Asenso Remit vs. Remitbee: Which money transfer service is best? (2021)

An increasing number of people have been choosing digital remittances as a result of the pandemic. The shift from in-person to digital had already begun before COVID-19, but it has accelerated as a result. Digital remittances offer a low cost, safe, more transparent, and convenient way of transferring money back home.

Choosing a money transfer service you can rely on to consistently support your family back home is a serious matter. We know this because before the pandemic, in 2019, an estimated 200 million migrant workforce sent home nearly US$700 billion. That’s an average of roughly $4000 CAD per person.

This is why we’ve made a series of posts comparing some of your top digital options. Today we’ll see how Remitbee compares to Asenso Remit.

When comparing money transfer services, there are twelve key factors you should consider:

Background

What’s Asenso Remit’s Background?

Asenso Remit is owned by Kabayan Capital Ltd. which is based in the UK. It was created in 2017 as a way for Filipinos to send money back home.

Their head office is in Ontario, Canada.

What’s Remitbee’s Background?

Remitbee was one of the first digital money transfer services in Canada and is now considered one of Canada’s top options. Some of its major transfer destinations include the Philippines, India, and Sri Lanka. It was created by immigrants in Canada for immigrants in Canada and everyone who works for the company has been in similar shoes to their customers .

Remitbee was founded in Canada in 2015 and is currently located in Ontario.

Exchange Rates & Fees

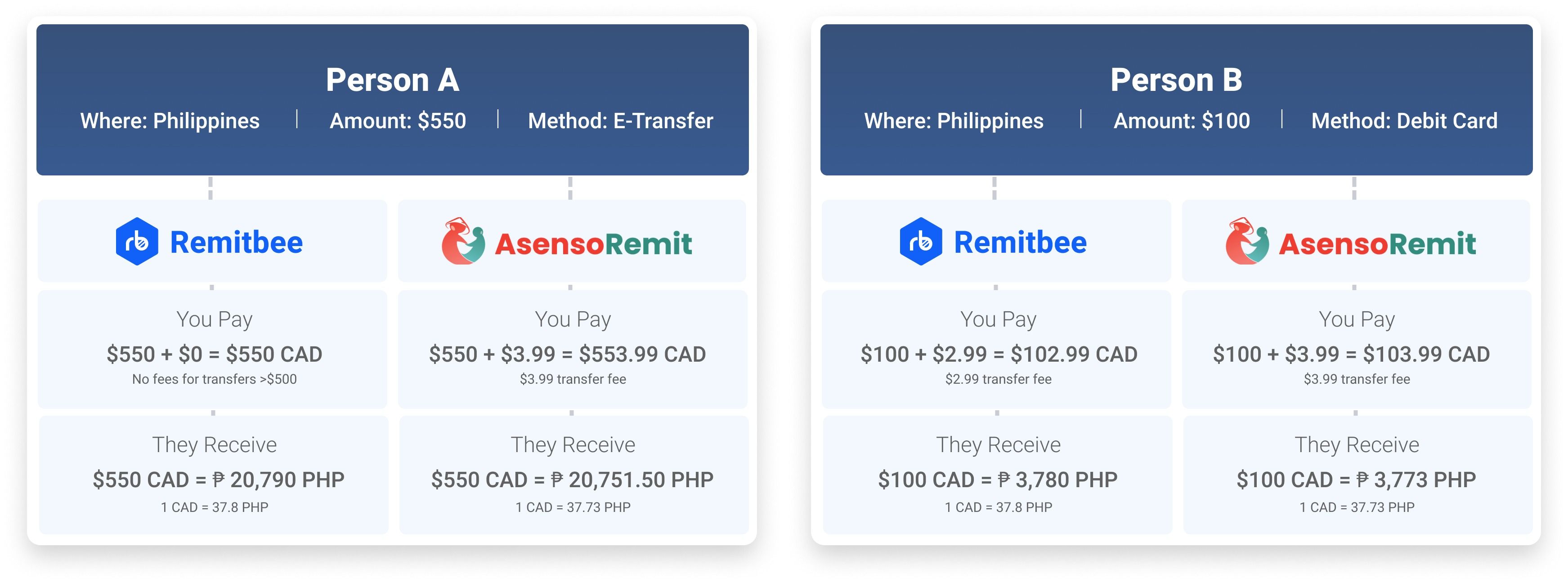

Remitbee has a better exchange rate and has overall lower fees and higher transfer limits. If you want to transfer very low amounts, Asenso Remit may be competitive. However, if you want to transfer more, Remitbee wins.

