5 Best USD Accounts for Canadians

There are a whole host of benefits to getting a USD account for Canadians. These include avoiding the foreign transaction fee on your credit card, which is usually over 2 percent each time. You can also get paid from overseas clients or employers with a better exchange rate. With a USD account, you don’t have to be a victim to the daily ups and downs of the USD/CAD exchange rate as well.

Still, when choosing USD accounts, there are several factors to consider. These include monthly fees, transaction fees, and any possible interest paid. Here are the five best USD accounts for Canadians.

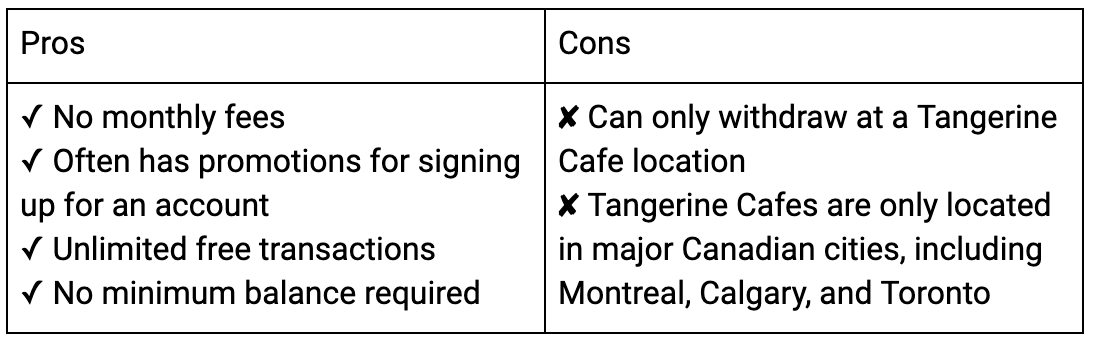

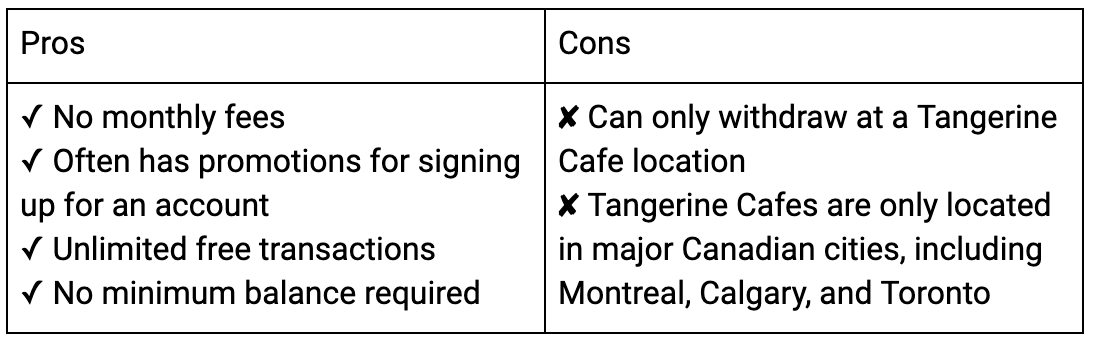

1. Tangerine US Savings Account

Tangerine, the online-only bank, has a popular US account that ranks highly among consumers. The Tangerine USD Savings Account benefits from no monthly fees and unlimited free transactions. Account-holders can earn interest at a rate of 0.10 percent. There is no minimum balance required on this account. To access your money though, you will need to visit a Tangerine location. The alternative is to transfer it to a US dollar chequing account with another bank, then withdraw it from there.

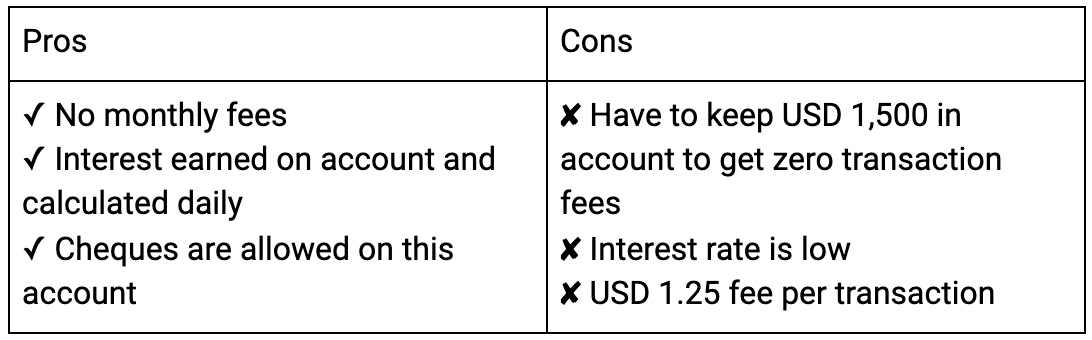

2. TD Bank US Daily Interest Chequing Account

The TD Bank US Daily Chequing Account TD’s best USD account option and the bank also offers a Borderless Plan account. The US daily interest account has no monthly fees and standard transaction fees of USD 1.25. You can benefit from no transaction fees at all, but your balance has to be above USD 1,500. The standard 0.01 percent interest is also paid only on balances of $1,000 or more, which is quite a low rate among its competitors. However, the interest is calculated daily. If you bank with TD Bank already, you can use their app or online banking to transfer funds between your TD Bank Canadian accounts and this account.

