equity as collateral.

The amount a homeowner can loan will be partly determined by a consolidated loan-to-value (CLTV) ratio of 80% to 90% of the assessed value.

Furthermore, the borrower's credit score and history of payments determine the loan amount and interest rate. Traditional home equity loans, like conventional mortgages, have a definite repayment period.

The borrower is expected to make consistent, fixed payments that cover both principal and interest. If the loan is not paid off, the home may be sold to sustain the outstanding debt, like any mortgage.

Are you planning to get a home equity loan in Canada? If so, then you may be interested in learning more about RemitBee. RemitBee is a Canadian company that allows you to send money abroad quickly and easily.

With Remitbee, you can rest assured that your money will arrive safely and securely. Plus, there are no hidden charges!