Let’s go more in-depth:

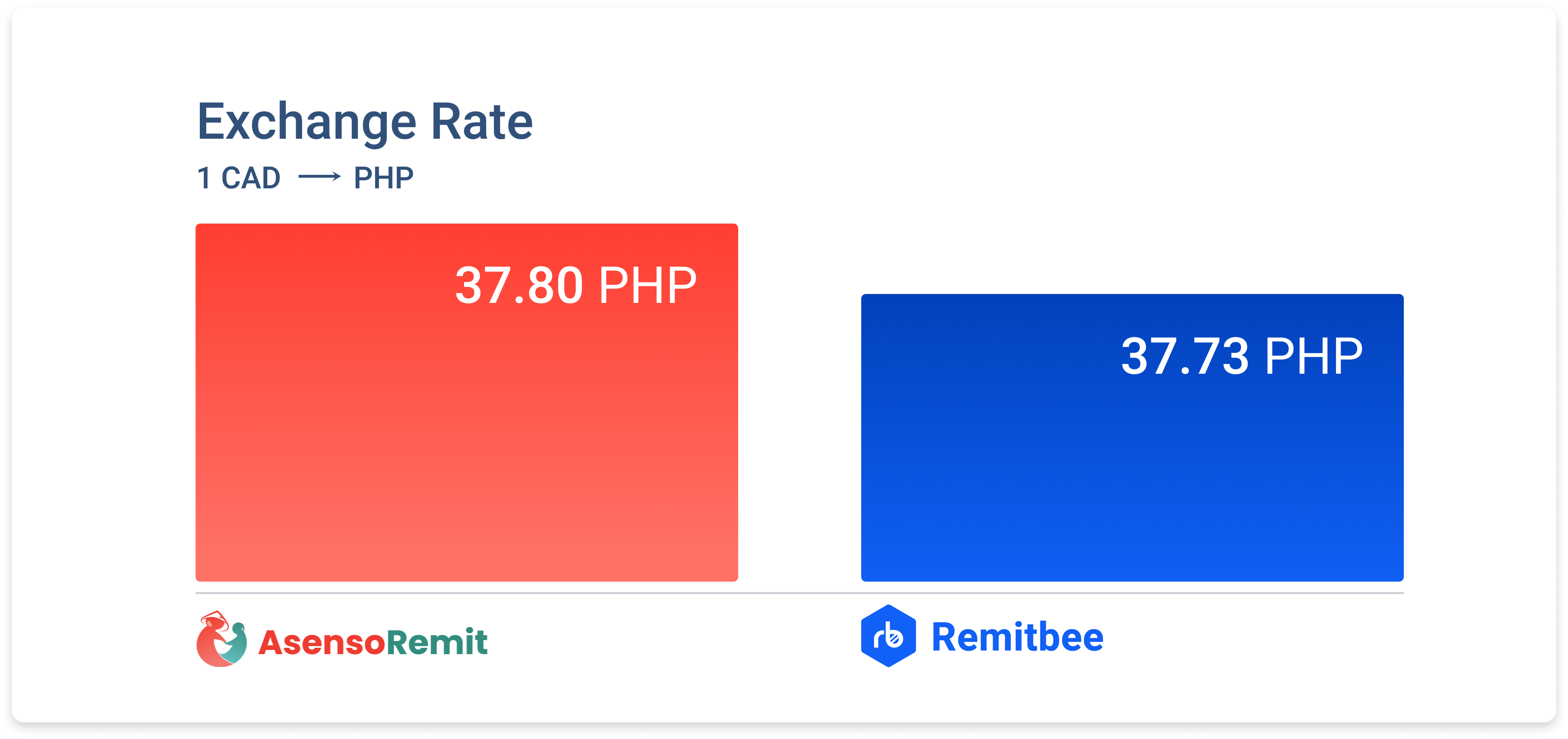

Exchange rates

Exchange rates fluctuate daily so make sure to compare the exchange rate you’re being offered with the real (or mid-market) exchange rate on Google. For example, if you’re looking for the real exchange rate from CAD to PHP, just put “CADPHP” into Google search.

As of January 21, the real exchange rate is 1.00 CAD → 38.07 PHP

Now let’s compare the two as of January 21, 2021:

Asenso Remit’s exchange rate for CAD/PHP

1.00 CAD → 37.90 PHP

Remitbee’s exchange rate for CAD/PHP is

1.00 CAD → 37.9486 PHP

According to these numbers, Remitbee is slightly closer to the mid-market exchange rate. Now let’s look at both services’ fees.

Fees

Asenso Remit