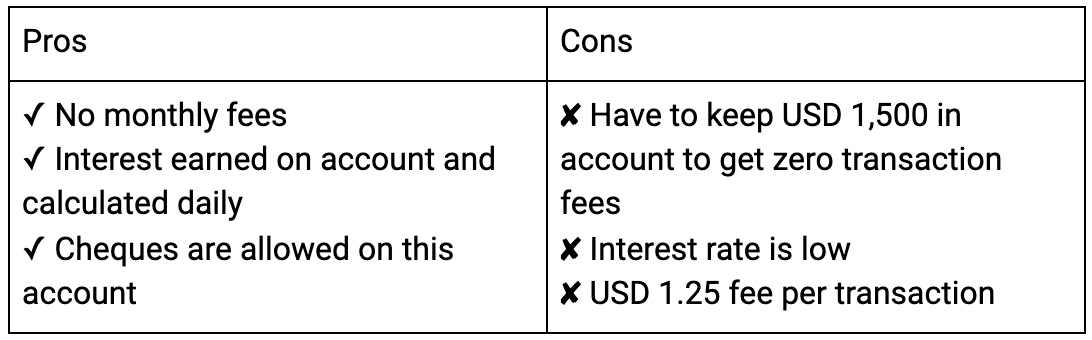

3. BMO (Bank of Montreal) US Dollar Premium Rate Savings Account

The BMO US Dollar Premium Rate Savings Account is BMO’s main USD account offering. The bank also offers a US Dollar Chequing Account. There are no monthly fees, and you can earn 0.05 percent interest. However, you need to already bank with BMO to take advantage of this account.

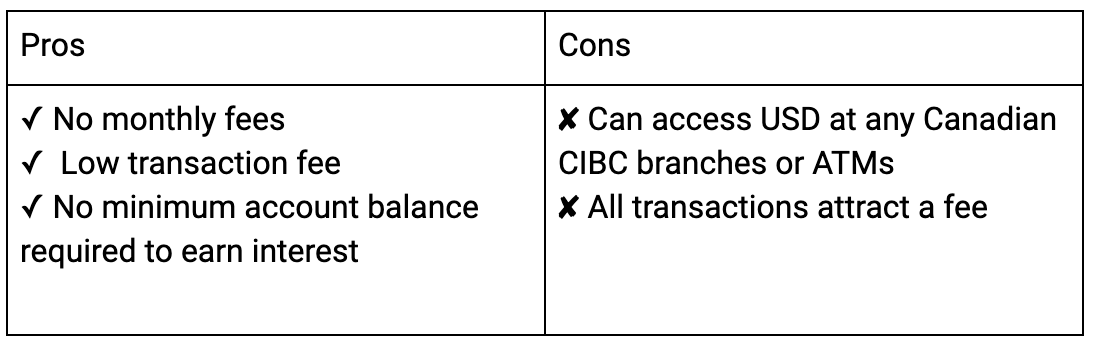

4. CIBC USD Personal Account

The CIBC USD Personal Account has no minimum balance requirement to earn interest of 0.05 percent. There are no monthly fees and transaction fees are only USD 0.75 fee per transaction. One unique feature CIBC has is that it allows you to write USD cheques with this account.

Also, Read - The 5 Best USD Credit Cards for Canadians in 2021

5. RBC US High-Interest eSavings

RBC’s USD accounts include the RBC US High-Interest eSavings and the RBC personal account. The first has no monthly fees and pays 0.05 percent interest. You get one free transaction per month, thereafter it costs $3.00. RBC makes it easy to access this account if you already bank with them. You get free online transfers to other RBC deposit accounts as long as they are in your name. You can also transfer money from this account at any of RBC’s ATMs. One monthly debit is allowed, after which a fee is charged for each transaction.

Overall, Tangerine may be the best option for those looking to avoid fees. If you already bank with one of the major banks though, you may find it more convenient to open a USD account with them. There are other ways to convert USD to CAD or CAD to USD. Services like Remitbee Currency Exchange offer a better exchange rate and transparent fees.