Asenso Remit offers a fee calculator which shows that the fees tend to go up about $1 easily the more you add. Be sure to be aware of this. Also, keep in mind you may have to pay fees twice if the amount you need to transfer is over their limit.

Credit to bank account: From $3.99

Bills payment: From $3.99

Cash Collection transfer: From $4.99

Door-to-door: From $4.99

Asenso Remit transfer limits:

Paying by Debit Card: $300 (fee exclusive)

Paying by Interac e-Transfer: $3,000 (fee exclusive)

Paying by POS: $3,000 (fee exclusive)

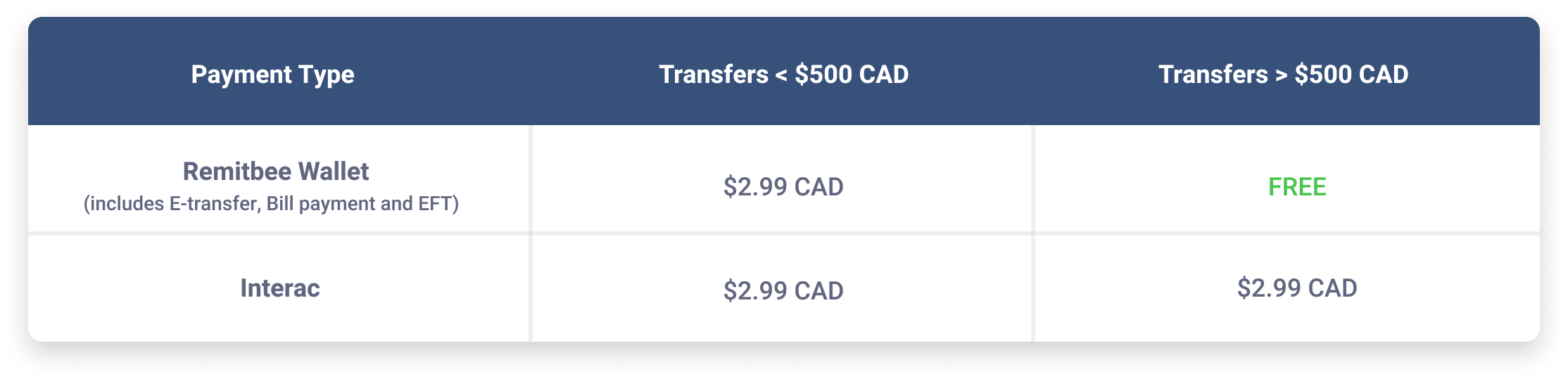

Remitbee

Remitbee also has a handy fee calculator that’s super easy to use. You simply drag the button to show how much you are planning to transfer, and it tells you how much the fees will be for each of the following methods: Wallet, Interac, debit.

They’ve also recently come out with new fees for Visa Debit/ Mastercard Debit:

And here are their fees when you use Remitbee Wallet and Interac.

Two things are noteworthy about Remitbee’s fees:

- When you send over $500 with Remitbee Wallet, your transfers are free (Remitbee Wallet itself is also free).

- Transaction limit of $9000 is significantly higher than Asenso Remit’s limit.

Sending 1000 CAD to Philippines

To give you a better idea how exchange rates and fees work together, let’s compare how much money (in PHP) the receiver will get when you send $1,000 CAD with each of the two services. (As of January 21, 2021)

Asenso Remit:

$1000 CAD= 37,900 PHP (not including fees)

- Debit: You would have to do 4 different transactions if you choose debit since $300 is the max per transaction. You would be paying 36.96 CAD in fees meaning you’d have to pay $1036.96. Your receiver will get 37,900.

- Interac & eTransfer: $5.99 CAD in fees meaning you would have to pay 1005.99 and your receiver would receive 37,900 PHP.

Remitbee:

$1000 CAD= 37,948.60 PHP (not including fees)

With the free Remitbee Wallet, there are no fees with this transfer. You would simply put in $1,000 CAD and they will receive $37,948.60 PHP.

If you choose to not use the free Remitbee Wallet, fees are as follows:

- Debit: 14.99 CAD

- Interac: 2.99 CAD

Transparency

In recent times, money transfer services have been plagued with a bunch of hidden fees and small print. Since digital transfer services have become popular, it’s become less of a problem because people can now easily compare their options. It’s still something to be extra mindful of.

Let’s see how both services do on transparency.

Asenso Remit

Asenso Remit offers a calculator for their fees on the website, so that’s a plus as far as transparency. However, if one uses the calculator, they will realize that even though fees start low and look promising, fees can quickly add up if you want to send more.

Also, they have a relatively low transfer limit, meaning you may have to pay multiple fees if you want to transfer a high amount.

Remitbee

Remitbee prides itself on its transparency and is very transparent about their business model and fees. They don’t have hidden fees and don’t highly markup their exchange rates in the way banks are known to do. Everything you need to know is on their website, including an easy to use fee calculator tool.

Ease of use

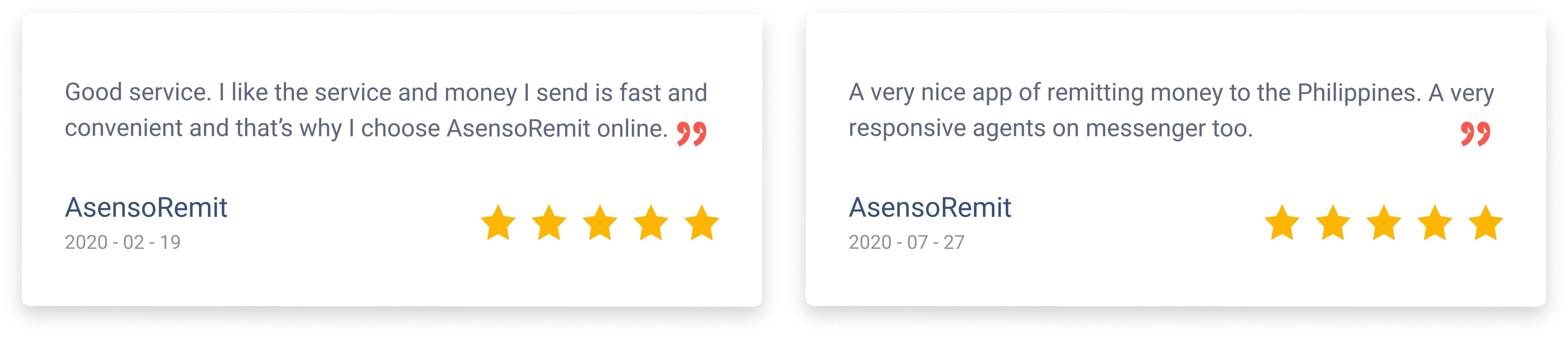

Both services are very easy to use, according to reviews.

Asenso Remit

They have many positive reviews regarding their ease of using the service. They offer touch ID which makes it easy to login. They also offer a good deal of guides on their website.

Remitbee

Remitbee offers many easy to follow guides on how to use the service. Getting authenticated and sending repeat transfers is a very straightforward and smooth process.

It also offers biometric authentication for your security and convenience making repeat logins fast and easy.

Remitbee’s ease of use is backed by many positive reviews commenting on this specific factor.

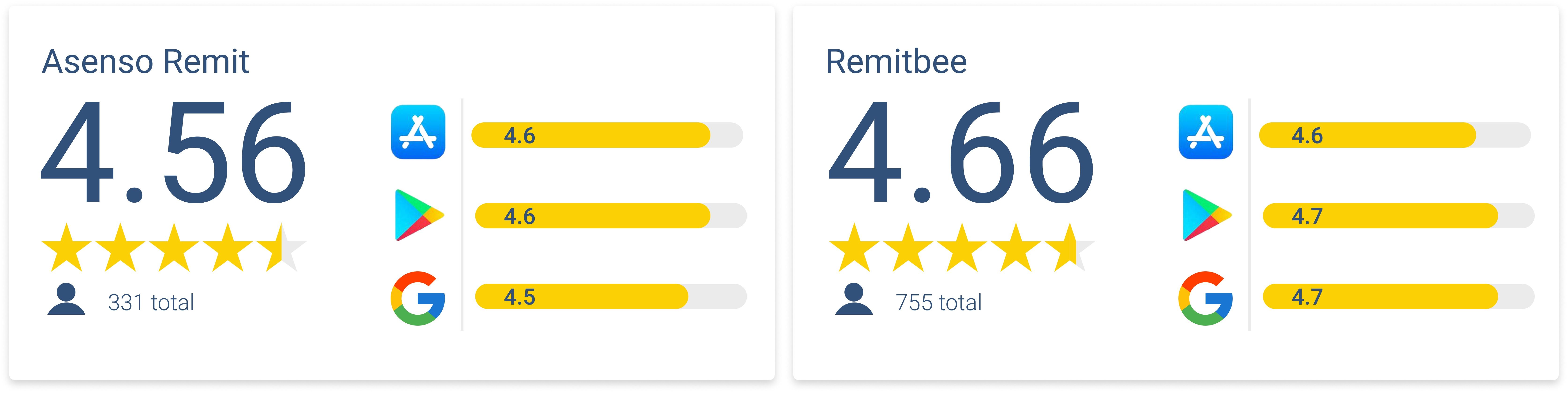

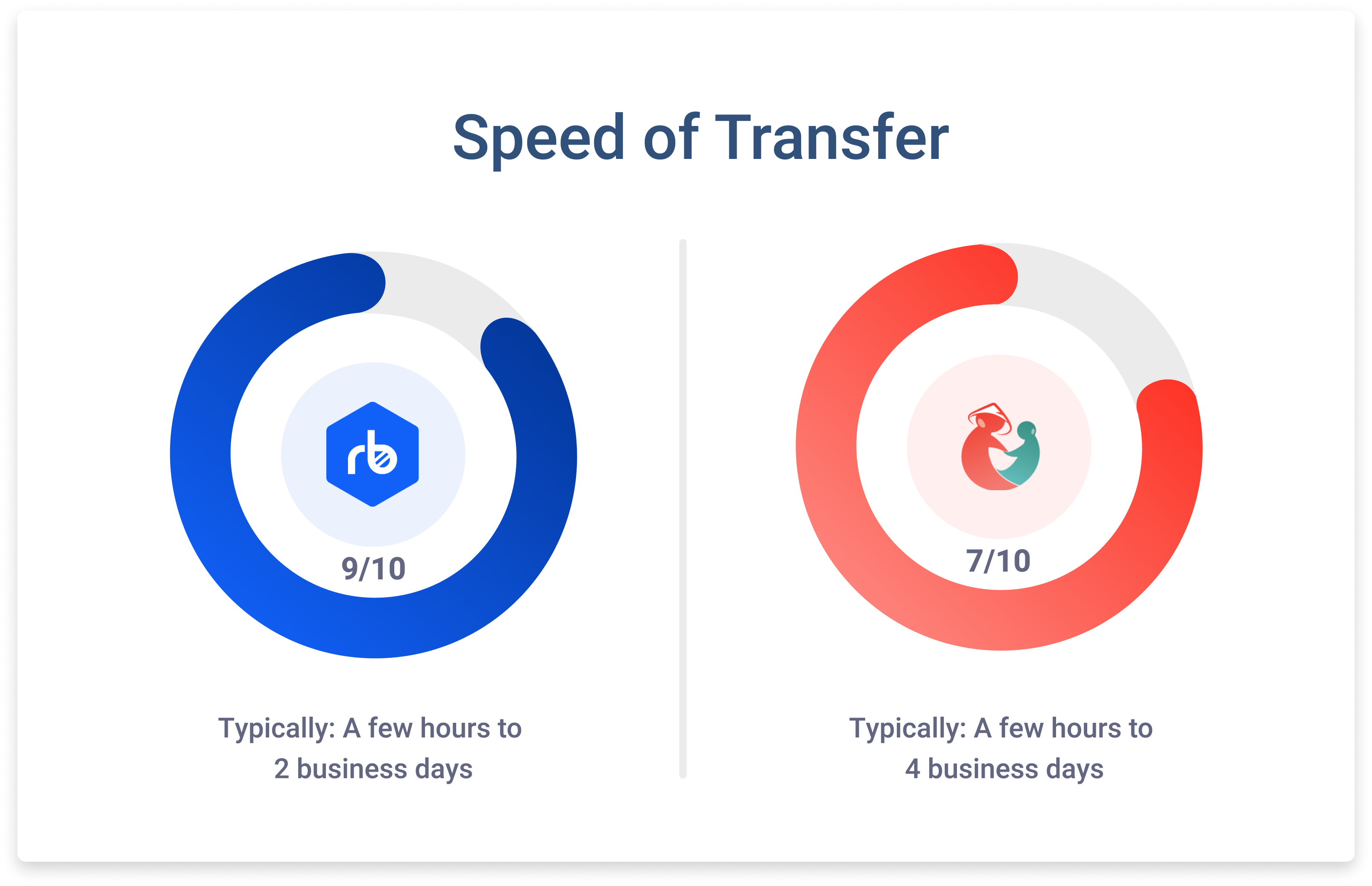

Customers reviews

Both Remitbee and Asenso Remit have similar ratings, with Remitbee’s ratings being slightly higher. Plus, Remitbee has more than double the amount of ratings. With that in mind, Remitbee wins this category. Here are the current numbers:

Ratings

Reviews

Asenso Remit

Remitbee:

Features and functionality

Asenso Remit

Asenso Remit offers various great features, including:

Remitbee

Remitbee offers a few exciting features, including:

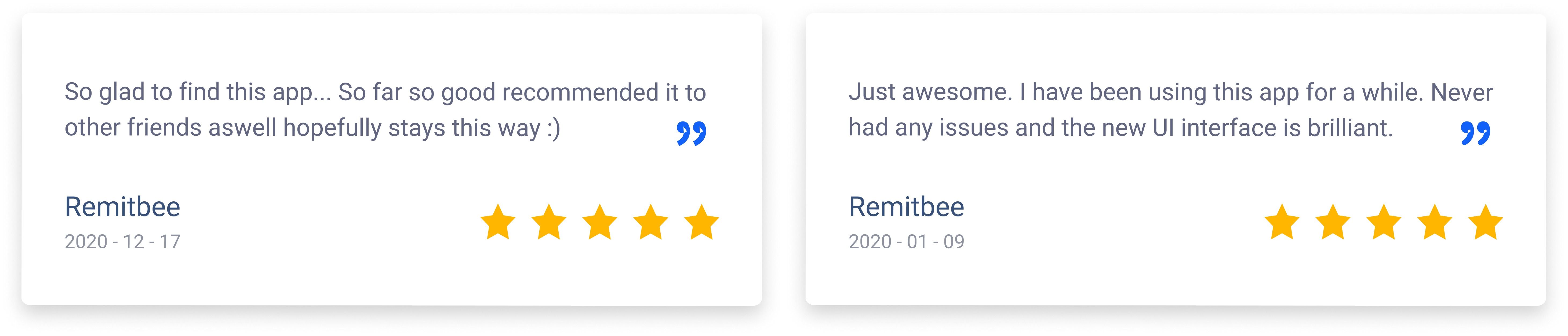

Payment methods

Asenso Remit

Asenso Remit supports several payment methods, including:

Remitbee

Remitbee’s payment methods include:

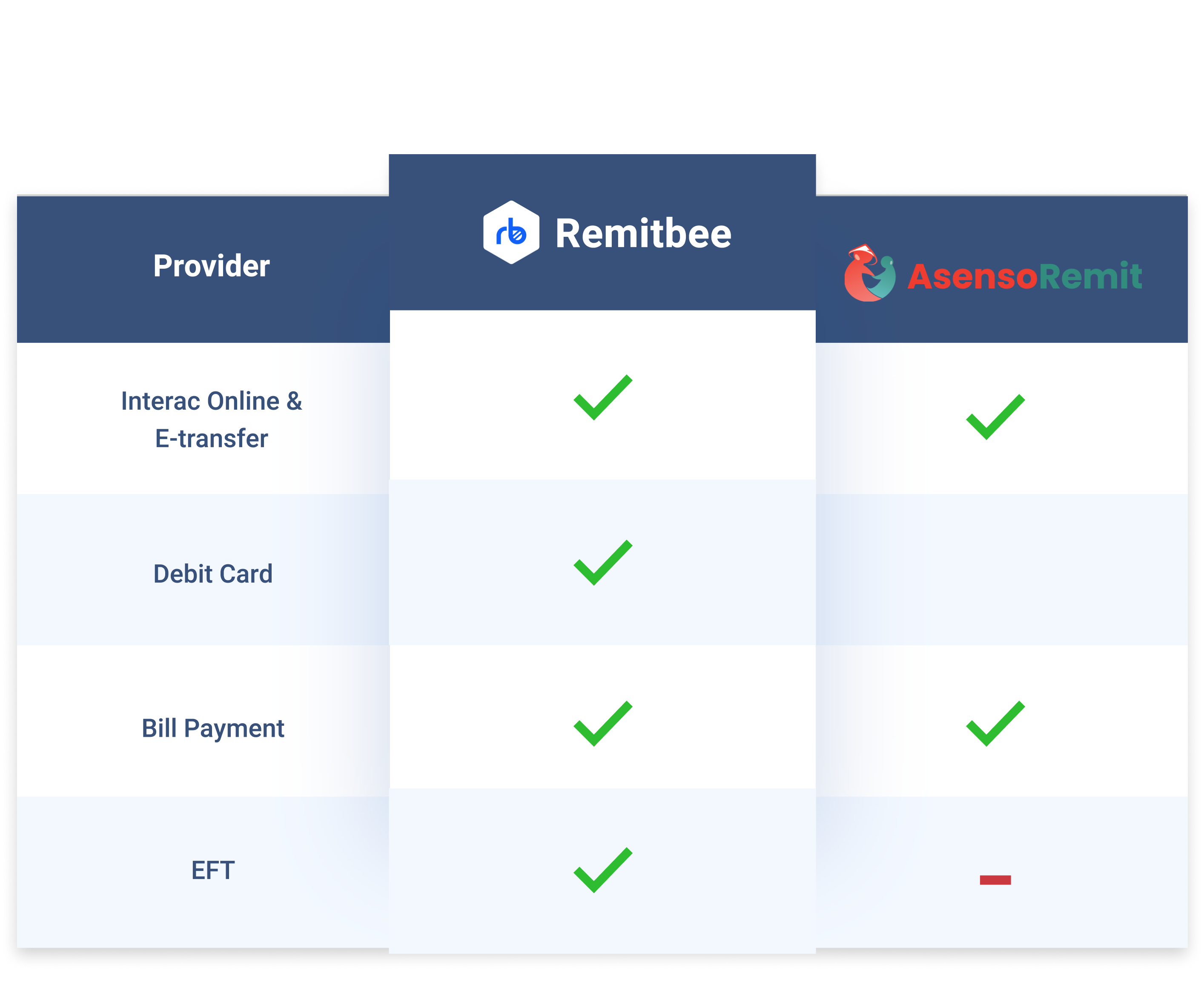

Speed of transfers

Asenso Remit

They claim that you can send money to the Philippines in up to an hour and that the money is transferred instantly to your recipient’s bank account or many cash pick up locations.

Door to door remittance and home delivery usually takes between 1-4 working days

Remitbee:

According to Remitbee, the fastest option to send money once your card is connected is EFT. These transfers are typically completed within one business day, usually within a few hours.

For other methods, speed of transfer depend on your level of verification, but are usually completed between 1-3 business days.

Credibility and security

Both services are impressive in this category and are backed by many happy customer reviews. Let’s take a closer look.

Asenso Remit

Asenso Remit is regulated by FINTRAC. They also use the same security as banks (128-bit encryption). Their practices are monitored and verified by TRUSTe and VeriSign.

Remitbee

Remitbee is regulated and audited by the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC). Your personal details and transaction records are protected by SHA-256 RSA encryption for dependable privacy and security.

Service & Coverage

Asenso Remit

With Asenso Remit you can send your remittance from only Canada to only the Philippines.

They offer a variety of services including:

Remitbee

Remitbee offers many services and covers over 45 countries. Some of its most popular money destinations are the Philippines, India, and Sri Lanka. Currently, you can only send money from Canada, but they are working on more countries.

They offer the following services:

Customer support

Asenso Remit

You can contact them through Facebook messenger. Their support centre is 24/7 according to their website.

Here are the numbers to call by province:

+1(437)886-2999 – Ontario

+1(587)287-2580 – Alberta

+1(514)545-2701 – Quebec

+1(204)202-9343 – Manitoba

+1(778)775-9987 – British Columbia

Alternatively, you can email them at [email protected] or send them a message on Facebook.

A lot of reviews say positive things about their customer support.

Remitbee

One of Remitbee’s super strong points is their customer support. Something noteworthy about their customer support is that they back it up with a 100% Money Back Guarantee (including any fees paid) as a commitment to their customers.

Remitbee also maintains good reviews on Google, Google Play, the Apple app store, and Trust Pilot.

If you want to get in touch with Remitbee, you can do so in the following ways:

Promotions

Putting it all together

Both Asenso Remit and Remitbee are strong money transfer services and are trustworthy alternatives to the old in-person money transfers. Both have many positive reviews and great ratings.

Overall, when it comes to transfer above $500, Remitbee is the better service. For transfers under 500, it’ll be a close call and will come down to a case by case basis depending on many factors (e.g.,delivery method, how often you have to send remittances, personal preferences).

If you’re ready to send your first transfer with Remitbee, the team has created an easy to follow guide on how to get started.

Disclaimer: All third-party trademarks (including logos) referenced by Remitbee Inc. in this article remain the property of their respective owners. Unless specifically identified as such, Remitbee's use of third-party trademarks does not indicate any relationship, sponsorship, or endorsement between Remitbee and the owners of these trademarks. Any reference by Remitbee to third-party trademarks is to identify the corresponding third-party goods and/or services and shall be considered nominative fair use under the trademark law. Furthermore, we are not responsible for any inaccuracies identified in the article's content, and that information can be verified by contacting the respective third parties directly mentioned in the article.